- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

A Fresh Look at Erie Indemnity (ERIE) Valuation After New Product Launch and Profitability Progress

Reviewed by Simply Wall St

Erie Indemnity (ERIE) has taken significant steps this quarter by improving its combined ratio and growing direct written premiums. The insurer also launched ErieSecure Auto in Ohio, with broader rollout plans on the horizon for investors to watch.

See our latest analysis for Erie Indemnity.

Even with the rollout of ErieSecure Auto and measurable operational improvements, Erie Indemnity’s momentum has faced real tests this year. Its share price has slipped 27.8% year-to-date, and the total shareholder return over the past year stands at -31.5%. Still, for long-term shareholders, the stock has managed a nearly 47.5% total return over five years, underscoring how swings in sentiment can shape the journey for this sector’s stalwarts.

If you’re looking for other opportunities while insurance stocks recalibrate, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

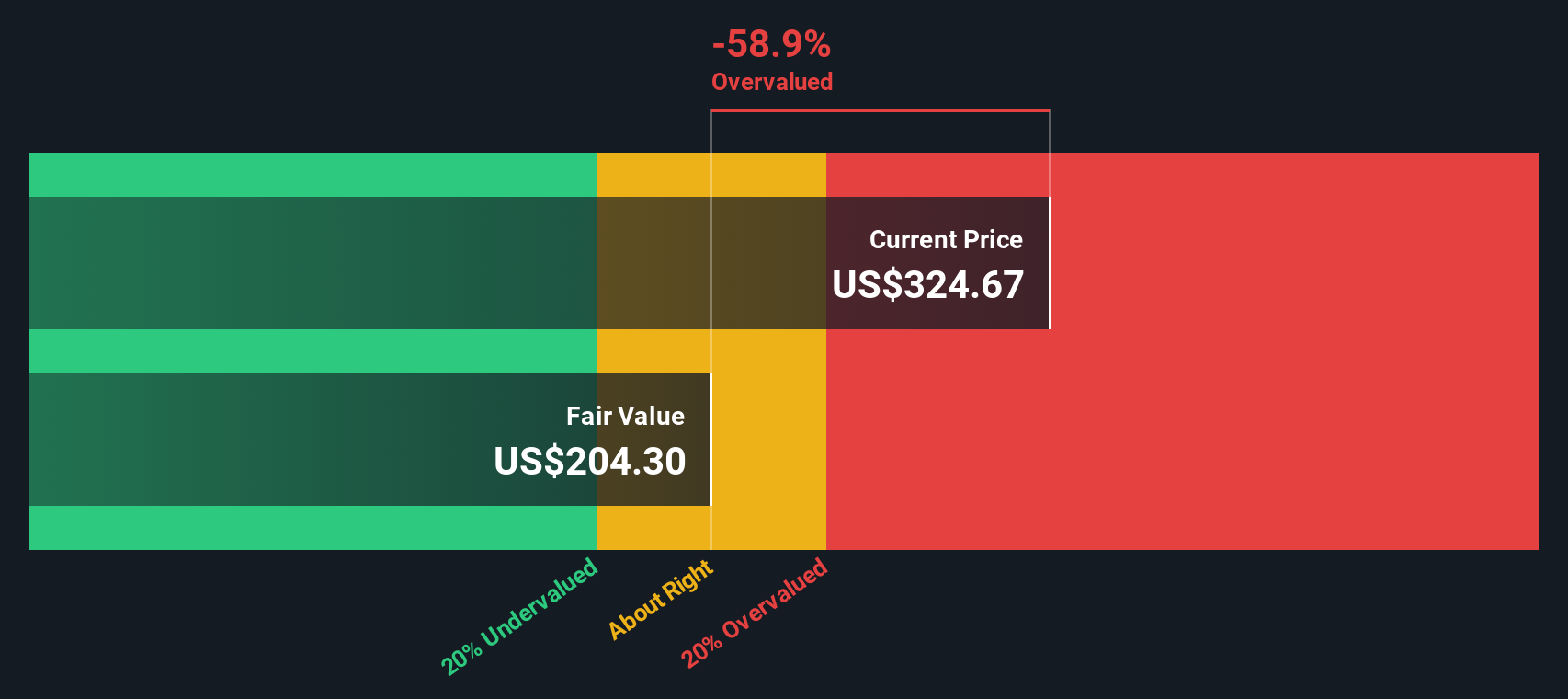

Given this recent mix of strategic launches and operational gains, combined with considerable share price weakness, it is fair to ask whether Erie Indemnity is an undervalued opportunity or if the market already anticipates its potential turnaround.

Price-to-Earnings of 23.9x: Is it justified?

Erie Indemnity currently trades at a price-to-earnings (P/E) ratio of 23.9x, which is significantly higher than its industry peers and what might be considered a fair multiple for the sector, given its fundamentals.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. In insurance, it reflects growth expectations and the perceived reliability of profits. ERIE’s elevated P/E suggests that the market is pricing in higher earnings quality or stronger long-term prospects relative to the industry.

However, compared to both the US insurance industry average of 12.9x and a fair P/E estimate of 14.1x, ERIE’s current valuation stands out as expensive. If market sentiment shifts or growth lags, there could be pressure for the stock’s multiple to move toward these reference points.

Explore the SWS fair ratio for Erie Indemnity

Result: Price-to-Earnings of 23.9x (OVERVALUED)

However, slowing revenue growth and ongoing share price weakness could continue to weigh on investor sentiment. This may potentially dampen any near-term turnaround hopes.

Find out about the key risks to this Erie Indemnity narrative.

Another View: DCF Tells a Different Story

Looking at Erie Indemnity through the lens of our SWS DCF model, a starkly different outcome emerges. The model points to ERIE trading above its fair value estimate of $221.51, which suggests the market price may be too high relative to future cash flows. Does this model call for caution, or is the premium justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Erie Indemnity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Erie Indemnity Narrative

If you see things differently or want to investigate further, you can explore the numbers and shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Erie Indemnity.

Looking for more investment ideas?

Act now and tap into other exceptional growth opportunities. Don’t miss out on stocks that could shape your strategy for the rest of the year.

- Supercharge your portfolio with these 933 undervalued stocks based on cash flows, bringing hidden value and solid fundamentals into sharp focus when others overlook them.

- Ride the AI boom by targeting these 26 AI penny stocks, which are setting themselves apart with innovation and future-facing solutions.

- Capture long-term cash flow with these 14 dividend stocks with yields > 3%, offering robust yields and providing steady income streams even in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success