- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

US Undiscovered Gems 3 Small Cap Stocks To Watch

Reviewed by Simply Wall St

In the current U.S. market landscape, major indices have shown resilience with a recent uptick following a tech sector rout, while small-cap stocks in the S&P 600 continue to navigate challenges such as high borrowing costs and trade policy uncertainties. Amidst these dynamics, investors are increasingly attentive to economic indicators like job growth and interest rates that can significantly impact small-cap companies. In this environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Franklin Financial Services | 142.38% | 5.48% | -4.56% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

American Coastal Insurance (ACIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: American Coastal Insurance Corporation operates in the United States, focusing on commercial and personal property and casualty insurance, with a market capitalization of $572.50 million.

Operations: ACIC generates revenue primarily from its commercial lines business, which amounts to $320.07 million.

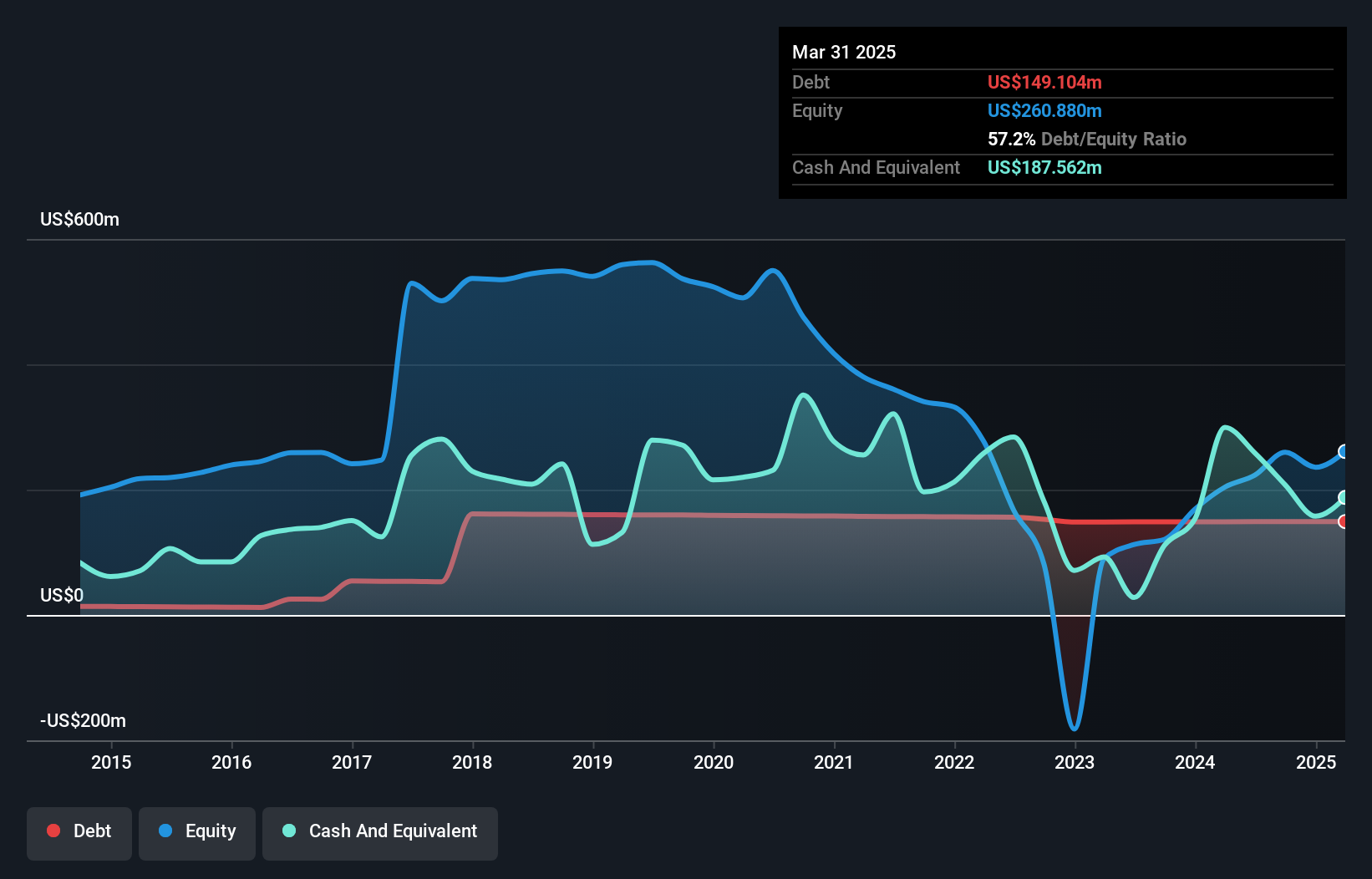

American Coastal Insurance, a nimble player in the insurance sector, is making strategic moves with its expansion into specialty segments and leveraging pricing power to boost market share. Despite facing high hurricane risk exposure in Florida and fluctuating reinsurance costs, the company has managed to grow earnings by 66.1% annually over the past five years. Currently trading at US$11.06 per share, it sits 71.7% below its estimated fair value, suggesting potential undervaluation. With a debt-to-equity ratio rising from 28.8% to 51%, they have more cash than total debt and cover interest payments comfortably at 10.4x EBIT coverage.

AudioCodes (AUDC)

Simply Wall St Value Rating: ★★★★★★

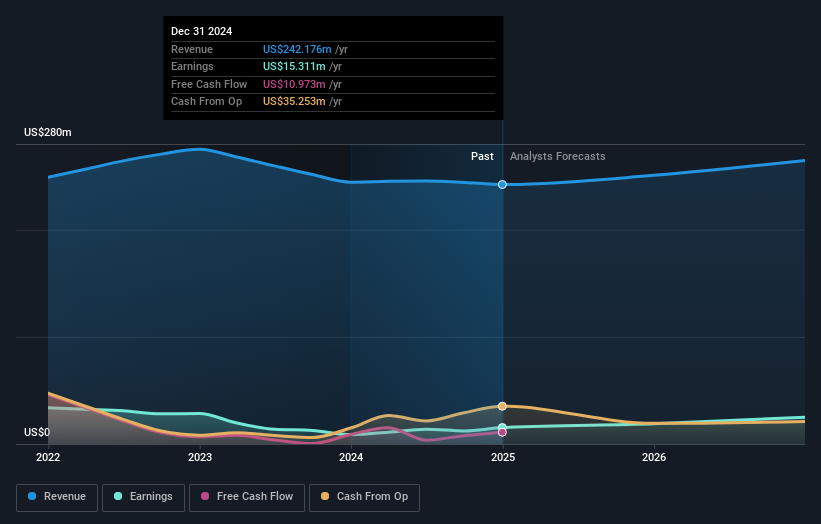

Overview: AudioCodes Ltd. offers advanced communications software, products, and productivity solutions for the digital workplace globally, with a market cap of $253.79 million.

Operations: AudioCodes generates revenue through its advanced communications software and productivity solutions. The company's market cap stands at $253.79 million.

AudioCodes, a nimble player in the communications sector, is making waves with its AI-powered voice services and strategic moves like joining Cisco Webex Calling's Cloud Connect Enablement program. Despite a 13% earnings growth last year, it lagged behind the broader industry’s 31%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 0.9%, indicating financial prudence. Recent buybacks saw over 1.26 million shares repurchased for $12.7 million, reflecting confidence in its valuation at nearly 69% below estimated fair value. However, analysts forecast a decline in profit margins amid modest revenue growth projections of just over 1% annually for the next three years due to macroeconomic and geopolitical challenges.

Investors Title (ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company specializes in providing title insurance services for a variety of property types, including residential, institutional, commercial, and industrial properties, with a market cap of $493.90 million.

Operations: The company's primary revenue stream is derived from title insurance, generating $265.11 million, while exchange services contribute $12.02 million. The net profit margin reflects the company's efficiency in managing its costs relative to its revenue streams.

