- United States

- /

- Personal Products

- /

- NYSE:ELF

Is e.l.f. Beauty a Bargain After Shares Drop 44% and New Global Partnerships?

Reviewed by Bailey Pemberton

- Wondering if e.l.f. Beauty is offering genuine value right now? You are not alone. The stock has experienced significant volatility lately, raising questions for savvy investors.

- Over the last month, shares dropped a dramatic 44.1%, and they are down 42.1% year-to-date. Despite this, the five-year total return remains an impressive 226.3%.

- Recent volatility has often been linked to shifting market sentiment on consumer brands, in addition to news about e.l.f. Beauty's expansion into new retail partnerships and international markets. These developments have created ongoing discussion about the company's future potential and risks.

- If you are interested in the numbers, e.l.f. Beauty scores a 3/6 on our valuation checks so far. We will soon break down the most common valuation methods for this stock. Stay tuned for our perspective on a more effective way to evaluate value at the end.

Find out why e.l.f. Beauty's -40.1% return over the last year is lagging behind its peers.

Approach 1: e.l.f. Beauty Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting those back to their present value. This analysis helps investors understand whether a stock looks cheap or expensive relative to its intrinsic value based on expected future performance.

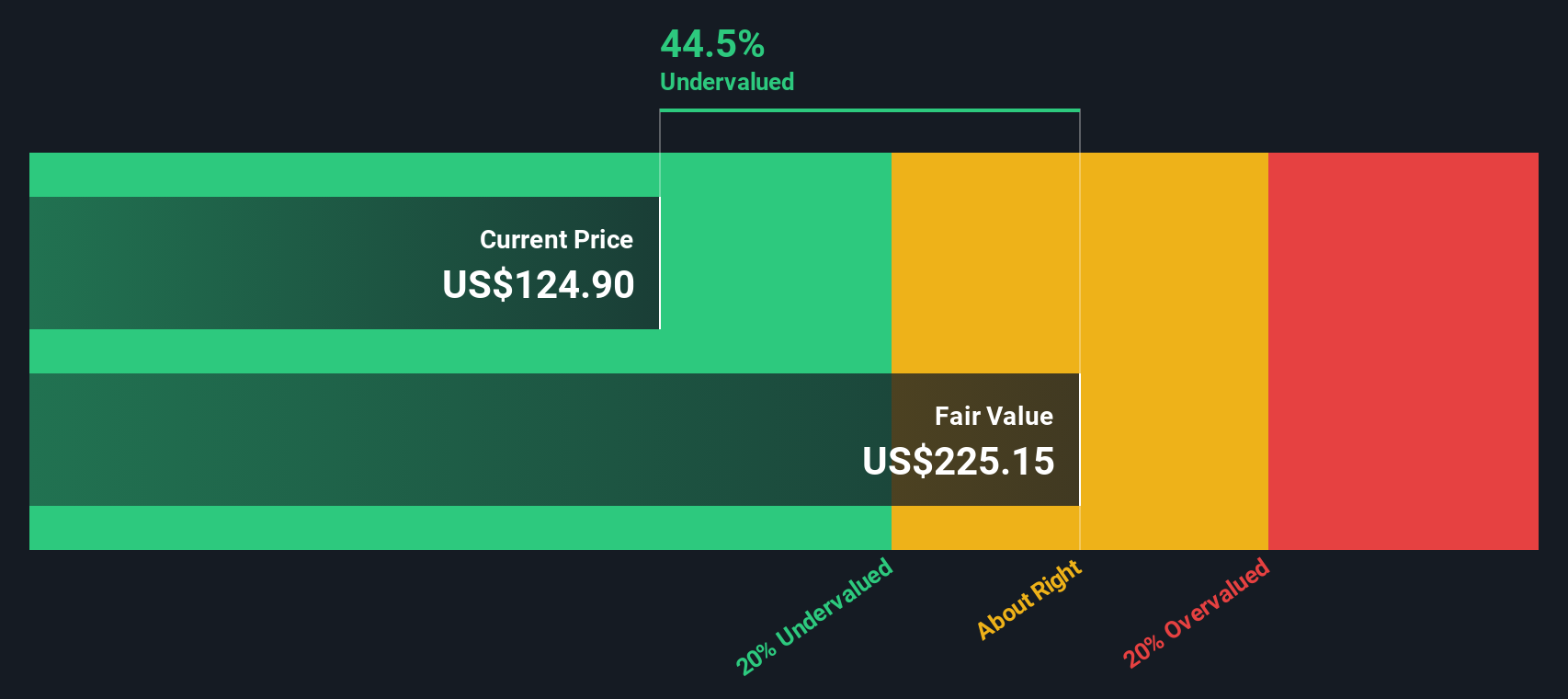

For e.l.f. Beauty, the model uses a 2 Stage Free Cash Flow to Equity approach. It begins with the company's latest twelve months free cash flow of $154.7 million. Analysts project that this figure will grow significantly, with Simply Wall St extrapolating it out to $466.6 million by 2035. The projections indicate a robust growth trajectory, with cash flow estimates from 2026 to 2028 provided by analysts and subsequent years estimated using industry benchmarks. All cash flows are in US dollars.

Based on these calculations, the estimated intrinsic fair value of e.l.f. Beauty is $122.16 per share. Given the DCF model's implied discount of 41.7%, the stock currently appears substantially undervalued compared to its underlying fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests e.l.f. Beauty is undervalued by 41.7%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: e.l.f. Beauty Price vs Earnings (PE Ratio)

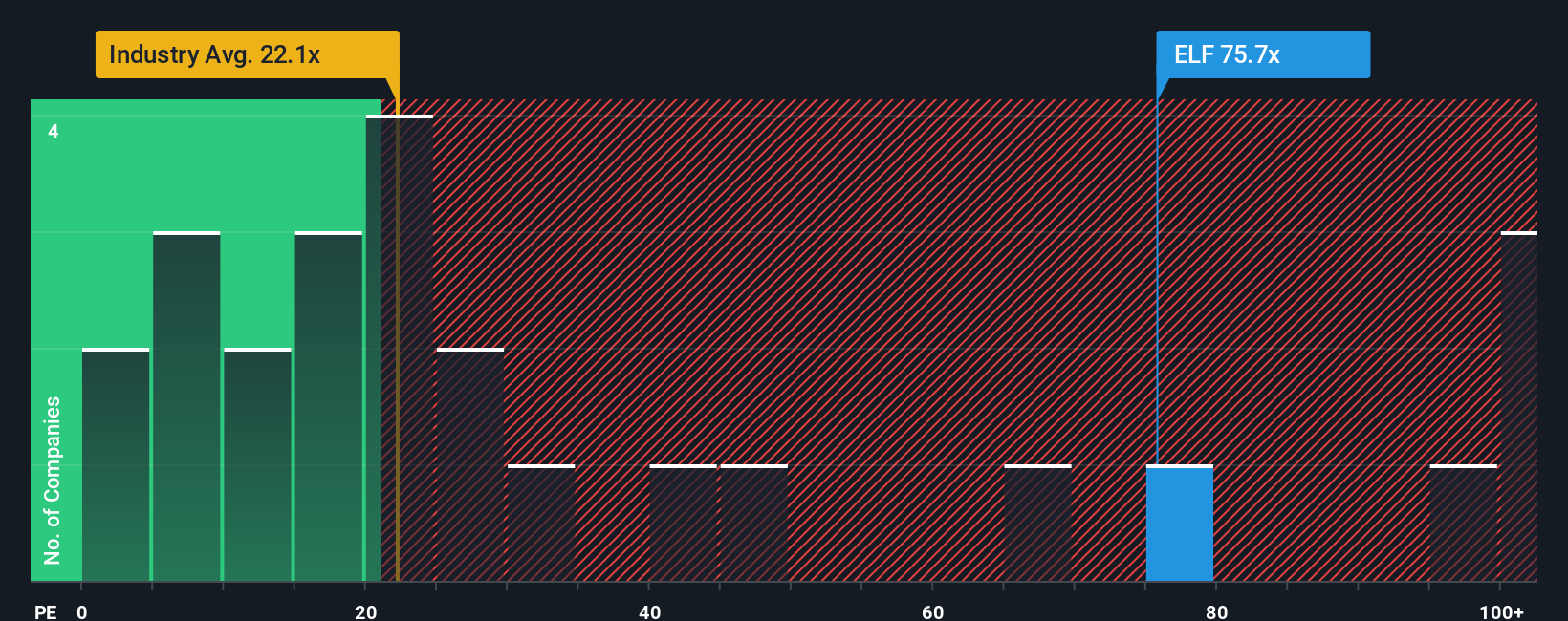

The Price-to-Earnings (PE) ratio is widely considered the go-to valuation metric for profitable companies such as e.l.f. Beauty, since it lets investors quickly assess how much they are paying for each dollar of current earnings. A company’s growth prospects and risk profile play a major role in determining what a “normal” or “fair” PE ratio should be. Higher expected growth or lower risk typically justifies a higher multiple, while companies with limited growth or greater risk usually trade at a discount.

At present, e.l.f. Beauty trades at a PE ratio of 51.9x. For comparison, its peers average 13.5x, and the wider Personal Products industry trades around 21.9x. Clearly, the market is baking in high expectations for continued outperformance.

Simply Wall St’s Fair Ratio takes this further by calculating that, given e.l.f. Beauty's specific growth, industry, profit margins, size, and risk factors, a fair PE multiple would be about 34.3x. This proprietary metric is more meaningful than a simple peer or industry comparison because it customizes the multiple to what’s actually driving the company’s value, not just how it stacks up against others.

Comparing the current PE of 51.9x to the Fair Ratio of 34.3x, it appears the stock is trading at a premium to what its fundamentals support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your e.l.f. Beauty Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your own investment story; it is how you interpret e.l.f. Beauty’s future growth, profit margins, and risks, capturing your outlook and translating it into numbers like fair value and earnings estimates.

This approach connects the company’s real-world journey to financial forecasts and then calculates a fair value, making the “why” behind the numbers more transparent and personal. Narratives are accessible and easy to use, available on Simply Wall St’s Community page where millions of investors share, debate, and refine their perspectives together.

They empower you to decide when to buy or sell by tracking how your Narrative’s fair value compares to the current share price. Since Narratives refresh automatically with every company update or breaking news, your insights remain current.

For example, with e.l.f. Beauty, some investors may believe international expansion and brand partnerships will fuel strong growth and set a higher fair value. Others see supply chain risks or tariff challenges as reasons for more caution and a lower valuation. Narratives help you visualize these possibilities, compare expectations, and ultimately invest with greater confidence and clarity.

Do you think there's more to the story for e.l.f. Beauty? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives