- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder (EL): Assessing Valuation After Recent Share Price Pullback and Year-to-Date Gains

Reviewed by Simply Wall St

See our latest analysis for Estée Lauder Companies.

Momentum for Estée Lauder Companies is mixed right now, with the share price sliding about 12% over the past month even with a strong year-to-date gain of 17%. Over the past year, however, total shareholder return sits at an impressive 32%, which comfortably outpaces the share price’s recent pullback and suggests that longer-term growth potential may still be on investors’ minds.

If you’re interested in finding what else might be leading the charge in today’s market, broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets after recent declines, the question remains: is Estée Lauder Companies undervalued at current levels, or are investors already factoring in the brand’s future growth prospects?

Most Popular Narrative: 15% Undervalued

Compared to its last close price of $86.61, the most widely followed narrative places Estée Lauder Companies’ fair value at $101.87. The current market discount is catching the attention of investors as expectations focus on digital expansion and luxury brand strength.

Expansion in emerging markets and digital channels is expected to drive sustained revenue growth, higher margins, and greater market share. Investments in innovation, restructuring, and AI-powered personalization are strengthening brand equity, operational efficiency, and long-term earnings resilience.

This narrative is fueled by ambitious forecasts. Will record-setting profit margins and digital channel growth truly redefine the company’s market leadership? The financial model behind this fair value combines rapid innovation, smart restructuring, and the promise of luxury dominance. Curious what core numbers unlock this price target? You might be surprised by the projections that support it.

Result: Fair Value of $101.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent travel retail weakness and overexposure to challenging markets, especially in Asia, could limit Estée Lauder’s recovery and undermine optimistic forecasts.

Find out about the key risks to this Estée Lauder Companies narrative.

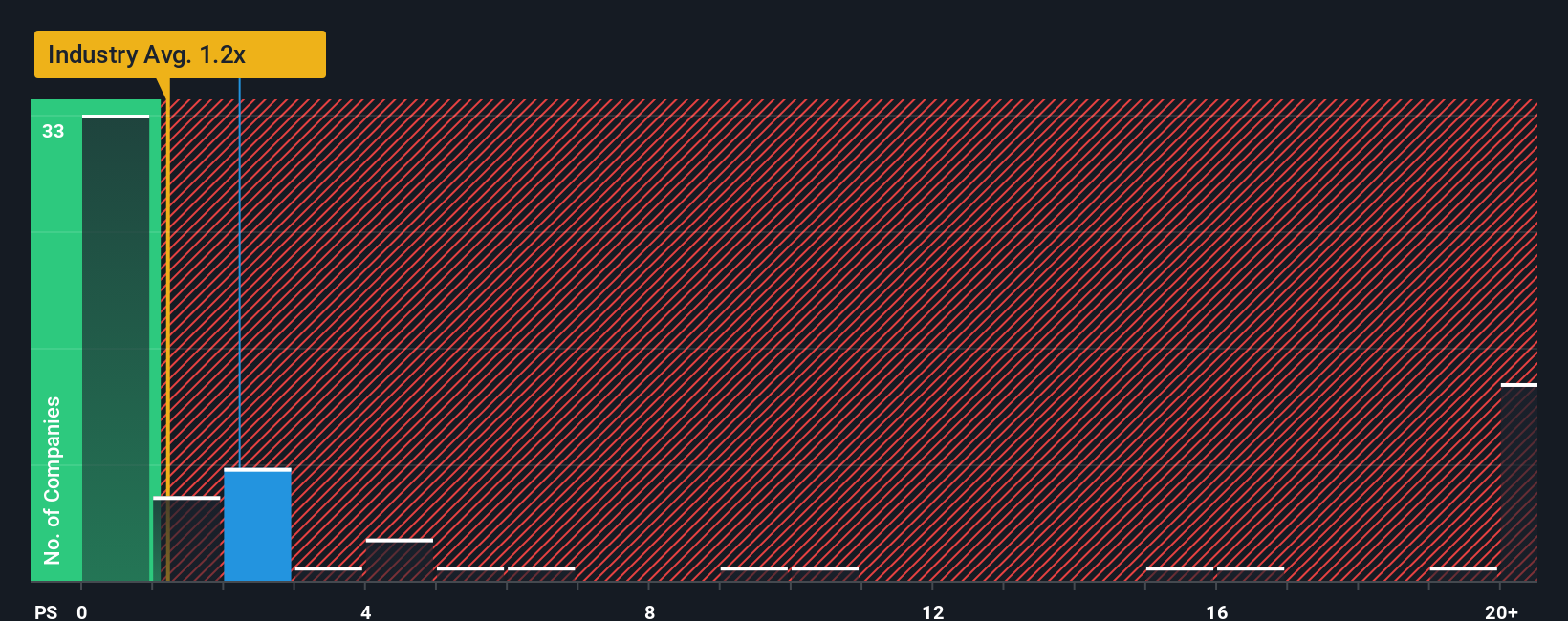

Another View: Multiples Comparison

Looking at valuation through a price-to-sales lens, Estée Lauder Companies trades at 2.2 times sales, which is notably higher than both the industry average of 0.7 times and the peer group average of 1.7 times. That is also above its fair ratio of 2.1. This gap suggests the stock is priced at a premium compared to market benchmarks, potentially signaling greater valuation risk for investors. Will this premium hold up if sales disappoint, or does it reflect confidence in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Estée Lauder Companies Narrative

If you have a different perspective or want to dive deeper into the numbers, you can develop your own narrative in just a few minutes. Do it your way

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing universe with handpicked opportunities you might not have considered yet. Don’t let the next great idea pass you by. Seize your chance now.

- Unlock the potential for higher yields and steady growth by tapping into these 16 dividend stocks with yields > 3% that consistently reward shareholders with attractive payouts.

- Power up your portfolio with these 25 AI penny stocks making game-changing advances in artificial intelligence and transforming diverse industries with innovation.

- Capitalize on the explosive upside of these 3612 penny stocks with strong financials showing strong financials and poised for breakout performance in dynamic markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives