- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder (EL): Slower 3.9% Revenue Growth and Rising Losses Set Earnings Backdrop

Reviewed by Simply Wall St

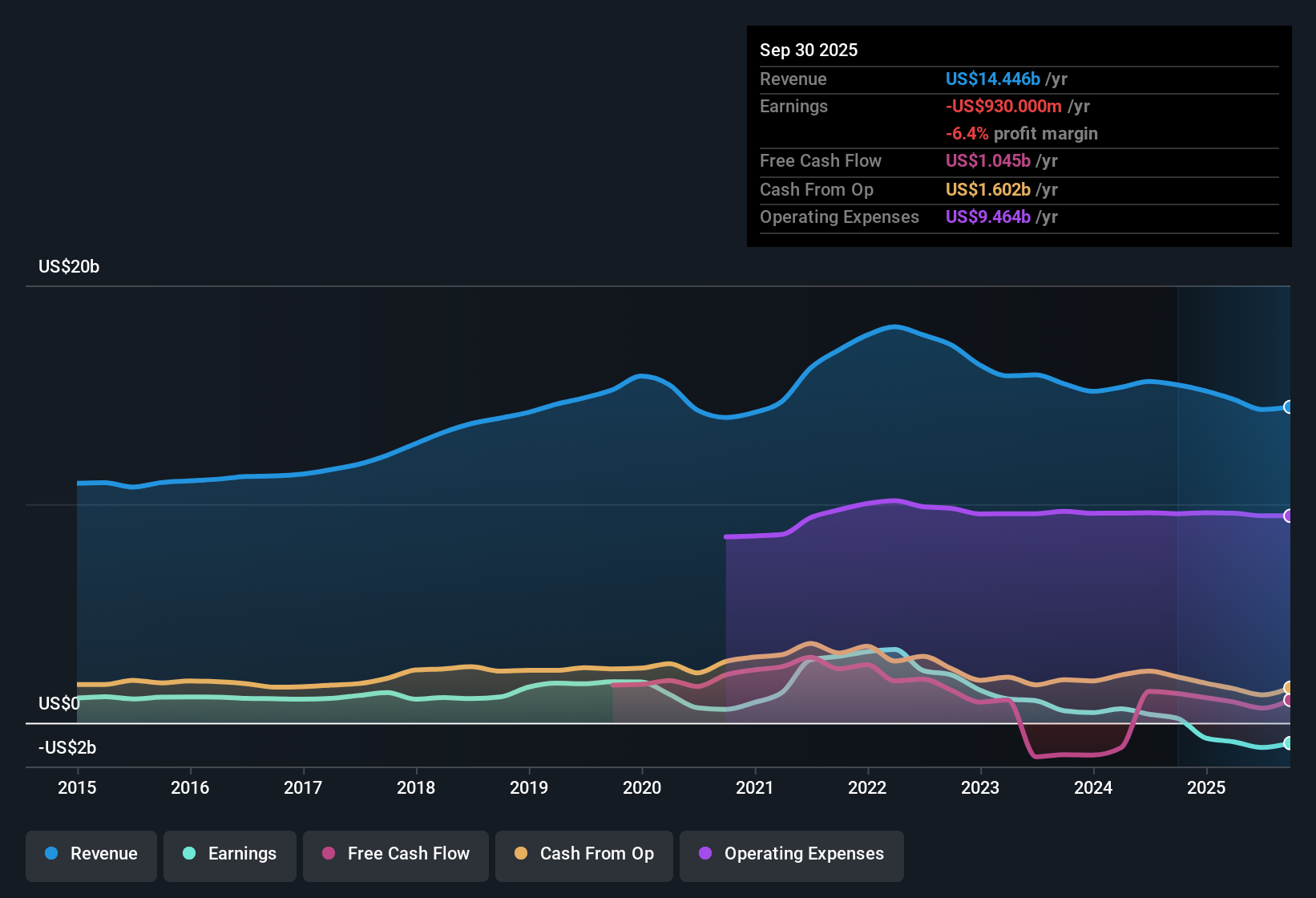

Estée Lauder Companies (EL) is trading below its estimated fair value of $116.16, with shares last noted at $96.69. The company’s Price-to-Sales ratio sits at 2.4x, on par with peers but more expensive than the broader US Personal Products industry average of 1.1x. Revenue is forecast to grow at 3.9% per year, lagging behind the broader US market’s 10.4% pace. Although losses have deepened at a 47.6% annual rate over the last five years, earnings are expected to grow 47.57% annually as the company moves toward profitability within the next three years. This outlook spotlights strong profit growth potential but also underscores the risks tied to Estée Lauder’s current financial position and its premium valuation.

See our full analysis for Estée Lauder Companies.The next section puts these headline numbers side by side with the prevailing community narratives. Some will be reinforced, while others may face fresh challenges.

See what the community is saying about Estée Lauder Companies

Margin Turnaround Expected by 2027

- Profit margins are forecast to rise from -7.9% today to 9.0% in three years. This would represent a dramatic swing that takes Estée Lauder from solidly negative territory to industry-level profitability.

- Analysts' consensus view highlights that investments in restructuring, greater use of AI, and expanding digital channels are expected to fuel margin recovery and long-term earnings growth.

- This initiative includes operating cost savings reinvested into innovation and consumer initiatives. The strategy directly targets margin improvement with measurable progress required within the next three years.

- Consensus notes ongoing risk from high restructuring costs, which could hinder these gains if sales growth does not accelerate fast enough to offset expenses.

- Consensus narrative points out that emerging markets, now only 10% of reported sales, are targeted for double-digit annual growth. If achieved, these geographies could play a vital role in supporting future margin expansion and overall profitability.

- Analysts see the digital shift, with 31% of sales already online, as another lever for better margins. They caution that continued travel retail weakness and cost pressure may weigh on progress in the near term.

- These factors create a highly contingent but potentially rewarding path to robust profitability if operational execution meets the ambitious forecasts set by management and consensus.

Innovation to Exceed 25% of Sales

- Estée Lauder aims to have innovation, meaning new products and launches, contribute over 25% of its sales by fiscal 2026. Currently, its mix is below this threshold.

- According to analysts' consensus view, meaningful investments in trend-driven skincare, makeup, and luxury fragrance launches underline management’s strategy to boost pricing power and strengthen brand equity.

- This targeted innovation is designed to enhance gross margins and improve time-to-market, bolstering resilience against competitive threats from direct-to-consumer, digital native, and clean beauty brands.

- Consensus acknowledges that these efforts must be balanced against significant restructuring costs, which, if not contained, risk eroding the financial flexibility needed to fully capitalize on innovation-driven growth.

Valuation Premium Despite Slower Growth

- At a Price-to-Sales ratio of 2.4x, Estée Lauder trades at a premium to the broader US Personal Products industry average of 1.1x, even as its 3.9% forecast annual revenue growth trails the 10.4% US market pace.

- From the consensus view, this premium is justified only if margin recovery and innovation targets are delivered on schedule, since peers offer faster growth at lower valuations.

- Analysts set a consensus price target of $100.83, just 4% above the current $96.69 share price. This suggests the market sees limited near-term upside unless Estée Lauder exceeds expectations on profitability and strategic execution.

- The DCF fair value stands higher at $116.16, so strong progress on restructuring and expansion could potentially unlock further upside if current headwinds are resolved.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Estée Lauder Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an alternative angle in the data? Put your unique perspective into a narrative in just a few minutes and shape the story yourself. Do it your way.

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Estée Lauder’s premium valuation and reliance on a margin turnaround make it vulnerable if strategic goals around sales growth and profitability fall short.

If you want to avoid stocks that need flawless execution to justify their lofty prices, search for better value opportunities by checking out these 833 undervalued stocks based on cash flows that align with more conservative investment strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives