- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

Baldwin Insurance Group (BWIN): Rapid Earnings and Revenue Growth Forecast Challenges Past Loss Narratives

Reviewed by Simply Wall St

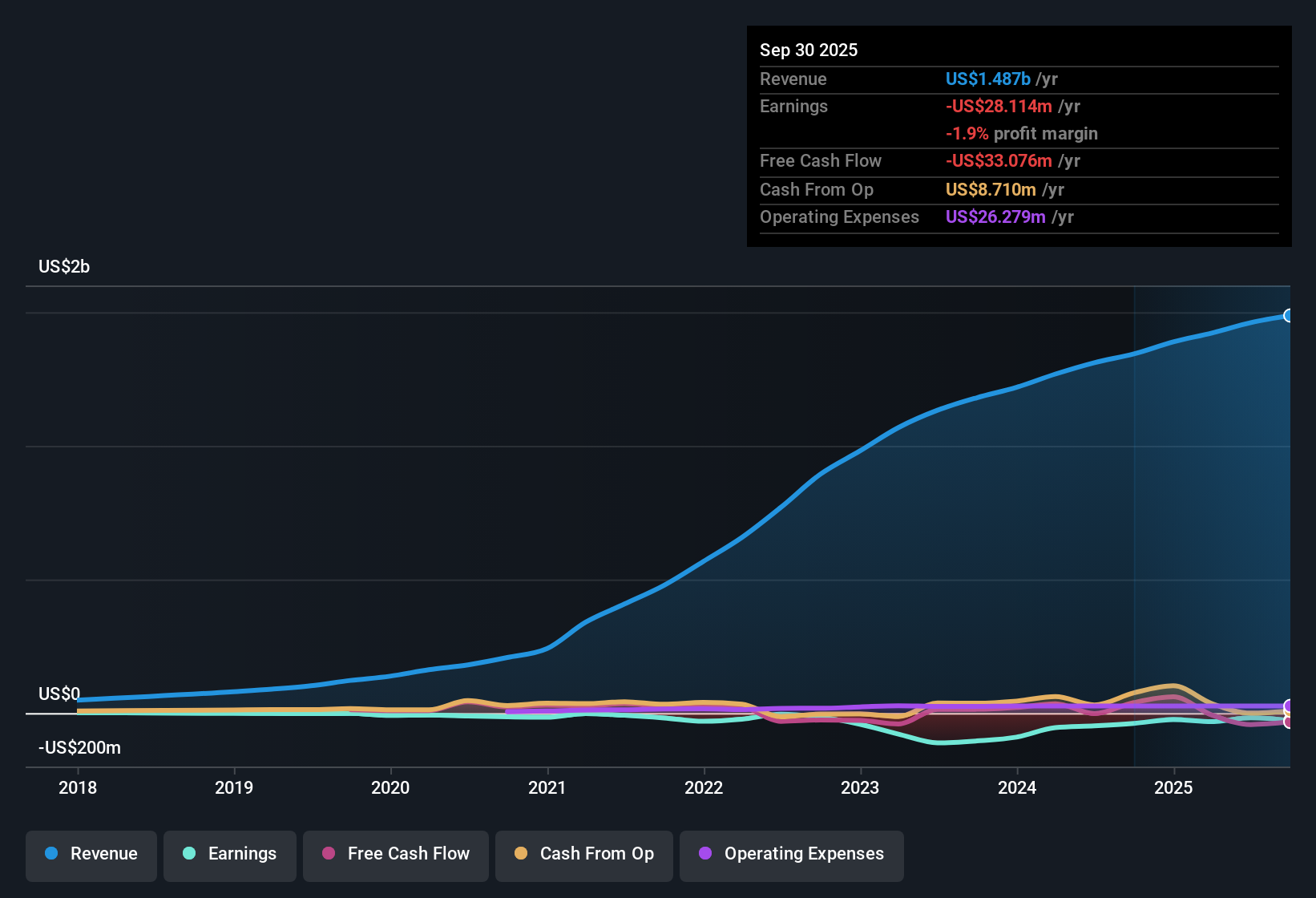

Baldwin Insurance Group (BWIN) remains unprofitable, with losses having grown at an annualized rate of 22.7% over the past five years. Looking ahead, analysts expect earnings to surge at 81.77% per year and revenue growth of 11% annually, both outpacing the broader US market. The key message for investors is the possibility of significant profit and revenue growth in the coming periods, which would be a notable shift from the company’s history of mounting losses.

See our full analysis for Baldwin Insurance Group.The next step is to see how these latest numbers compare with current market narratives. Some expectations will be confirmed, while others might face fresh questions.

See what the community is saying about Baldwin Insurance Group

Margin Expansion Forecast: Profit Margins Climb to 5%

- Analysts expect Baldwin Insurance Group's profit margins to rise from -1.2% today to 5.0% within three years, marking a pivotal financial shift as the company aims for sustainable profitability.

- According to the analysts' consensus view, this projected margin growth is supported by strategic partnerships and technology investments, but depends on:

- Efficiency gains tied to digital platform investments, which are expected to lower costs and improve earnings beyond current levels.

- Significant tailwinds from demographic changes and increased risk awareness, both supporting elevated demand in Baldwin's core markets despite present industry disruptions.

- Analysts highlight the transformation from years of losses to above-market profit potential as a major validation of their growth thesis.

See what the community is saying about Baldwin Insurance Group 📊 Read the full Baldwin Insurance Group Consensus Narrative.

High Leverage: Debt Sits at 4.17x EBITDA

- Baldwin's leverage remains elevated at 4.17x due to recent acquisition earnouts and investments in underwriting capacity, increasing sensitivity to interest rates and potential market downturns.

- Analysts' consensus view emphasizes the balance between growth opportunity and risk exposure:

- While debt-funded acquisitions have enabled rapid scale and access to new distribution pipelines, persistent financial leverage could constrain future earnings and capital allocation flexibility.

- Heightened leverage also means rising interest expense may offset margin gains if market conditions tighten or if integration of acquisitions takes longer than planned, tempering the near-term upside.

Valuation Premium: Price-to-Sales Ratio at 1.2x

- Baldwin Insurance Group's Price-to-Sales Ratio is 1.2x, placing it above the US Insurance industry average of 1.1x and below the peer group average of 2.8x. This highlights a moderate premium justified by growth forecasts.

- Consensus narrative notes investors are weighing this valuation premium against both risk and growth signals:

- The forecast for annual revenue growth of 11% outpaces industry norms and supports the case for a higher relative multiple.

- However, with current profitability still negative and the future PE ratio expectation of 68.8x (based on projected 2028 earnings), some investors may question if strong growth fully subsidizes the premium to the sector.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Baldwin Insurance Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story looks different through your lens? Take a moment to shape your own narrative and add your perspective in just minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Baldwin Insurance Group.

See What Else Is Out There

Baldwin Insurance Group faces persistent high leverage, and there is a risk that interest expenses may undermine projected margin gains if conditions worsen.

Want more financial peace of mind? Use solid balance sheet and fundamentals stocks screener (1979 results) to identify companies with stronger balance sheets and less exposure to debt-driven headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives