- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

Did Baldwin Insurance Group's (BWIN) Downward Earnings Revision Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

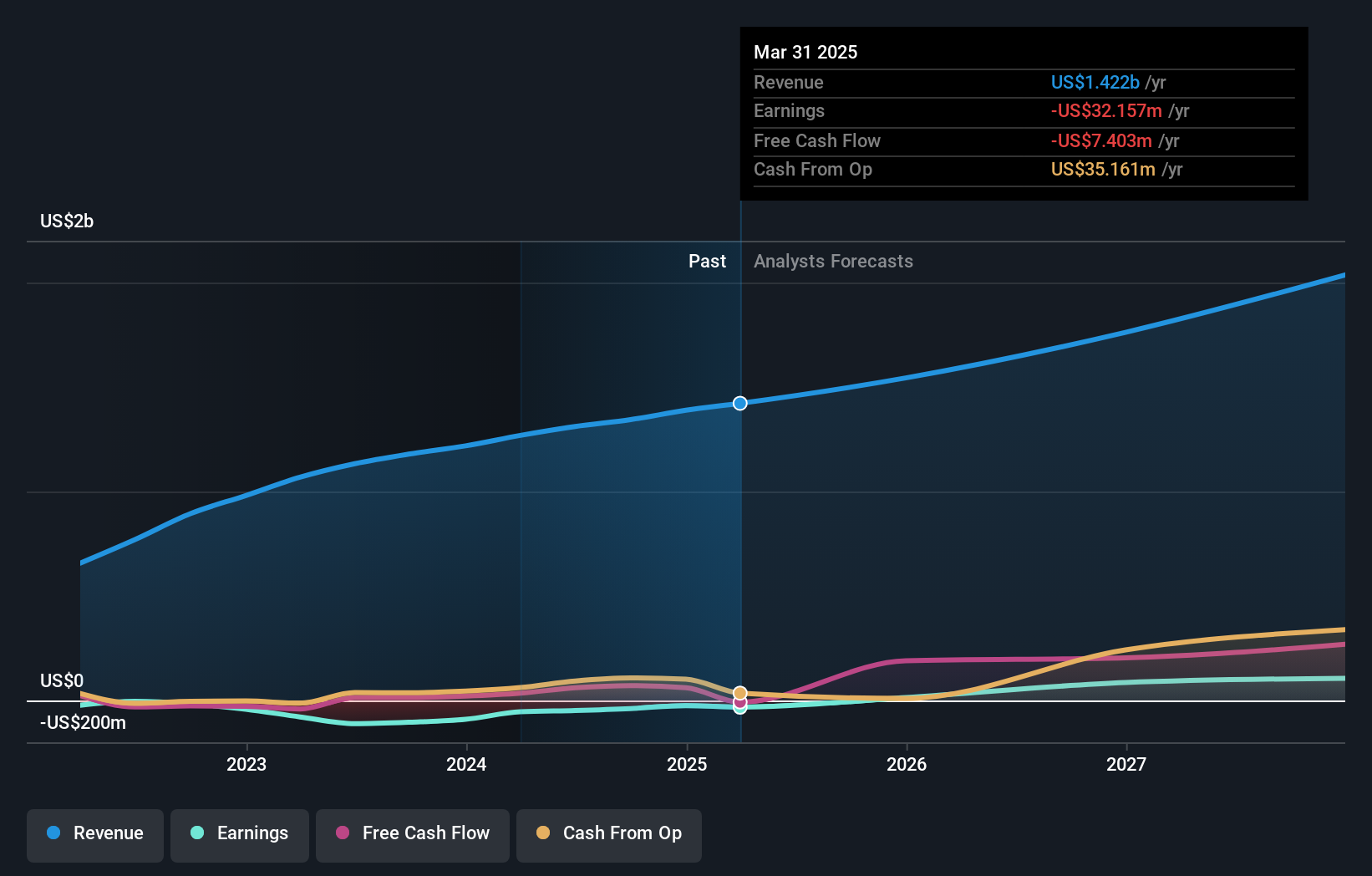

- Baldwin Insurance Group recently announced a downward revision of its full-year 2025 revenue and earnings forecasts ahead of its Q3 earnings release on November 4, 2025.

- The shift from positive to negative full-year earnings outlook comes shortly after the company previously missed quarterly earnings expectations, raising concerns about potential headwinds in its near-term financial performance.

- To assess the implications of Baldwin's revised outlook, we’ll explore how lower full-year estimates may affect the company's long-term investment case.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Baldwin Insurance Group Investment Narrative Recap

To own shares in Baldwin Insurance Group, you need confidence in its long-term ability to grow revenue through embedded partnerships and digital workflow investments, despite current profitability and pricing pressures. The recent downward revision in full-year 2025 outlook could meaningfully affect the main short-term catalyst, return to positive earnings, while also amplifying the business's key risk: persistent margin and revenue compression from unfavorable rate trends and rising competition.

Among recent announcements, the material revision of 2025 revenue and earnings forecasts stands out, as it puts a spotlight on the near-term risks to profitability and revenue growth. The new guidance, following a prior earnings miss, signals that headwinds from sector pricing and exposure dynamics may be deeper or more prolonged than previously anticipated, potentially slowing the company’s recovery path.

In contrast, investors should keep a close eye on how Baldwin’s exposure to ongoing pricing pressure in property and construction lines might impact margin stability and future…

Read the full narrative on Baldwin Insurance Group (it's free!)

Baldwin Insurance Group's narrative projects $2.1 billion revenue and $102.5 million earnings by 2028. This requires 12.3% yearly revenue growth and a $120.3 million earnings increase from -$17.8 million today.

Uncover how Baldwin Insurance Group's forecasts yield a $38.00 fair value, a 65% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community estimated Baldwin Insurance Group’s fair value, placing it at US$38. Those following the current earnings outlook should consider how persistent rate compression could weigh on future expectations. Explore diverse takes and decide how they might influence your analysis.

Explore another fair value estimate on Baldwin Insurance Group - why the stock might be worth just $38.00!

Build Your Own Baldwin Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baldwin Insurance Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Baldwin Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baldwin Insurance Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives