- United States

- /

- Household Products

- /

- NYSE:PG

Is There Hidden Value in P&G After This Year's 11% Share Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Procter & Gamble is currently a bargain or just another safe-haven blue chip? In either case, knowing where value lies is key for both new investors and long-time shareholders.

- In the past week, the stock climbed 1.5% but is still down 2.5% over the past month and 11% for the year. This suggests shifting views around its growth and risk profile.

- Recent headlines have focused on changing consumer spending and the company's emphasis on innovation through new product lines, both of which have influenced market sentiment. For example, several business publications have discussed changes to household product preferences as inflation and evolving demand trends create increased competition in the sector.

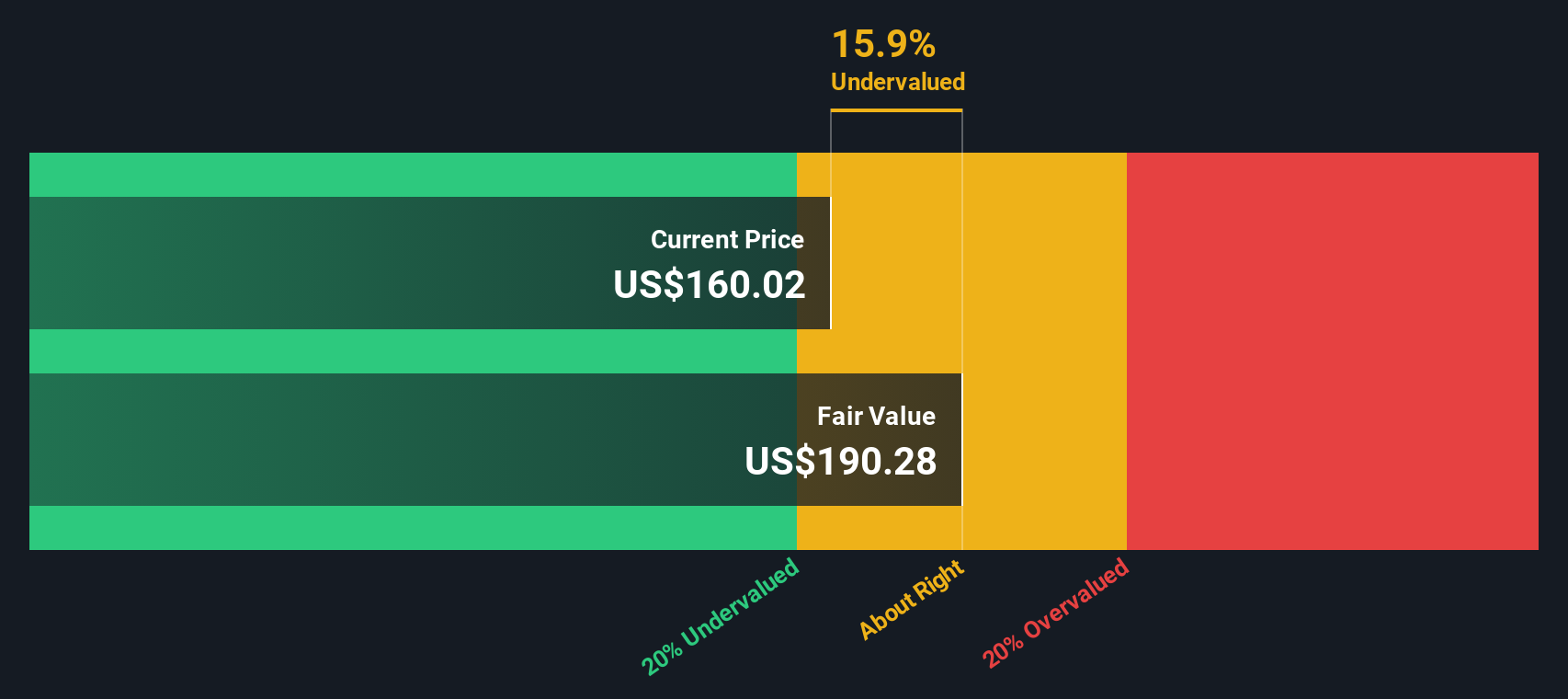

- On our valuation scorecard, Procter & Gamble receives a 3 out of 6 for undervaluation based on our key checks. A closer look at how we value the company may be useful, and there could be an even more insightful approach to understanding its worth presented at the end of this article.

Approach 1: Procter & Gamble Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today’s value. This approach is often used to determine what a business is truly worth compared to its current market price.

For Procter & Gamble, the most recent Free Cash Flow (FCF) was $15.4 billion. Analyst projections show steady growth, with FCF expected to reach around $17.0 billion in 2028. Beyond five years, Simply Wall St extrapolates further and estimates FCF could reach over $21.3 billion in 2035. All cash flows are reported in US dollars.

Using a two-stage Free Cash Flow to Equity model, Simply Wall St calculates an intrinsic fair value of $185.05 per share for Procter & Gamble. This suggests the stock is trading at a 20.2% discount to its estimated true value based on future cash flows.

This implies that Procter & Gamble is currently undervalued, offering potential opportunity for investors who believe in the reliability of these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Procter & Gamble is undervalued by 20.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

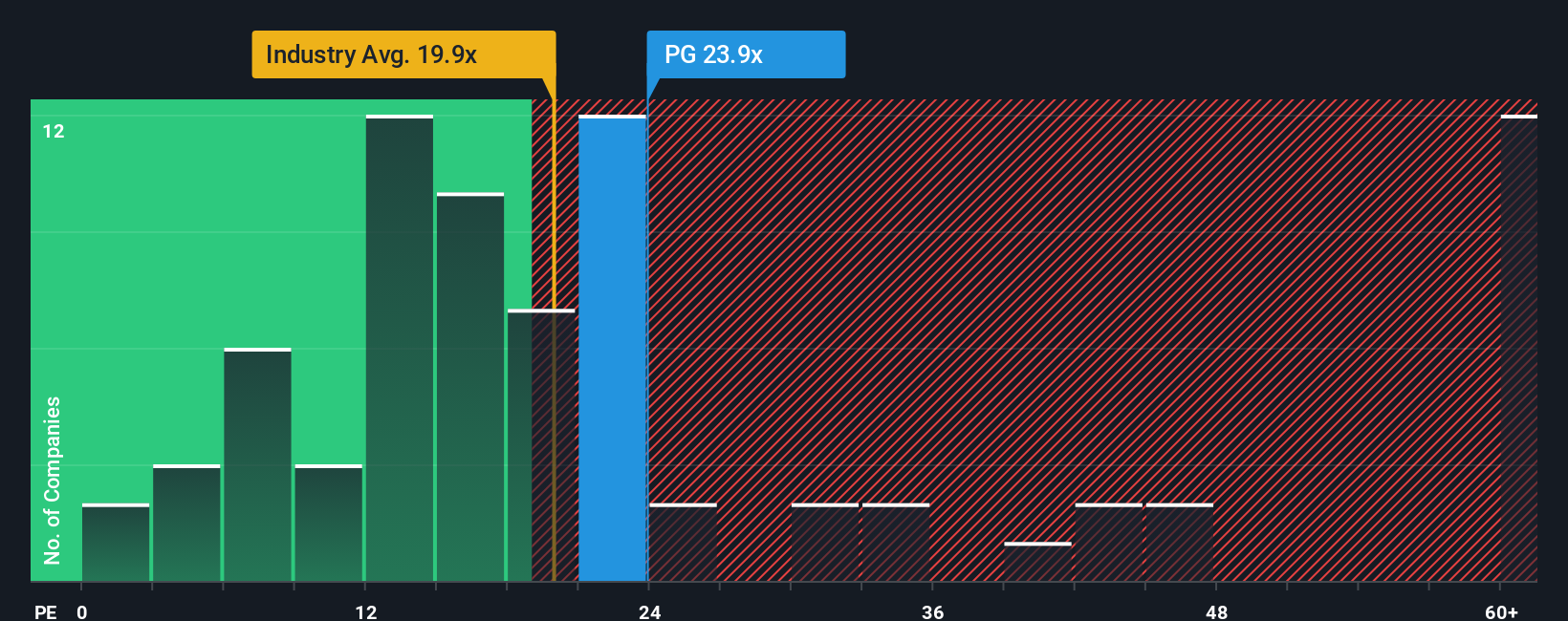

Approach 2: Procter & Gamble Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Procter & Gamble. It is especially useful when evaluating mature businesses with stable earnings. This multiple is relevant because it balances current earnings power with investor expectations for future growth.

A "normal" PE ratio can differ depending on factors such as expected earnings growth and business risk. Companies with higher growth prospects or lower risk typically warrant higher PE ratios, while firms facing volatility often trade at lower multiples. Benchmarks such as the industry average PE, peer group average, and a company’s own historical ratios are important reference points.

Procter & Gamble currently trades at a PE ratio of 21x. This is higher than the Household Products industry average of 18x but broadly in line with its peer group average of 20x. Simply Wall St has developed a proprietary metric called the Fair Ratio, calculated as 26x for Procter & Gamble. This Fair Ratio adjusts for earnings growth, profit margins, risk profile, industry standards, and market capitalization, providing a more holistic gauge of fair value than industry or peer comparisons alone.

Comparing the Fair Ratio of 26x with the current PE of 21x shows Procter & Gamble is trading below what would be considered fair for its profile. This implies potential undervaluation based on this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

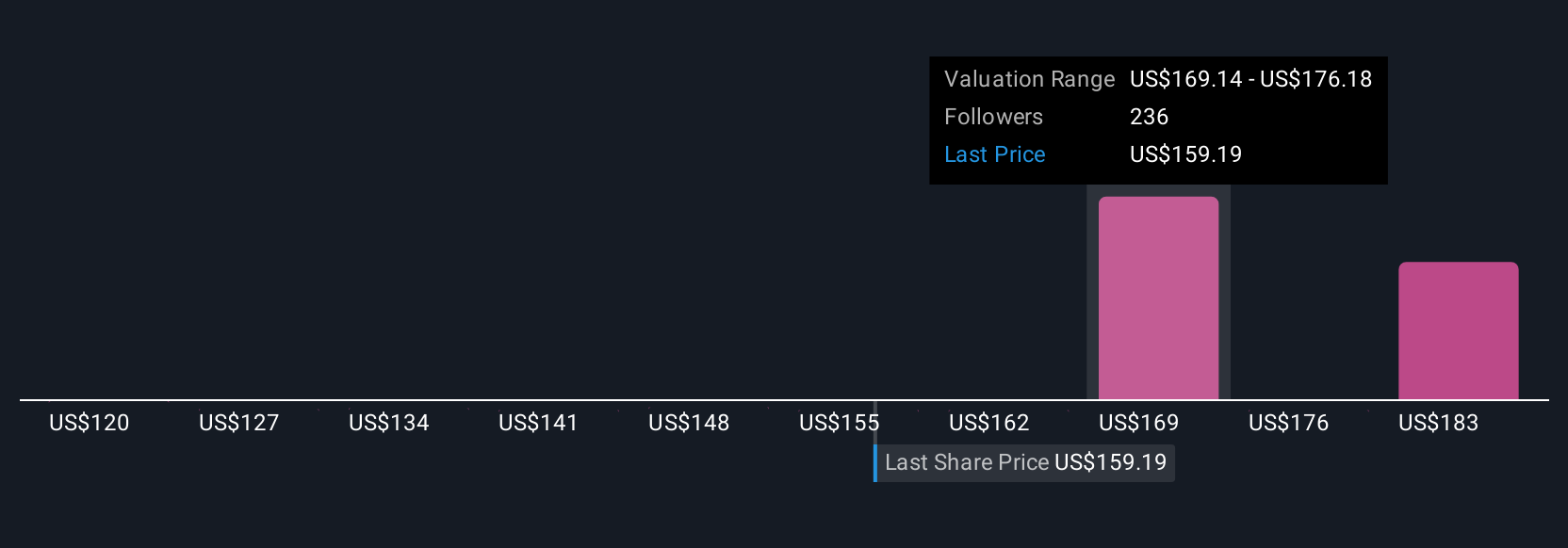

Upgrade Your Decision Making: Choose your Procter & Gamble Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective about a company, bringing together your own assumptions about its future revenue, earnings, and fair value. All of these are connected to what you believe is driving its business forward or holding it back.

Narratives allow you to link Procter & Gamble’s actual business story, such as its innovation, global reach, or market risks, to a dynamic financial forecast and an updated estimate of fair value. They provide a clear way to compare your own analysis with the market price, making buy, hold, or sell decisions more straightforward.

These Narratives are easy to create and customize on the Simply Wall St Community page, where millions of investors share and update their perspectives in real time. When news breaks or earnings results are released, Narratives automatically update any connected forecasts and valuations, keeping your thesis aligned with the latest developments.

For example, one Procter & Gamble Narrative forecasts a fair value as high as $147 per share by assuming challenges like global economic volatility and modest growth. Another projects as much as $186 per share by factoring in strong innovation and rising market share. By exploring different Narratives, you can find the one best aligned with your views and act confidently when the numbers and your story connect.

For Procter & Gamble, we will make it really easy for you with previews of two leading Procter & Gamble Narratives:

- 🐂 Procter & Gamble Bull Case

Fair Value: $169.05

Current Valuation: 12.6% undervalued

Projected Revenue Growth: 3.19%

- Analysts expect innovation and new product rollouts to drive increased market share, revenues, and expanded net margins.

- Consensus forecasts project revenues of $92.8 billion and earnings of $17.8 billion by 2028, assuming gradual margin expansion and stable consumer confidence.

- The consensus price target is just 6.7% above today’s price, suggesting the stock is close to fair value unless growth or margins outperform expectations.

- 🐻 Procter & Gamble Bear Case

Fair Value: $119.81

Current Valuation: 23.3% overvalued

Projected Revenue Growth: 4.68%

- Slowing growth and margin pressures mean fair value may be significantly below the current market price, even with P&G’s operational strength.

- Weighted average from four methods, including DCF, DDM, and historical dividend and PE measures, suggests limited upside and potential overvaluation at current levels.

- P&G remains a reliable dividend grower but is likely priced at a premium, with little support for a sustained rise unless profitability or sales growth accelerate meaningfully.

Do you think there's more to the story for Procter & Gamble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives