- United States

- /

- Household Products

- /

- NYSE:ENR

Energizer Holdings (ENR): Evaluating Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Energizer Holdings.

After a tough year for shareholders, with a 1-year total shareholder return of -23.43%, Energizer Holdings’ share price has shown signs of stabilizing in recent months. However, momentum appears to be fading compared to the earlier rally.

If Energizer’s recent moves have you rethinking your approach, it might be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

This recent drop raises a classic investor question: is Energizer Holdings now trading below its true worth, or does the current share price already reflect the company’s future growth prospects?

Price-to-Earnings of 6.5x: Is it justified?

At a price-to-earnings ratio of just 6.5x, Energizer Holdings is currently trading at a deep discount to both its global household products peers and the wider market, with a recent closing price of $24.09.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of the company’s earnings. For a consumer staples business like Energizer, this multiple provides a clear gauge of how the market values steady profits, brand strength, and resilience through different economic cycles.

The current multiple is significantly below the industry average, suggesting the market is taking a skeptical view of Energizer’s future earnings or expecting limited growth ahead. Compared to global peers with an average PE of 19.7x, the stock appears out of favor. The fair PE ratio, estimated at 18.1x, indicates notable upside potential if sentiment improves and the market values the company closer to this level.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 6.5x (UNDERVALUED)

However, steady revenue and net income growth could be challenged if consumer demand softens or if competitive pressures further compress margins.

Find out about the key risks to this Energizer Holdings narrative.

Another View: What Does Our DCF Model Say?

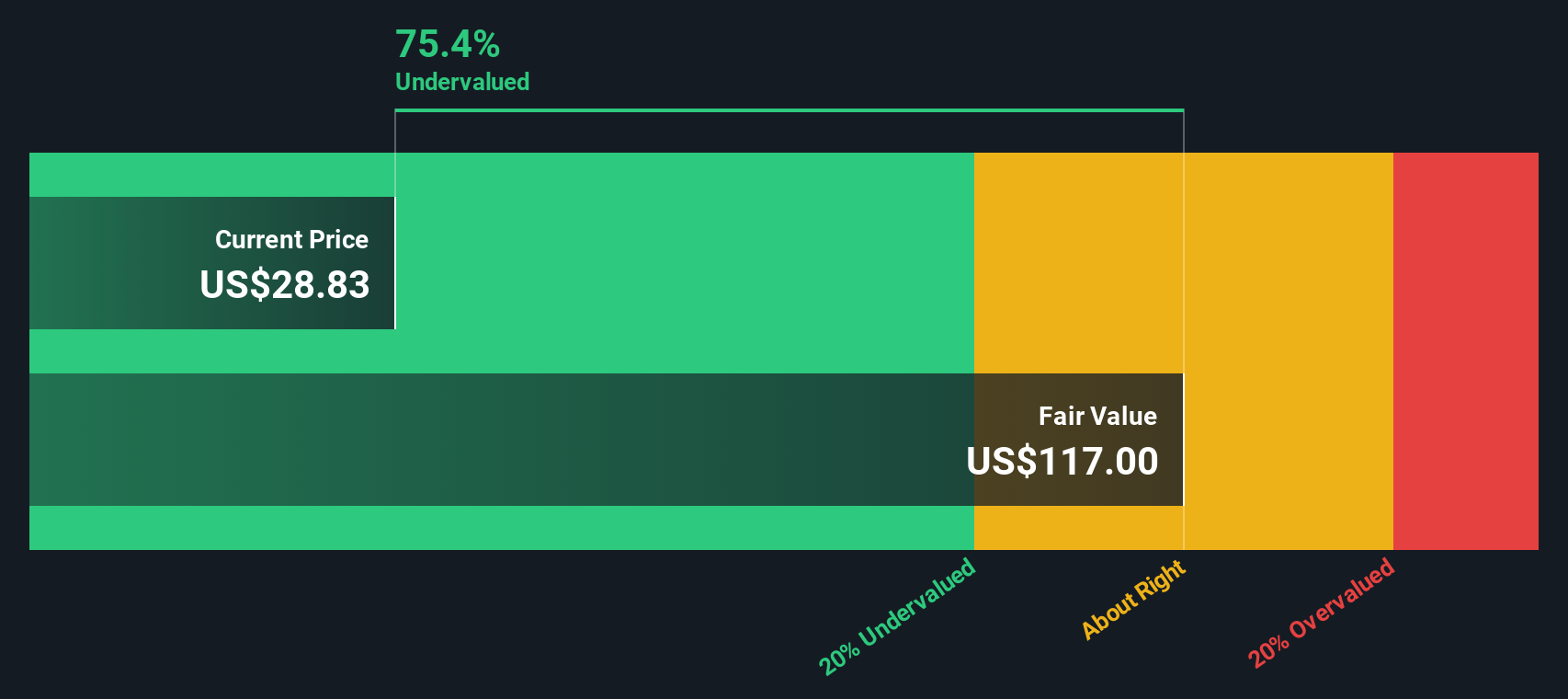

Looking at Energizer Holdings through the lens of our DCF model provides a strikingly different result. The SWS DCF model estimates fair value at $110.78 per share, which is far above the current market price of $24.09. This suggests the stock could be deeply undervalued based on future cash flows. Is the market overlooking meaningful long-term value, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your perspective quickly and easily, your way with Do it your way.

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put yourself ahead of the curve by hunting for stocks with unique advantages and growth potential. Don’t settle for the usual suspects. Power up your portfolio now for tomorrow’s gains.

- Tap into tomorrow’s financial opportunities by checking out these 80 cryptocurrency and blockchain stocks and focus on companies capitalizing on blockchain innovation and digital assets.

- Spot resilient picks that pay you back. Browse these 19 dividend stocks with yields > 3% to find robust yields that can strengthen your passive income stream.

- Uncover cutting-edge disruption in healthcare by exploring these 34 healthcare AI stocks and connect with pioneers reshaping medical solutions through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives