- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Erie Indemnity (ERIE): Assessing Valuation Following Second Quarter Earnings Miss

Reviewed by Kshitija Bhandaru

Erie Indemnity (ERIE) saw its stock slide after releasing second quarter earnings that missed expectations on both revenue and profits. Many investors are now reassessing the company’s outlook as it heads into the rest of 2025.

See our latest analysis for Erie Indemnity.

After a disappointing earnings report that pushed shares to a new 52-week low, Erie Indemnity’s share price is now sitting at $319.16. Although recent revenue growth and a strong return on equity illustrate the company’s financial resilience, the one-year total shareholder return of -0.38% suggests momentum has faded in the face of short-term headwinds. This has left investors on the lookout for signs of a turnaround.

If you’re open to fresh ideas beyond Erie’s recent moves, now could be the perfect time to discover fast growing stocks with high insider ownership.

With shares now trading well below recent highs, investors are left to consider if Erie Indemnity’s current valuation reflects all the near-term risks or if there is real potential for upside as markets look ahead.

Price-to-Earnings of 26.7x: Is it justified?

At $319.16, Erie Indemnity trades on a price-to-earnings ratio of 26.7x, which is significantly higher than both its peers and the broader industry. This elevated multiple raises the question of whether investors are paying too much for each dollar of the company’s earnings compared to alternatives.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for a company’s earnings power. In the insurance sector, this multiple often serves as a quick benchmark for how the market values expected profits and future growth prospects. For Erie Indemnity, the current P/E signals high market expectations, especially given the company’s steady but not extraordinary earnings growth trajectory.

In comparison, Erie Indemnity’s P/E is far above both the US Insurance industry average of 14.2x and the estimated fair price-to-earnings ratio of 16.3x. This sharp premium suggests that the market could be overpricing the company’s near-term earnings potential, and there is a real risk that the multiple may move closer to industry and fair value levels.

Explore the SWS fair ratio for Erie Indemnity

Result: Price-to-Earnings of 26.7x (OVERVALUED)

However, slower annual revenue growth and ongoing share price declines could signal deeper challenges for Erie Indemnity in the near term, as well as for investor sentiment.

Find out about the key risks to this Erie Indemnity narrative.

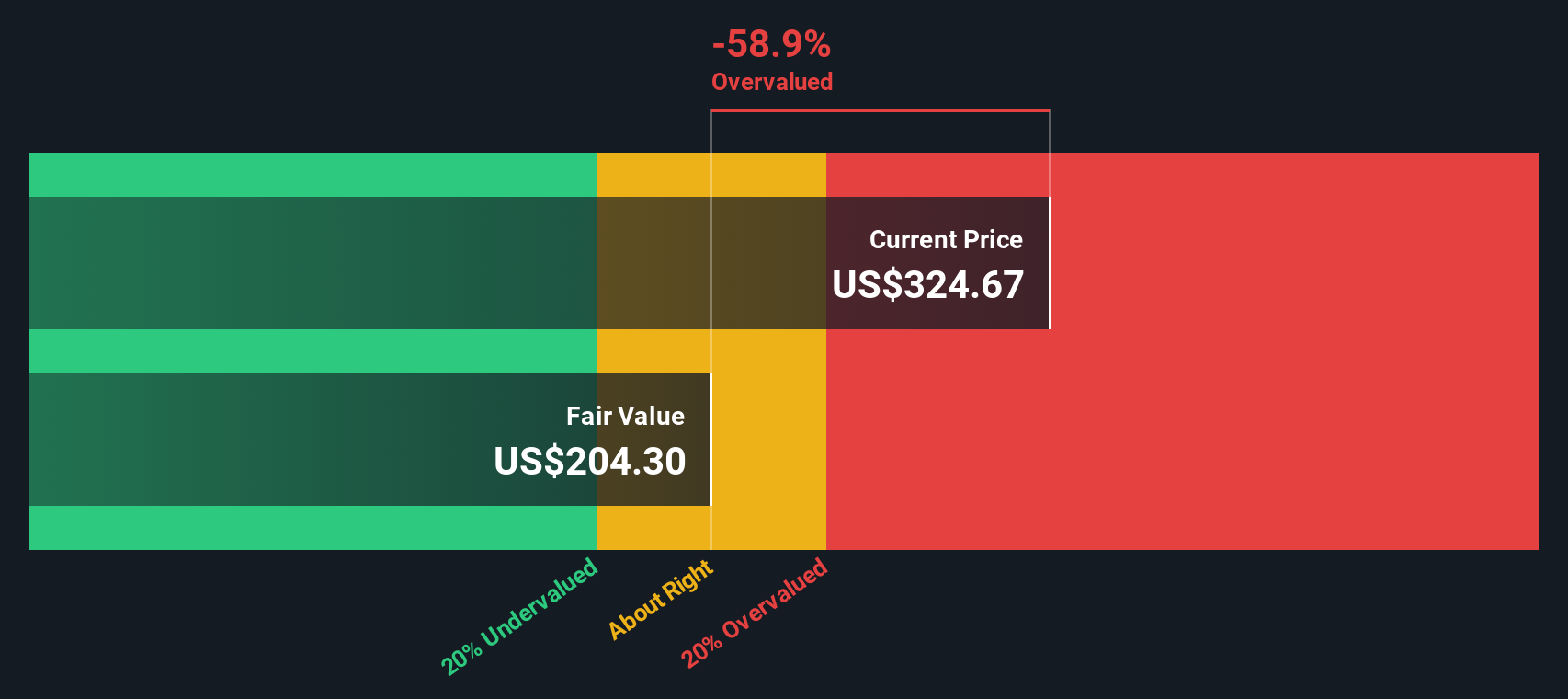

Another View: Our DCF Model Weighs In

Looking at our SWS DCF model for Erie Indemnity, the outcome is far less optimistic. The model estimates a fair value of $204.30. This suggests that the current share price of $319.16 is significantly above what the company's future cash flows might justify. The DCF method highlights potential overvaluation from a long-term fundamentals perspective.

What does this large gap mean for investors, and could the market bring Erie’s price closer to its calculated fair value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Erie Indemnity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Erie Indemnity Narrative

If you have a different perspective or want to dive deeper into Erie Indemnity’s financial story, you can explore the numbers and craft your own view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Erie Indemnity.

Looking for more investment ideas?

Smart investors never limit their options. Take action now and broaden your investment horizons. Don’t let standout opportunities pass you by when there is so much potential waiting to be found.

- Uncover high-yield opportunities by targeting strong income streams through these 19 dividend stocks with yields > 3% with exceptional returns above 3%.

- Supercharge your watchlist with bold disruptors reshaping industries by getting a firsthand look at these 25 AI penny stocks.

- Snap up future market leaders by searching for compelling value plays among these 886 undervalued stocks based on cash flows driven by genuine earnings potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives