- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG) Reports Strong Earnings And Announces Leadership Changes

Reviewed by Simply Wall St

Following the recent announcement of its Fourth Quarter and Full Year Results, Procter & Gamble (PG) experienced a 1.34% increase in its total shareholder returns this past week. The company's positive earnings results, with sales and net income seeing year-over-year growth, may have added weight to stock's movement within the broader market, which rose by 1.5%. The strength of P&G's earnings aligned with optimistic market sentiment amid robust corporate performance across various sectors. Additionally, the unveiled corporate guidance and the commencement of a leadership transition highlighted the company's strategic direction, further supporting investor confidence during the week.

We've spotted 1 weakness for Procter & Gamble you should be aware of.

The recent announcement of Procter & Gamble's Fourth Quarter and Full Year Results, coinciding with a favorable earnings report, positively influenced investor sentiment, resulting in a 1.34% increase in its total shareholder returns over the past week. This movement aligns with the company's broader performance, which has delivered a 35.42% total return over the past five years. During this period, Procter & Gamble's initiatives, such as investments in product innovation and productivity improvements, appear instrumental in its growth trajectory, despite current stock prices slightly lagging behind the US market's return of 17.7% over the past year.

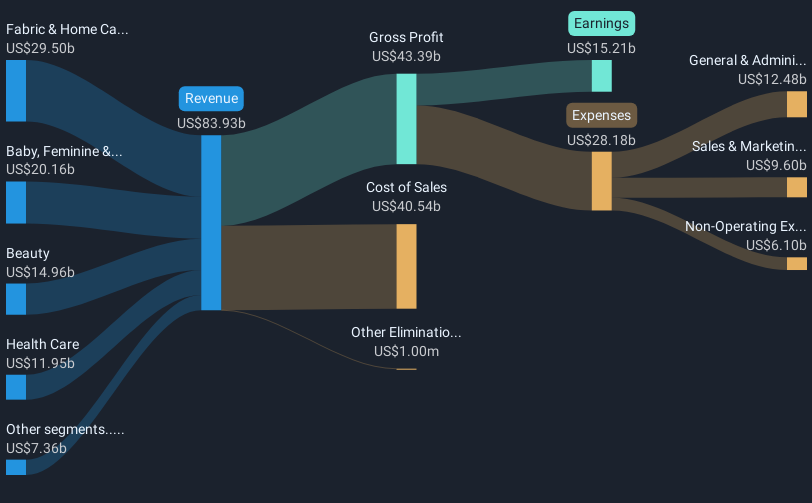

With Procter & Gamble's revenues at US$83.93 billion and earnings at US$15.21 billion, the current share price of US$157.11 reflects a slight discount of approximately 9.3% against the consensus price target of US$171.71. Given the price movement and market reaction to the recent earnings, the company’s strategic focus on expanding market share and improving net margins could support future revenue growth and potentially align with analyst forecasts projecting earnings of US$18.4 billion by mid-2028. As analysts expect a PE ratio shift from 24.4x to 26.0x, the stock price's proximity to the target indicates analyst consensus on fair valuation, though market volatility and external risks remain significant factors to monitor.

Assess Procter & Gamble's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives