- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Palomar Holdings (PLMR): Assessing Valuation Following Strong Q3 Growth and Upgraded 2025 Outlook

Reviewed by Simply Wall St

Palomar Holdings (PLMR) released its third quarter earnings, showing significant increases in both revenue and net income compared to the same period last year. The company also raised its financial outlook for 2025.

See our latest analysis for Palomar Holdings.

After delivering another quarter of strong profit growth and raising its 2025 outlook, Palomar Holdings has seen its share price maintain steady gains, closing at $117.79. The company’s long-term picture is even more compelling, with a 22.99% total shareholder return over one year and a notable 65.74% total shareholder return over three years. This reflects building momentum as confidence grows on the back of earnings outperformance and effective risk management.

If Palomar’s impressive numbers have you interested in broader opportunities, now’s the perfect time to explore fast growing stocks with high insider ownership.

With performance and guidance both trending higher, the key question becomes whether Palomar’s success is fully reflected in its current share price or if investors could still find value before future growth is priced in.

Most Popular Narrative: 23.2% Undervalued

The prevailing narrative points to a significant gap between Palomar Holdings' fair value estimate and the current share price, suggesting there may be further upside potential. Investors are taking notice, as the company's strong financial trajectory strengthens conviction in this outlook.

"Ongoing investment in proprietary technology, data analytics, and advanced underwriting disciplines is improving risk assessment and pricing accuracy, already reflected in strong combined ratios and low loss ratios. These factors could continue to enhance underwriting profitability and expand net margins over time."

Want to know the story behind this seemingly ambitious valuation? Find out which future revenue growth, profit margins, and technology bets give this narrative its edge. Uncover what analysts are calculating, as the full rationale might just surprise you.

Result: Fair Value of $153.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower earthquake insurance growth and ongoing sector-wide valuation pressure could quickly change the story for Palomar’s optimistic outlook.

Find out about the key risks to this Palomar Holdings narrative.

Another View: Market Multiples Paint a Different Picture

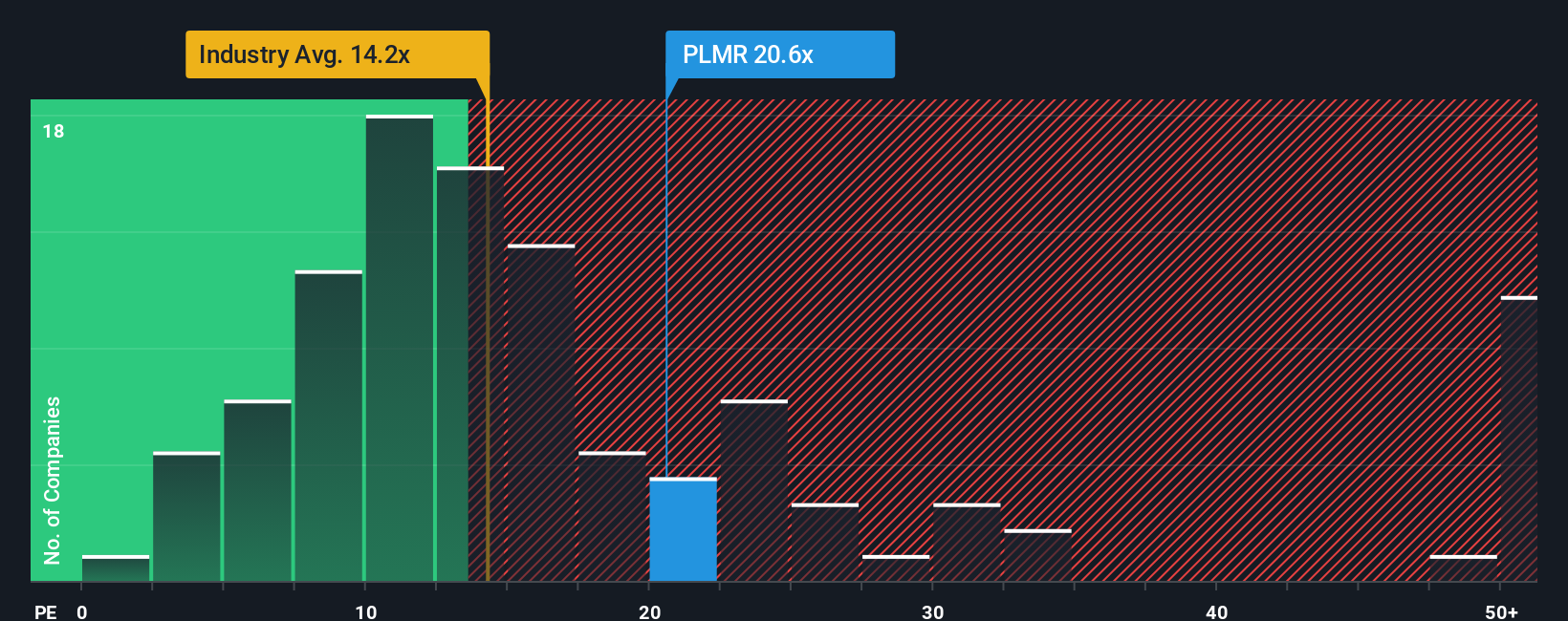

While discounted cash flow analysis suggests Palomar Holdings is undervalued, a glance at its price-to-earnings ratio tells a more complicated story. Shares currently trade at 20.4x earnings, which is noticeably higher than the industry average of 13.6x, its peers' average of 19.2x, and above the fair ratio of 15.7x. This premium could indicate optimism, but it also raises questions about potential downside risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palomar Holdings Narrative

If you see things differently or want to dig deeper on your own terms, you can pull together your own story with just a few clicks. Do it your way.

A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Grow your portfolio smarter and stay ahead of the crowd. Simply Wall Street’s powerful Screener helps you target stocks with breakout potential in trending sectors.

- Capture strong yields right now by checking out these 17 dividend stocks with yields > 3% offering attractive income opportunities in a volatile market.

- Spot game-changers pushing boundaries in medicine and patient care by starting with these 32 healthcare AI stocks, which is designed for innovation-focused investors.

- Access momentum in emerging technology by taking a look at these 25 AI penny stocks poised for the next wave of growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives