- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG): Reassessing Valuation After Jefferies’ Upgrade and AI-Driven Efficiency Push

Reviewed by Simply Wall St

Jefferies’ upgrade of Procter & Gamble (PG) to Buy has put fresh attention on a stock that is finally getting some credit for its AI driven efficiency push and steady brand power.

See our latest analysis for Procter & Gamble.

Despite Jefferies’ upgrade, fresh buzz around Pantene’s Alix Earle campaign, and upcoming leadership changes, PG’s 2025 share price return is still negative. Its five year total shareholder return near 19% shows longer term compounding remains intact, and current momentum looks more like an early stabilisation than a full reversal.

If PG’s mix of brands and AI efficiency has your attention, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling stories building behind the scenes.

With the shares down double digits this year but trading nearly 17% below consensus targets and an even larger gap to some bullish calls, is Procter & Gamble a rare quality franchise on sale, or is the market already discounting its next leg of growth?

Most Popular Narrative: 20.6% Overvalued

According to andre_santos, the narrative fair value of $119.81 sits well below Procter & Gamble’s last close at $144.46, setting up a tension between dependable cash flows and a premium price tag.

Given the company maturity and stage of its lifecycle, growth is expected to remain modest at the rate of inflation and the risk free rate, so it will float around 2-4% over the next years.

Despite a strong last year, long-term FCF growth is expected to normalize, as with the revenues, around the risk free rate of 2-4%.

Want to see why slow and steady assumptions still point to a rich price tag? The narrative leans on subtle shifts in margins, cash flows, and payout discipline. Curious which levers matter most and how they add up to that fair value call? Dive in to unpack the full storyline behind the numbers.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper AI-driven productivity lift or sustained premium pricing in emerging markets could support faster growth and undermine the slow and steady thesis.

Find out about the key risks to this Procter & Gamble narrative.

Another View on Valuation

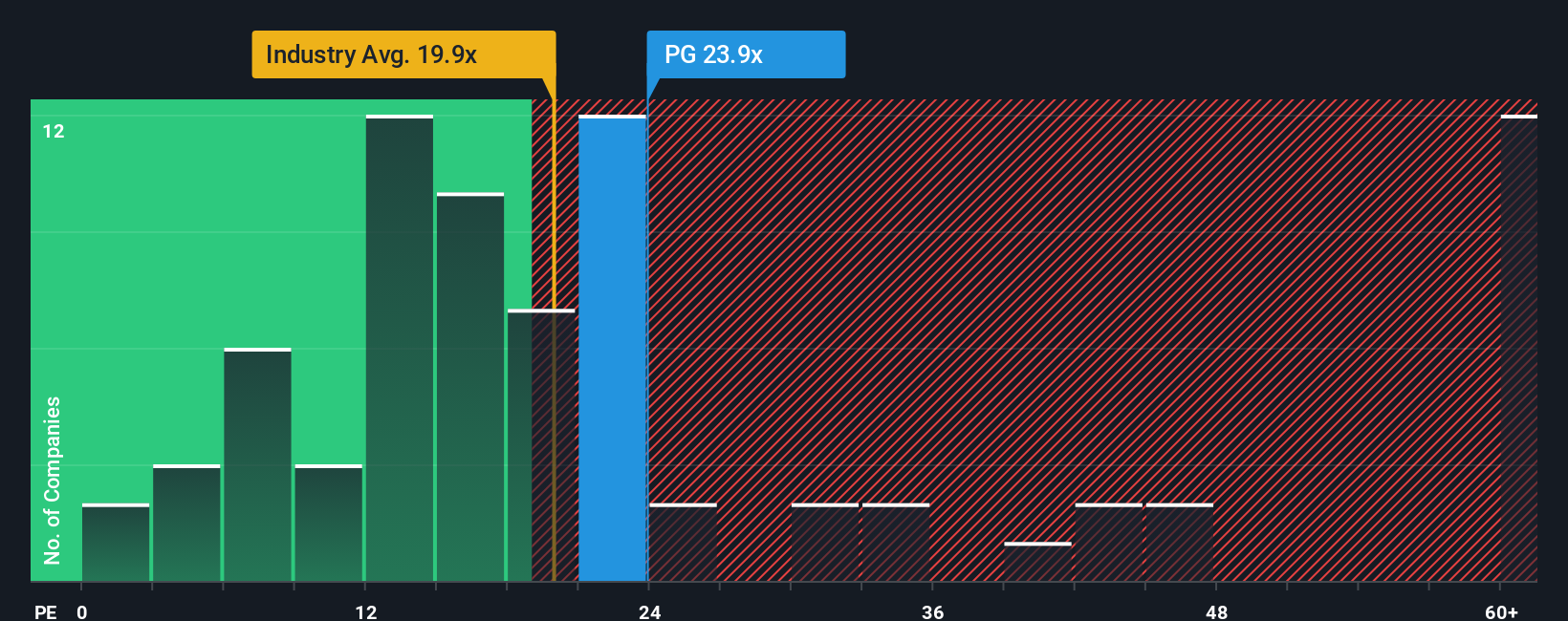

Our earnings based valuation paints a different picture. At 20.5 times earnings versus a fair ratio of 22 times, Procter & Gamble screens as reasonably priced on fundamentals, even if it still looks pricey against the global household products average of 16.9 times. Is the market quietly baking in a quality premium that sticks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procter & Gamble Narrative

If the story here does not quite fit your view or you would rather dig into the numbers yourself, you can build a personalized take in under three minutes: Do it your way.

A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Before you move on, explore fresh ideas tailored to your style, from income to innovation, so you are not the one hearing about them later.

- Turn volatility into opportunity by targeting beaten down names with real potential using these 3625 penny stocks with strong financials and separate the hype from the hidden bargains.

- Focus on automation and data by looking at businesses powering intelligent tools with these 25 AI penny stocks and stay informed as their earnings results are reported.

- Put valuation on your side by hunting for companies trading below their cash flow characteristics through these 914 undervalued stocks based on cash flows and use that insight to support your research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion