- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder (EL): Assessing Valuation Following $1B Equity Raise and Improved Quarterly Earnings

Reviewed by Simply Wall St

Estée Lauder Companies has completed a major follow-on equity offering and raised just over $1 billion in new capital. This move comes as the company posted improved quarterly earnings and reaffirmed its quarterly dividend, signaling operational momentum.

See our latest analysis for Estée Lauder Companies.

Momentum for Estée Lauder Companies has clearly picked up in recent months, with improved earnings, a new partnership with Shopify, and the successful equity raise all adding to a sense of renewed confidence. While the share price return is up over 23% year-to-date and total shareholder return over the past year sits at a robust 46.6%, investors are still weighing the long road back after deep medium-term losses. Signs point to recovery, but volatility lingers after a tough few years.

If this rebound has you curious about what other growth stories are out there, now is the perfect time to discover fast growing stocks with high insider ownership

With shares rebounding, robust earnings, and a renewed dividend, the key question for investors now is whether Estée Lauder Companies is still trading at a discount or if the market has already factored in the next wave of growth.

Most Popular Narrative: 4.2% Undervalued

Compared to the last close price of $91.09, the narrative consensus puts Estée Lauder Companies’ fair value higher, hinting at renewed optimism from leading analysts. Additional fuel for this narrative comes from expectations around digital expansion, innovation, and restructuring impact.

Estée Lauder is increasing its penetration in high-growth emerging markets (notably Asia-Pacific, Latin America, and Southeast Asia), which have a growing middle class with rising disposable incomes. These markets currently only represent 10% of reported sales but are targeted for double-digit growth, which could drive long-term revenue and market share expansion.

Want to uncover what financial levers could send the stock soaring? The most popular narrative is betting big on global expansion, razor-sharp margin improvement, and a profit surge few expect. The calculations behind this fair value may surprise you. See which growth drivers analysts are doubling down on before you make your next move.

Result: Fair Value of $95.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent travel retail weakness and intensifying competition from fast-moving beauty brands could undermine Estée Lauder Companies' path to sustained margin recovery.

Find out about the key risks to this Estée Lauder Companies narrative.

Another View: Multiples Send Mixed Signals

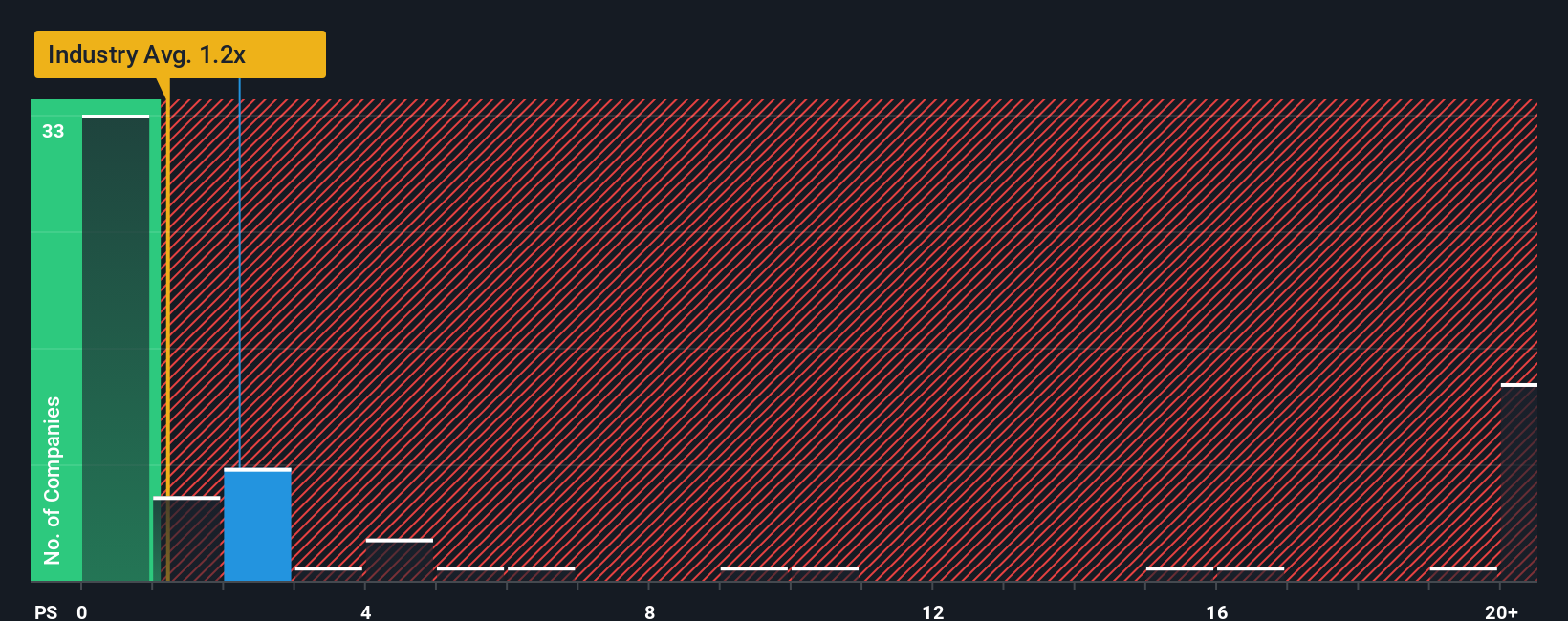

While the fair value narrative suggests Estée Lauder Companies is undervalued, looking at its sales ratio tells a more nuanced story. The company trades at 2.3x sales, which is higher than both its industry average of 0.9x and its fair ratio of 2.1x. This raises the risk that shares may be less of a bargain than they first appear. Could the market be overestimating growth potential, or is there still upside to capture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Estée Lauder Companies Narrative

If you think the story looks different from your perspective or want to dig through the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors act quickly to spot what's next. Don't let this be the only opportunity you seize. Power your strategy with ideas you won't find just anywhere.

- Boost your search for future game-changers by scanning these 26 AI penny stocks, where innovation is driving stunning returns in AI-powered businesses.

- Supercharge your income potential with these 20 dividend stocks with yields > 3%, featuring top-yielding stocks for steady, reliable returns in any market.

- Gain an edge in the digital economy and find companies riding blockchain trends with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives