- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Could Goosehead Insurance’s (GSHD) Share Buyback Reveal Shifts in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Goosehead Insurance recently reported its third quarter and nine-month 2025 earnings, posting higher revenue year-over-year with steady earnings per share, and announced the completion of a share repurchase program totaling 691,000 shares for US$59.19 million.

- While net income was nearly unchanged, the completed buyback reduced the company's share count, which could impact earnings per share calculations going forward.

- We'll explore how the finished share repurchase might influence Goosehead Insurance's evolving investment narrative and analyst outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Goosehead Insurance Investment Narrative Recap

To be a Goosehead Insurance shareholder, you need to believe in the ongoing expansion and productivity of its franchise agent network and its ability to capitalize on digital platforms, driving efficient growth in a competitive insurance space. The recent share repurchase and steady earnings per share suggest minimal impact, at least in the short term, on key catalysts like agent network growth, while not shifting the most significant risk: external threats from technological disruption or evolving carrier relationships.

Among recent announcements, the completed share buyback stands out in this context. While reducing the number of outstanding shares may support future earnings per share, Goosehead’s revenue growth and evolving digital platforms remain central to longer-term opportunities catalyzing recurring commission streams, particularly if partnerships and scalable technology continue to gain traction.

On the other hand, investors should be aware that rising competition from digital insurance channels means Goosehead’s core agent-driven model faces...

Read the full narrative on Goosehead Insurance (it's free!)

Goosehead Insurance's outlook points to $588.5 million in revenue and $71.4 million in earnings by 2028. This scenario assumes a 20.0% annual revenue growth rate and an earnings increase of $41.5 million from current earnings of $29.9 million.

Uncover how Goosehead Insurance's forecasts yield a $98.10 fair value, a 47% upside to its current price.

Exploring Other Perspectives

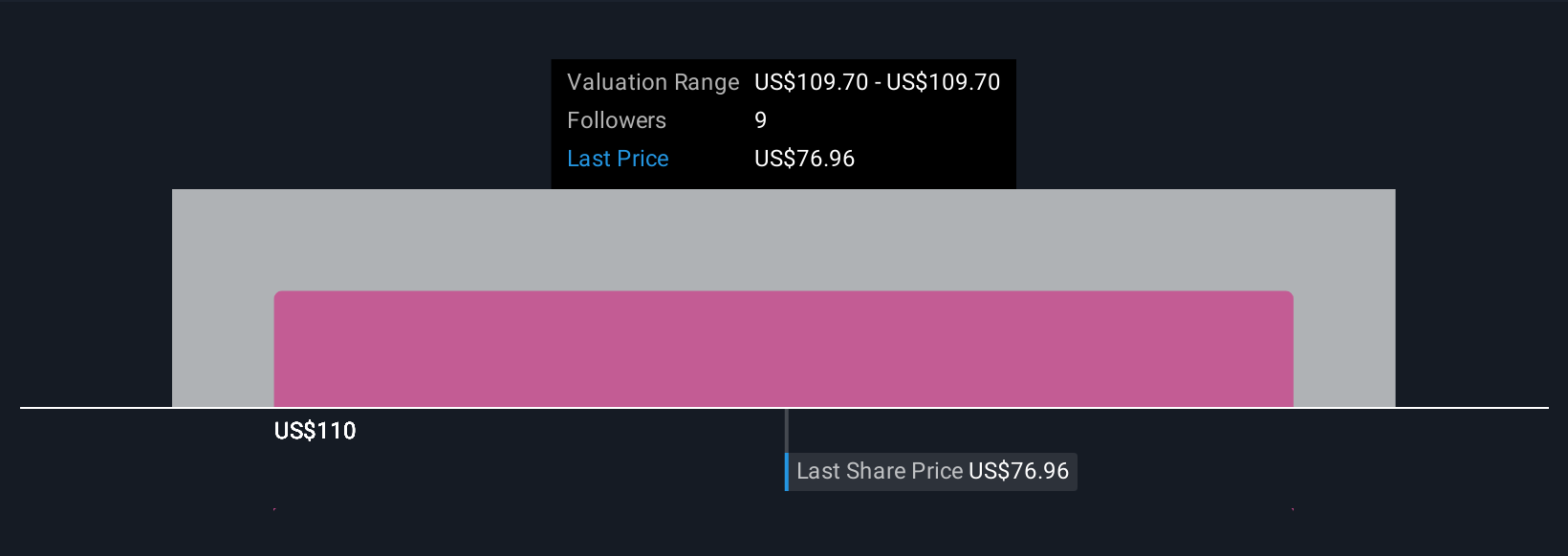

Simply Wall St Community members produced two fair value estimates for Goosehead Insurance, ranging widely from US$53.75 to US$98.10 per share. While these views reflect very different growth expectations, many participants remain focused on the company's drive to scale its agent network and invest in technology, key factors that could shape earnings power ahead.

Explore 2 other fair value estimates on Goosehead Insurance - why the stock might be worth as much as 47% more than the current price!

Build Your Own Goosehead Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goosehead Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goosehead Insurance's overall financial health at a glance.

No Opportunity In Goosehead Insurance?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives