- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble NYSE:PG Faces Investor Activism and Launches Innovative Pampers Product Line

Reviewed by Simply Wall St

Click here to discover the nuances of Procter & Gamble with our detailed analytical report.

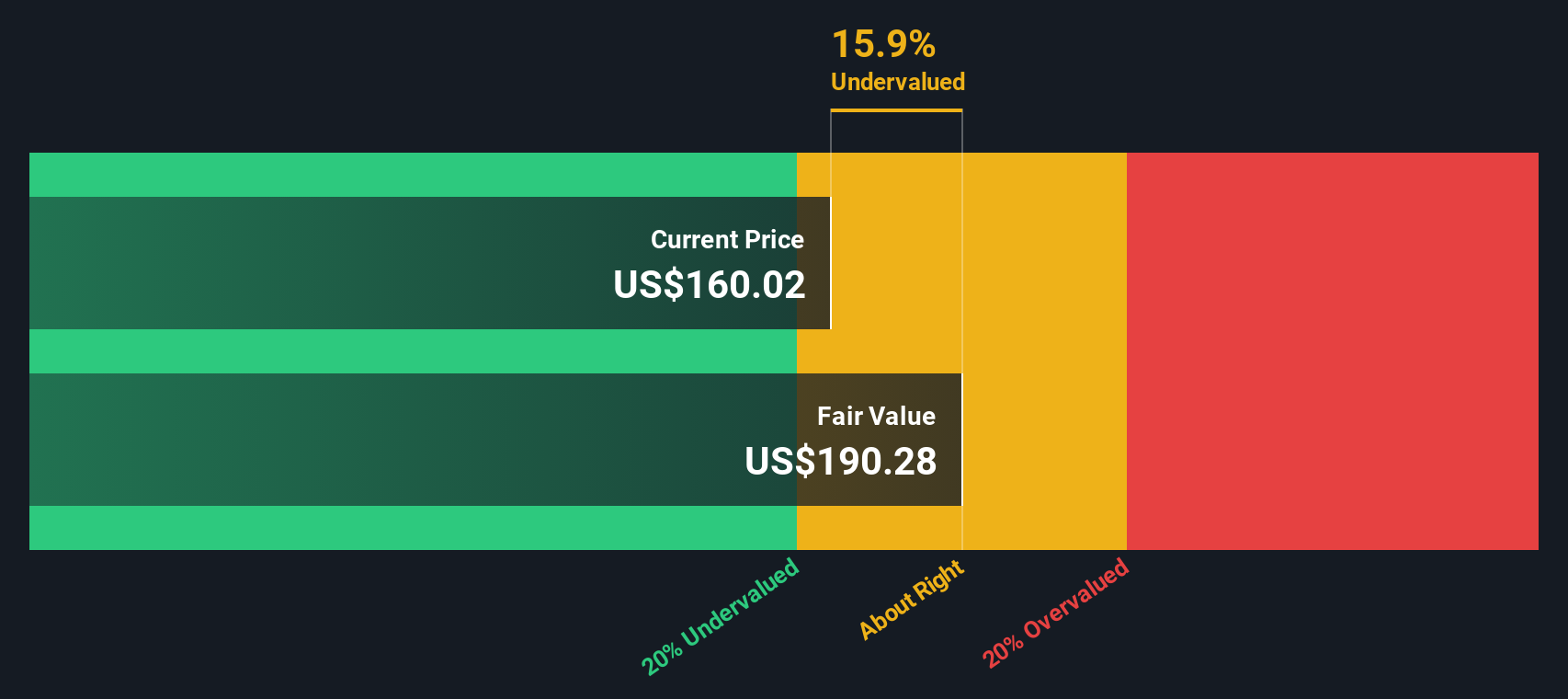

Unique Capabilities Enhancing Procter & Gamble's Market Position

Procter & Gamble (P&G) has demonstrated strong financial health, with a focus on profitability and consistent performance. The company reported a 4% organic sales growth for fiscal 2024, marking the sixth consecutive year of such growth, as highlighted by CFO Andre Schulten. This broad-based growth across eight out of ten product categories underscores P&G's strategic execution and market share expansion. The company's ability to return nearly $4 billion to shareholders through dividends and share repurchases further emphasizes its financial strength. Additionally, P&G's valuation is considered favorable compared to peers, with a Price-To-Earnings Ratio of 26.9x against a peer average of 37.6x, and it trades below its estimated fair value of $224.37, suggesting potential for future appreciation.

Vulnerabilities Impacting Procter & Gamble

However, P&G faces challenges in specific markets and categories. The company's organic sales in Greater China decreased by 9%, attributed to market conditions and brand-specific issues with SK-II. Performance in the Skin and Personal Care and Baby Care categories also saw low single-digit growth. Furthermore, the Argentine market contributed less to organic sales following a business divestiture and decreased shipment volumes. P&G is expensive relative to the industry average, with its Price-To-Earnings Ratio of 26.9x surpassing the Global Household Products industry average of 17.6x. These factors highlight areas where P&G must focus on improvement.

Potential Strategies for Leveraging Growth and Competitive Advantage

P&G is well-positioned to capitalize on innovation and market expansion opportunities. CEO Jon Moeller emphasizes the company's dynamic strategy, which adapts to consumer and societal needs, focusing on growing markets. The recent launch of Pampers Premium Protection, featuring advanced skin protection technology, exemplifies P&G's commitment to product innovation. Additionally, productivity improvements, targeting gross savings of up to $1.5 billion before tax, are expected to enhance operational efficiency. By leveraging digital acumen and sustainability initiatives, P&G aims to streamline its supply chain and drive shareholder value, potentially strengthening its competitive advantage.

Competitive Pressures and Market Risks Facing Procter & Gamble

Despite these opportunities, P&G must navigate several external threats. The company anticipates a volatile environment in fiscal 2025, influenced by input costs, currency fluctuations, and geopolitical dynamics. Competitive pressures and pricing challenges are expected as markets stabilize to growth rates of 3% to 4%. Regulatory and geopolitical risks, particularly foreign exchange and commodity headwinds, pose additional challenges. Furthermore, recent investor activism highlights concerns over environmental risks in P&G's supply chains, urging shareholders to reconsider board elections. These factors present ongoing challenges that P&G must address to maintain its market leadership.

To gain deeper insights into Procter & Gamble's historical performance, explore our detailed analysis of past performance.To dive deeper into how Procter & Gamble's valuation metrics are shaping its market position, check out our detailed analysis of Procter & Gamble's Valuation.Procter & Gamble's consistent 4% organic sales growth and strategic market share expansion across most product categories highlight its strong financial health and effective execution. The company's ability to return $4 billion to shareholders demonstrates its commitment to shareholder value, while its Price-To-Earnings Ratio of 26.9x, favorable compared to a peer average of 37.6x, suggests potential for future stock appreciation, especially as it trades below its estimated fair value of $224.37. However, challenges in specific markets like Greater China and Argentina, coupled with competitive pressures and geopolitical risks, indicate areas requiring strategic focus. Despite being more expensive than the industry average, P&G's innovative strategies and efficiency improvements position it well to navigate these challenges and sustain its market leadership, providing a promising outlook for future performance.

Summing It All Up

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Established dividend payer and good value.