- United States

- /

- Insurance

- /

- NasdaqGS:AMSF

AMERISAFE (AMSF) Margin Decline Reinforces Market Caution Despite Discounted Valuation

Reviewed by Simply Wall St

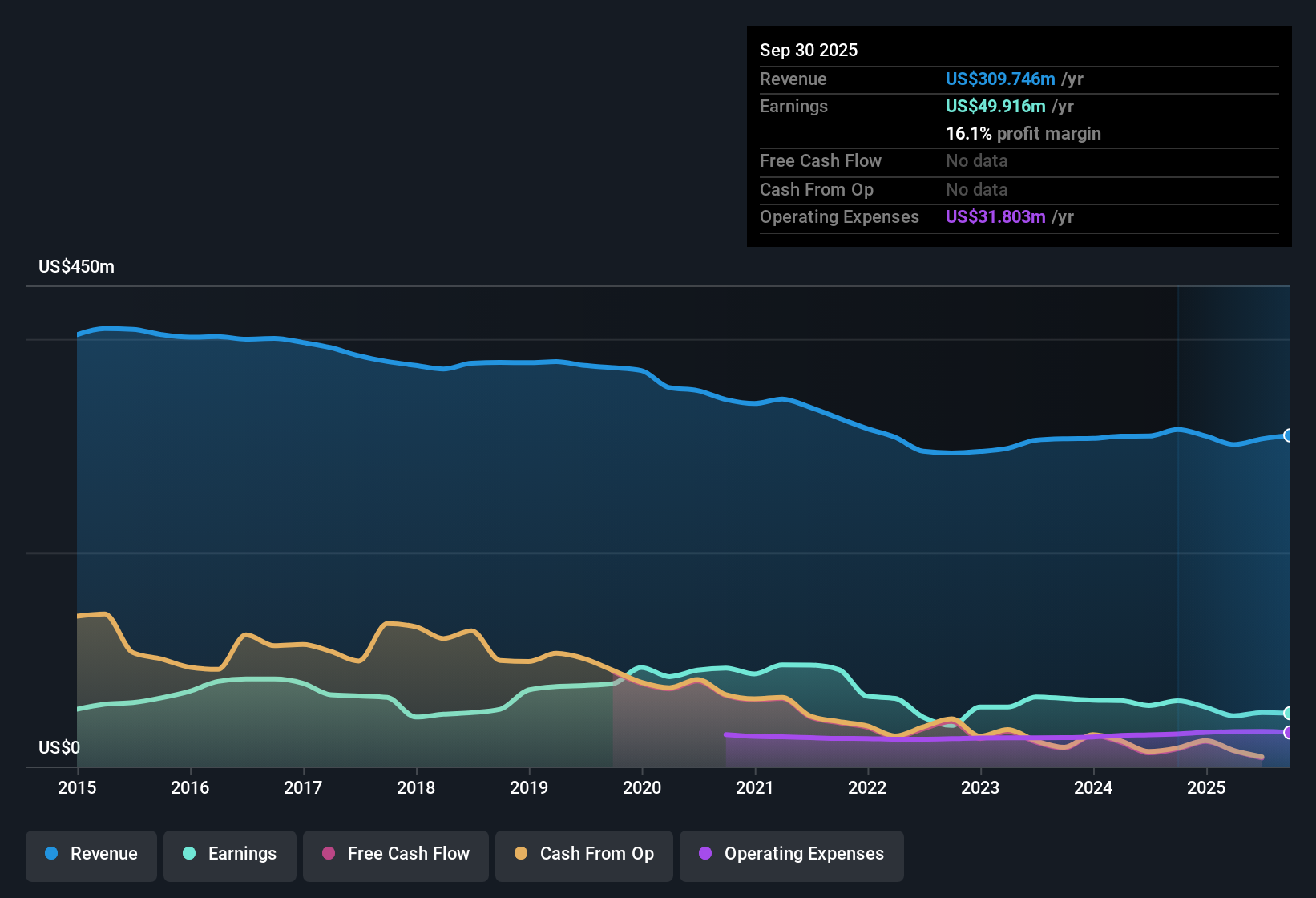

AMERISAFE (AMSF) posted a net profit margin of 16.5%, down from last year’s 18.5%, as earnings have declined by 12.6% annually over the past five years and are forecast to shrink a further 6.4% per year in the next three years. Revenue is expected to grow at just 4.8% per year, lagging the broader US market’s 10.3% pace, while the stock trades at $39.94, notably below the estimated fair value of $55.41. Despite these headwinds and concerns around dividend sustainability, management points to the high quality of reported earnings. The steep discount to valuation could catch the eye of value-focused investors.

See our full analysis for AMERISAFE.Next, we’ll put AMERISAFE’s latest results head-to-head with the dominant market narratives to see what lines up, and what gets challenged.

See what the community is saying about AMERISAFE

Expense Ratios Climb Above 31%

- AMERISAFE's expense ratio rose to 31.3% this quarter, compared to 29.8% in the prior year. Ongoing investments in technology and higher insurance assessments contributed to increased costs.

- Analysts' consensus view highlights that while spending on operational efficiency and agent support should eventually benefit margins, persistently higher expenses could erode future profit expansion.

- The consensus narrative points out that sustained tech investment and process improvements are key for underwriting and claims management. However, the recent climb in expense ratios raises concerns over whether these efficiency gains will be enough to maintain net margins in a soft pricing climate.

- Consensus notes that top-line growth may not be fast enough to offset rising costs, potentially squeezing profits further even as policy growth remains positive.

- Consensus narrative urges investors to consider whether expense control will improve soon enough to protect margins.

- 📊 Read the full AMERISAFE Consensus Narrative.

Premium Pricing Pressure Intensifies

- Approved workers’ compensation loss costs have continued to decline by mid-single digits year-over-year, creating ongoing pressure on AMERISAFE’s premium rates and slowing top-line growth despite gains in policy count and voluntary premiums.

- Analysts' consensus view notes that while robust policy retention at 93.8% and strong agent partnerships are helping expand the addressable market, the downward pressure on premium pricing threatens to limit revenue gains.

- Consensus also questions whether audit premium, a significant contributor to earned premiums, can maintain previous levels, as recent moderation has directly impacted revenues and could worsen if industry challenges persist.

- While technology investment supports underwriting discipline, consensus flags the risk that rising medical claim costs and ongoing pricing softness will challenge AMERISAFE’s ability to deliver high-margin growth in the future.

DCF Fair Value Signals Undervalued Shares

- With the stock trading at $39.94, there is a notable 27.8% discount to the DCF fair value of $55.41, and a 23% gap to the analyst price target of $52.00. This suggests the market remains skeptical of future profit durability.

- Analysts' consensus view frames this valuation disconnect as a classic tension: on one hand, slower earnings and margin compression justify caution; on the other hand, disciplined risk selection and prudent capital management leave the door open for a positive surprise.

- Consensus underscores that analyst targets assume both revenue and margin metrics rebound by 2028, which would require a significant increase in the stock's price-to-earnings ratio to 35.5x, well above the US insurance industry average of 14.3x.

- This means investors must decide if current pessimism over soft industry conditions has gone too far, or if further downside risk is justified given shrinking projected profits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AMERISAFE on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your insights front and center and share your view with the community in just a few minutes. Do it your way.

A great starting point for your AMERISAFE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

AMERISAFE faces slowing earnings, rising expense ratios, and struggles to grow revenue quickly enough to offset mounting costs and pricing pressure.

If you want to focus on steadier performers, check out stable growth stocks screener (2112 results) to find companies that consistently deliver reliable growth even as industry conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSF

AMERISAFE

An insurance holding company, underwrites workers’ compensation insurance in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives