- United States

- /

- Household Products

- /

- NYSE:PG

How P&G's Strong Q4 Earnings and Upbeat Outlook Could Impact Investors (PG)

Reviewed by Simply Wall St

- On August 29, 2025, Procter & Gamble reported Q4 2025 earnings that exceeded analyst estimates, with adjusted EPS of US$1.48 and revenues of US$20.89 billion, and announced strong forward guidance for fiscal 2026.

- P&G’s announcement highlights management’s confidence in delivering ongoing organic sales and free cash flow growth, despite the challenging business backdrop.

- We'll examine how Procter & Gamble's robust earnings report and upbeat outlook could shape its investment narrative for the coming year.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Procter & Gamble Investment Narrative Recap

To be a Procter & Gamble shareholder today, you need confidence in the company's ability to navigate consumer demand shifts and protect margins as external cost pressures persist. The latest shareholder proposal requesting more detailed reporting on plastic packaging, along with management’s recommendation to vote against it, does not appear to materially affect P&G’s primary near-term catalysts, namely, continued organic sales and free cash flow growth, nor does it exceed the top risk, which remains cost headwinds from tariffs and commodities.

Among recent announcements, P&G’s Q4 2025 results stand out, with earnings and revenues beating expectations and guidance reaffirming low-to-mid single digit sales and EPS growth for fiscal 2026. This continued focus on expanding top line growth while improving shareholder returns supports the catalyst of margin and cash flow productivity, which are vital as the company manages ongoing raw material and packaging cost challenges.

However, in contrast, investors should also be mindful of the risk that rising input costs or tariff impacts could pressure core earnings if recent mitigation efforts fall short...

Read the full narrative on Procter & Gamble (it's free!)

Procter & Gamble's narrative projects $93.0 billion revenue and $18.0 billion earnings by 2028. This requires 3.3% yearly revenue growth and a $2.3 billion earnings increase from $15.7 billion.

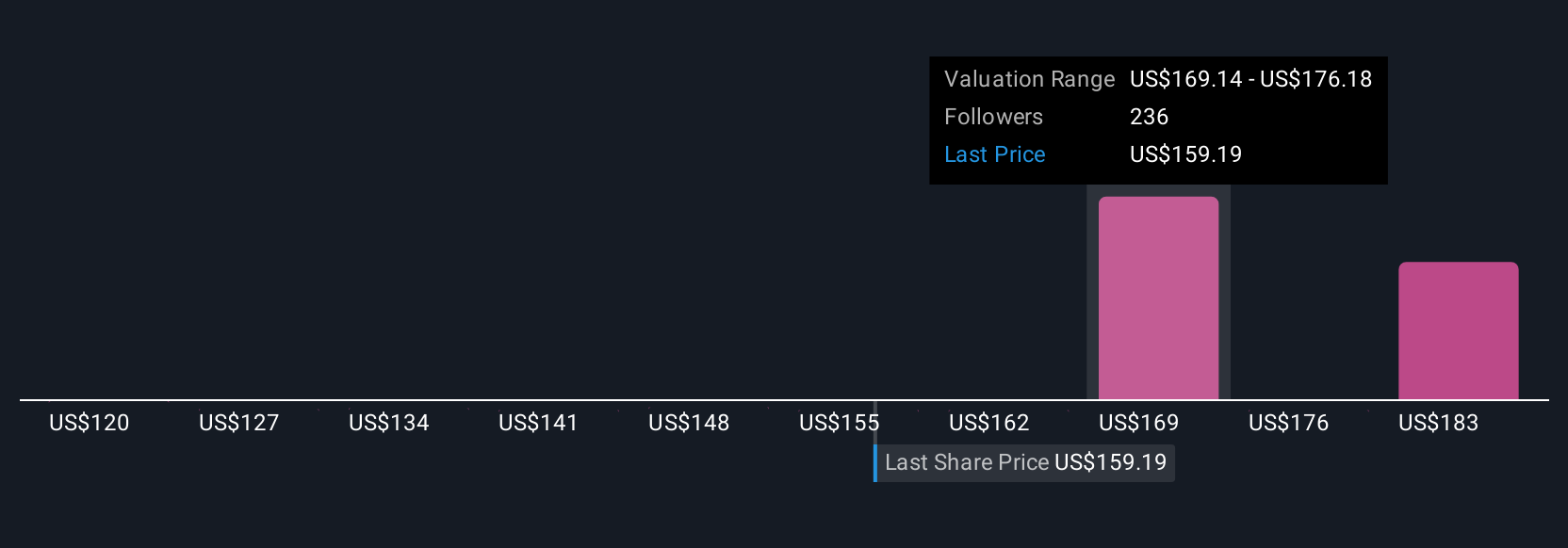

Uncover how Procter & Gamble's forecasts yield a $170.64 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Twenty members of the Simply Wall St Community set fair value estimates for P&G ranging from US$119.81 to US$190.28. While some anticipate significant upside or downside, many are closely watching whether P&G’s margin improvements can keep pace with persistent cost pressures in the household products industry.

Explore 20 other fair value estimates on Procter & Gamble - why the stock might be worth as much as 21% more than the current price!

Build Your Own Procter & Gamble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procter & Gamble research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Procter & Gamble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procter & Gamble's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives