- United States

- /

- Personal Products

- /

- NYSE:KVUE

Does Kenvue’s Strategic Partnership Signal a Change in Its Market Value?

Reviewed by Bailey Pemberton

- Ever wondered if Kenvue is a bargain hiding in plain sight? You are not alone. Understanding where true value lies can put you ahead of the market.

- Kenvue shares have had a wild ride recently. They are up 10.1% in the last week but still down 25.0% year-to-date, making investors question if sentiment is shifting or risks are on the rise.

- Much of this movement is happening after news that Kenvue finalized a significant product partnership and announced a strategic update focused on expanding its wellness brands. This has added fuel to the price swings and provided fresh context on the company’s growth story beyond daily headlines.

- When it comes to fundamentals, Kenvue currently boasts a solid 5 out of 6 on our valuation checks, which means it is undervalued in the vast majority of metrics we track. Up next, we will examine how those valuation scores stack up using a few different approaches, and introduce an even sharper way to gauge value at the end of this piece.

Find out why Kenvue's -28.7% return over the last year is lagging behind its peers.

Approach 1: Kenvue Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true worth of a company by projecting its future cash flows and discounting them back to today's value. For Kenvue, this approach uses a two-stage Free Cash Flow to Equity model, combining both analyst forecasts and longer-term extrapolations to evaluate the business's earning power.

Currently, Kenvue generates about $1.67 Billion in Free Cash Flow (FCF). Analyst projections indicate steady growth, with FCF expected to reach approximately $2.83 Billion by 2029. After that point, estimates are extrapolated and point toward ongoing increases through the next decade, based on assumptions provided by Simply Wall St after analyst coverage ends. These projections all refer to figures in US dollars, in line with both Kenvue's reporting and listing currency.

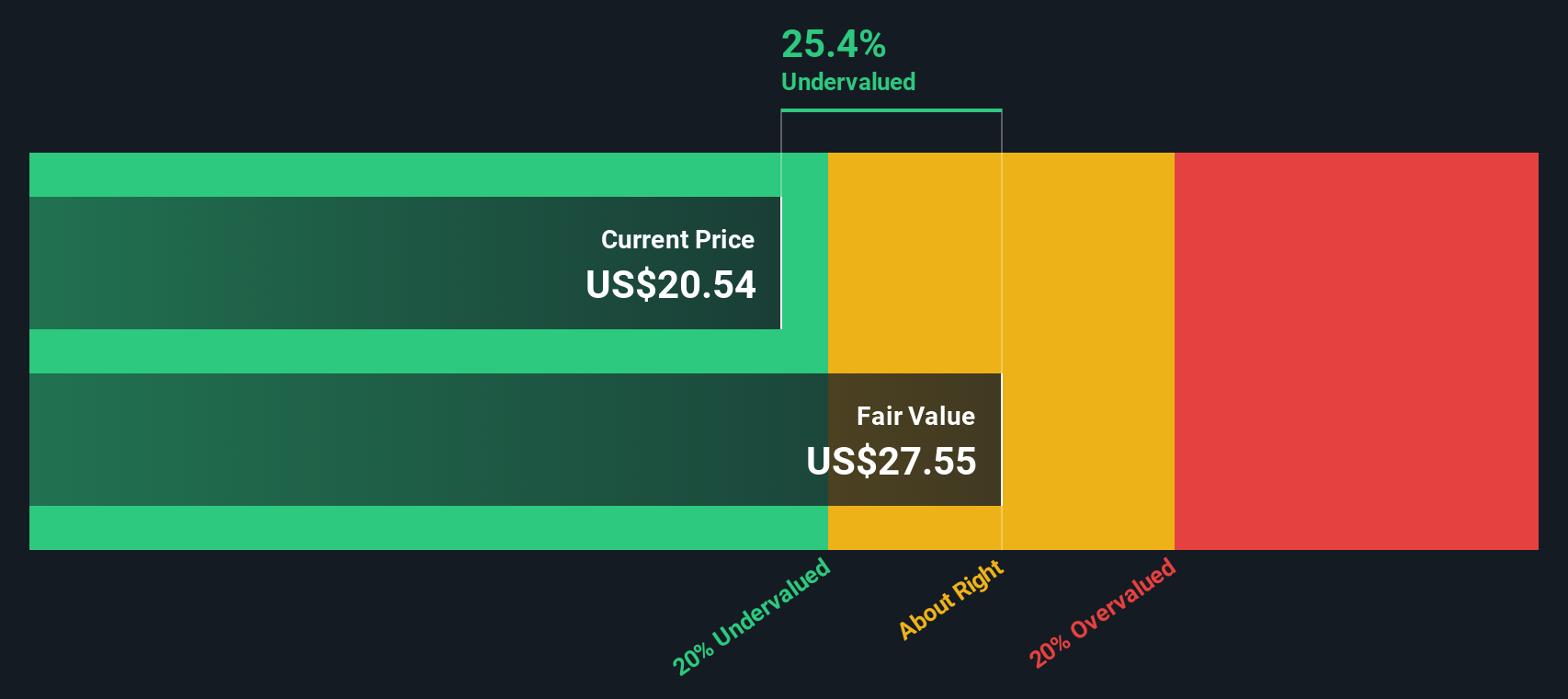

The DCF calculation places Kenvue's intrinsic value at $27.80, implying a discount of 42.6% compared to recent trading levels. This sizable gap suggests that the stock trades well below what its future cash flows indicate it is worth, marking Kenvue as quite undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kenvue is undervalued by 42.6%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Kenvue Price vs Earnings

For profitable companies like Kenvue, the Price-to-Earnings (PE) ratio is one of the most reliable ways to gauge valuation. The PE ratio gives investors a straightforward view of how much they are paying for each dollar of company earnings. Importantly, "normal" or "fair" PE ratios are shaped by factors such as expected future growth and perceived risk. Investors are generally willing to pay higher multiples for businesses with strong growth prospects or more stable, predictable earnings.

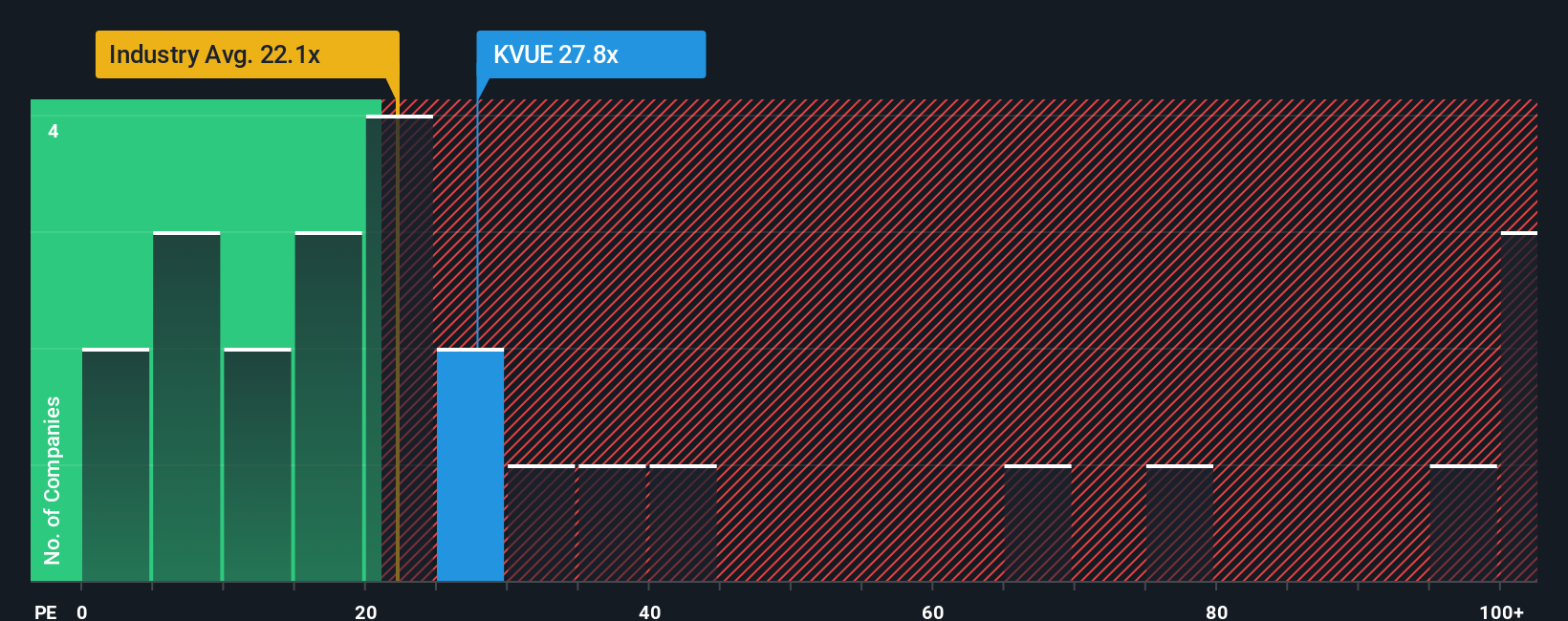

Kenvue currently trades at a PE ratio of 21.4x, which is slightly below the Personal Products industry average of 22.1x and well under the peer group average of 32.2x. While these benchmarks provide an initial point of reference, the more meaningful comparison comes from Simply Wall St’s proprietary “Fair Ratio.” This model estimates a stock’s ideal valuation multiple by factoring in not just industry comparisons but also company-specific elements like earnings growth, profit margins, risks, and company size.

For Kenvue, the Fair Ratio stands at 23.9x. This is only modestly higher than its current PE multiple, suggesting that while Kenvue trades at a discount to its “Fair” value, the gap is close enough that its valuation appears reasonable based on the company’s current outlook and traits.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kenvue Narrative

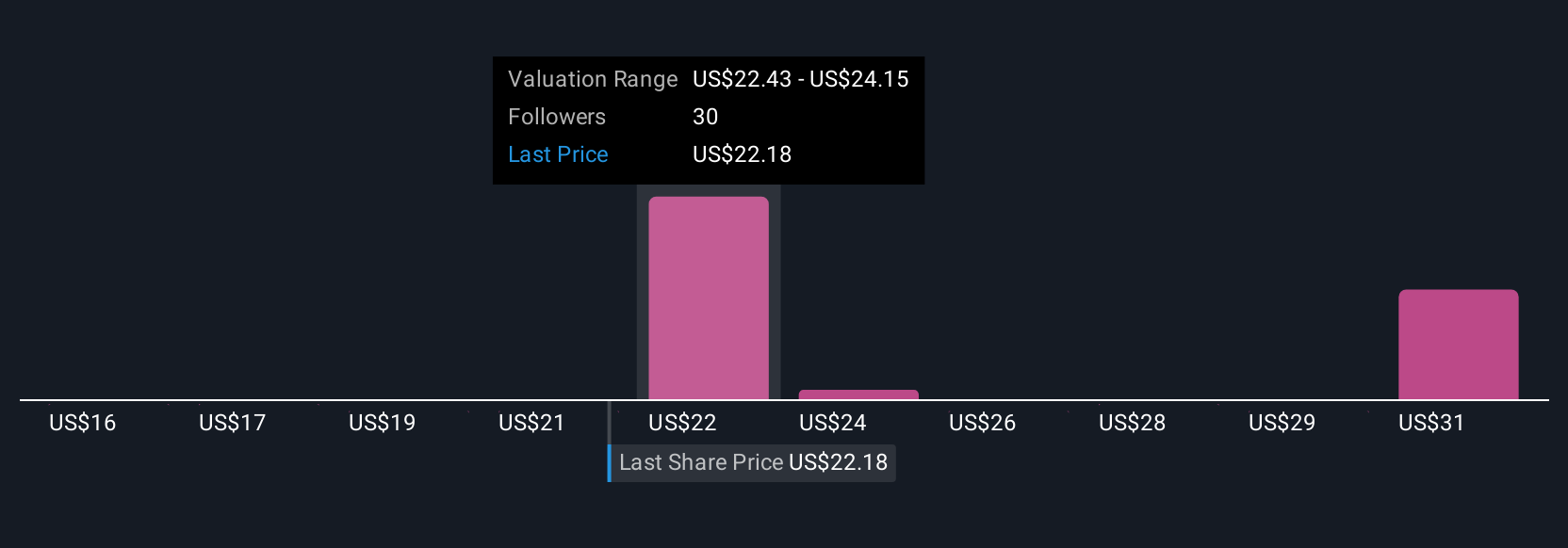

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, the “why” behind the numbers, where you set your own view of Kenvue’s fair value by forecasting its future revenue, earnings, and margins, rather than just relying on analyst targets or historical data.

Narratives connect a company’s story (your investing perspective and assumptions) directly to a dynamic financial forecast, and then translate that into a Fair Value estimate, allowing you to clearly see how your view compares to others on the Simply Wall St Community page, trusted by millions of investors.

Putting Narratives into action, you can easily monitor when it might be time to buy or sell by seeing if your Fair Value is above or below Kenvue's current share price. Since Narratives update automatically when important news or earnings are released, your insights stay relevant as conditions change.

For example, one investor’s Narrative might assume Kenvue will successfully drive growth in emerging markets and push potential Fair Value close to $26.00. A more cautious investor, concerned about legal risks, could set their Narrative Fair Value nearer to $19.00. You can compare both perspectives instantly and update your own as new facts emerge.

Do you think there's more to the story for Kenvue? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives