- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Goosehead Insurance (GSHD): Assessing Valuation After CEO’s Insider Buy and New Positive Analyst Coverage

Reviewed by Simply Wall St

Goosehead Insurance (GSHD) caught investors’ attention after President and CEO Mark Miller purchased 5,000 shares of company stock. This insider transaction is often seen as a sign of management’s confidence in the business and its outlook.

See our latest analysis for Goosehead Insurance.

Goosehead Insurance shares have rebounded in recent weeks, with a 1-month share price return of 10% helping to recover part of this year’s decline. Although the stock remains down more than 28% year-to-date and has posted a -36% total shareholder return over the last twelve months, management’s insider buying and a vote of confidence from Jefferies indicate that momentum may be turning after a challenging stretch for investors.

If insider conviction makes you curious about broader market trends, now is an excellent moment to explore fast growing stocks with high insider ownership.

But with shares still off their highs despite management’s show of confidence, the key question for investors is whether Goosehead Insurance now offers an attractive entry point or if the market has already factored in future growth.

Most Popular Narrative: 19% Undervalued

Goosehead Insurance’s most widely followed narrative puts its fair value at $93.70, a figure that is considerably higher than its last close price of $75.56. As buyers consider a recent uptick alongside longer-term concerns, this narrative provides an optimistic view on the company’s evolving foundation.

Rapid adoption of Goosehead's proprietary AI and digital platforms is driving lower servicing costs and improved client experience, positioning the company to benefit from rising consumer demand for seamless, tech-enabled insurance solutions. This is expected to expand operating leverage and boost net margins over time.

Want to know the growth blueprint behind this high valuation? The core component of this narrative is record-breaking earnings and a future profit multiple often seen in technology leaders. Interested in which bold financial projections support that price target? Dive deeper to explore the numbers that shape this fair value calculation.

Result: Fair Value of $93.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher climate-related claim costs and potential slowdowns in expanding the agent network could undermine Goosehead Insurance’s optimistic earnings and growth projections.

Find out about the key risks to this Goosehead Insurance narrative.

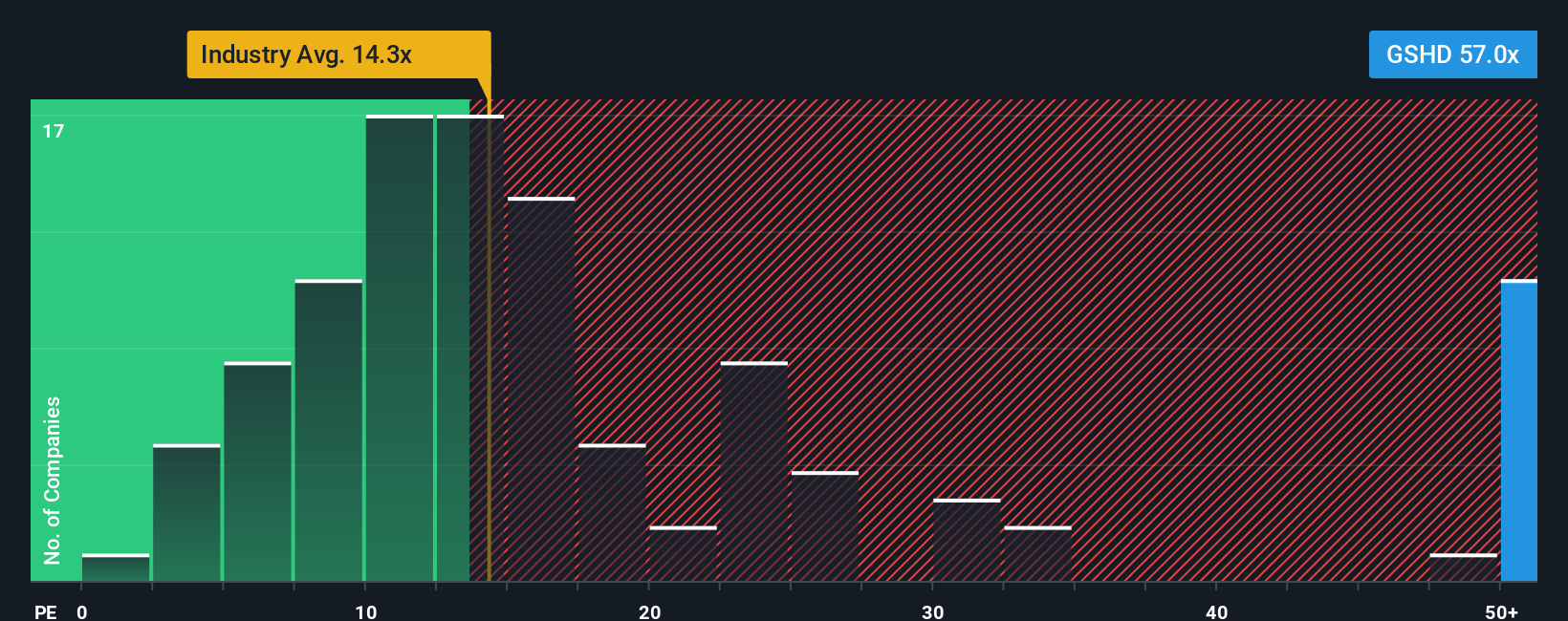

Another View: Signals from Profit Multiples

While the market buzzes about Goosehead Insurance’s discount to fair value, there is a less optimistic angle to consider. Its price-to-earnings ratio stands at 62.2x, sharply higher than the US Insurance industry’s 13.3x and also above peers at 53.7x. The fair ratio that the market could move toward is just 21.7x, creating a wide gap that adds valuation risk for buyers considering today’s share price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goosehead Insurance Narrative

If you want to challenge this perspective or craft your own view based on the numbers, you can easily create a narrative in under three minutes. Do it your way.

A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by. Take the next step in your investing journey with ideas tailored for bold, forward-thinking investors like you.

- Catch growing income potential when you check out these 14 dividend stocks with yields > 3% yielding over 3% and see which companies reward shareholders handsomely.

- Jump into the world of technological breakthroughs by scanning these 25 AI penny stocks packed with firms pioneering artificial intelligence innovation.

- Upgrade your portfolio by targeting value unlocked in these 930 undervalued stocks based on cash flows, revealing companies whose fundamentals suggest there is more upside waiting to be realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026