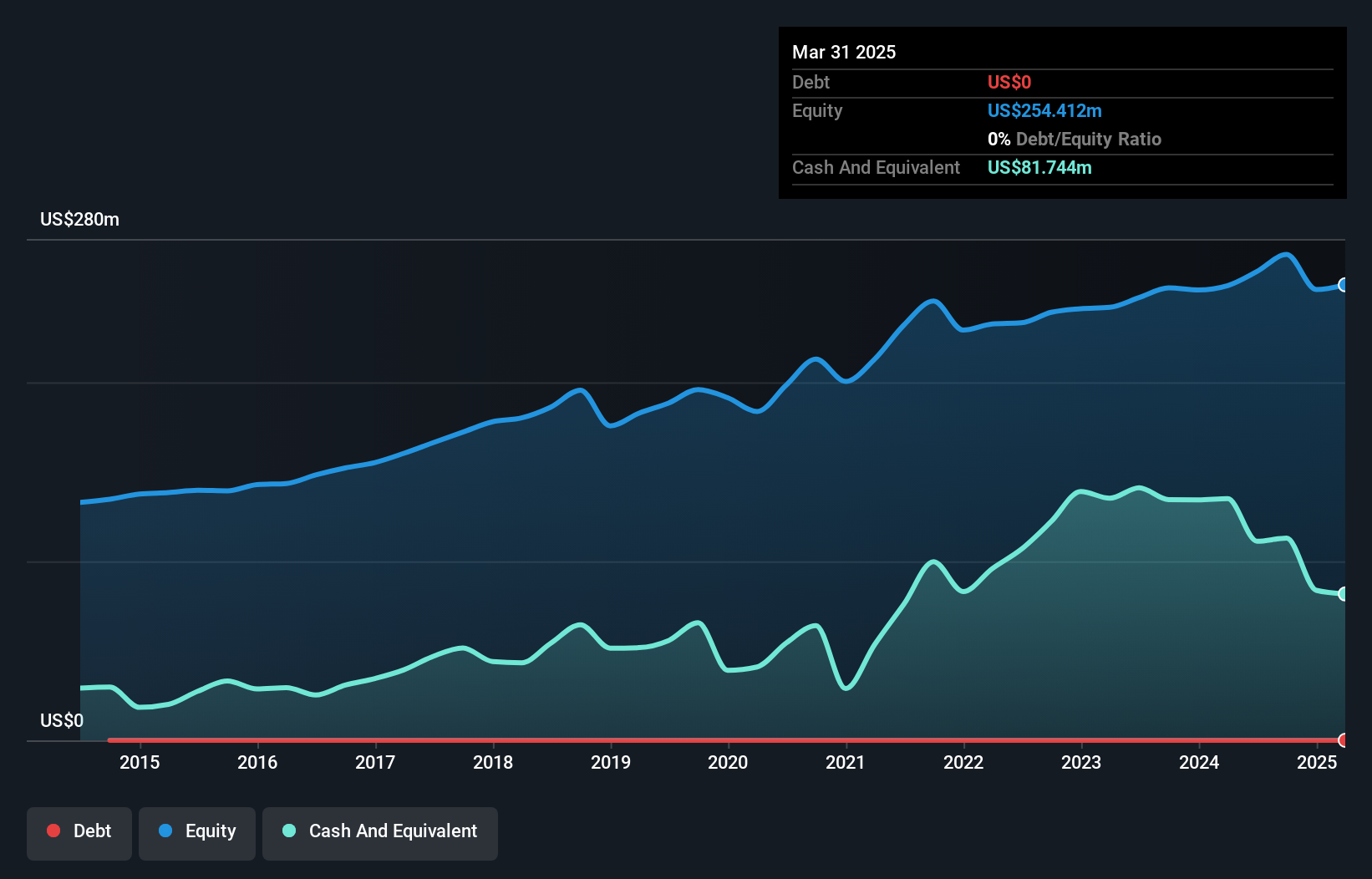

Investors Title, a nimble player in the insurance sector, has shown resilience with earnings growth of 25.9% over the past year, outpacing the industry average of 13.2%. Despite a challenging five-year period marked by an annual earnings decrease of 14.5%, recent performance is promising. The company reported third-quarter revenue of US$73.02 million and net income of US$12.21 million, reflecting solid gains from last year's figures. With no debt on its books for five years and trading slightly below its estimated fair value, Investors Title presents a compelling case for those eyeing steady financial health and high-quality earnings in their portfolio considerations.

Turning Ideas Into Actions

- Navigate through the entire inventory of 296 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property and casualty insurance business in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives