- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder Companies (EL): Evaluating Valuation After Strategic Geographic Reporting Restructure Announcement

Reviewed by Kshitija Bhandaru

Estée Lauder Companies (EL) is shaking up its reporting structure with a new geographic reorganization, creating updated regional groupings to streamline operations and boost accountability across its global business. The move does not alter operating segments or consolidated results. However, it positions the company to adapt more deliberately to shifting market landscapes.

See our latest analysis for Estée Lauder Companies.

Estée Lauder’s refreshed reporting structure arrives just as the company seeks to turn momentum around after muted share price action this year. While their latest reorganization signals intention to adapt and grow, the 1-year total shareholder return is still negative, which underscores how recent efforts come amid an extended period of underperformance and renewed investor attention to long-term strategy.

If Estée Lauder’s next steps prompt you to broaden your perspective, now is a great time to discover fast growing stocks with high insider ownership.

With shares still trading well below their five-year highs and Estée Lauder’s intrinsic value estimated to be higher than its current price, the question arises: does this present a buying opportunity, or is the market already factoring in future recovery?

Most Popular Narrative: 3.7% Undervalued

Estée Lauder Companies’ most popular valuation view puts fair value slightly above the latest closing price, suggesting modest upside if the assumptions play out. This set of projections reflects increased optimism versus earlier analyst forecasts, marking a potential turning point in sentiment for the stock.

Estée Lauder is increasing its penetration in high-growth emerging markets (notably Asia-Pacific, Latin America, and Southeast Asia), which have a growing middle class with rising disposable incomes. These markets currently account for only 10% of reported sales but are targeted for double-digit growth. This is likely to drive long-term revenue and market share expansion.

How can a niche global push and digital reinvention lead to a higher price tag? The blueprint powering this narrative’s fair value relies on ambitious growth forecasts and profit recovery. But which precise assumptions tipped the scales in favor of bulls? The full narrative unveils the foundation behind this valuation call. See what could really move the numbers.

Result: Fair Value of $91.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent travel retail weakness and rising competition from digital-first brands could present challenges for Estée Lauder in achieving its growth targets.

Find out about the key risks to this Estée Lauder Companies narrative.

Another View: Valuing by Sales Ratios

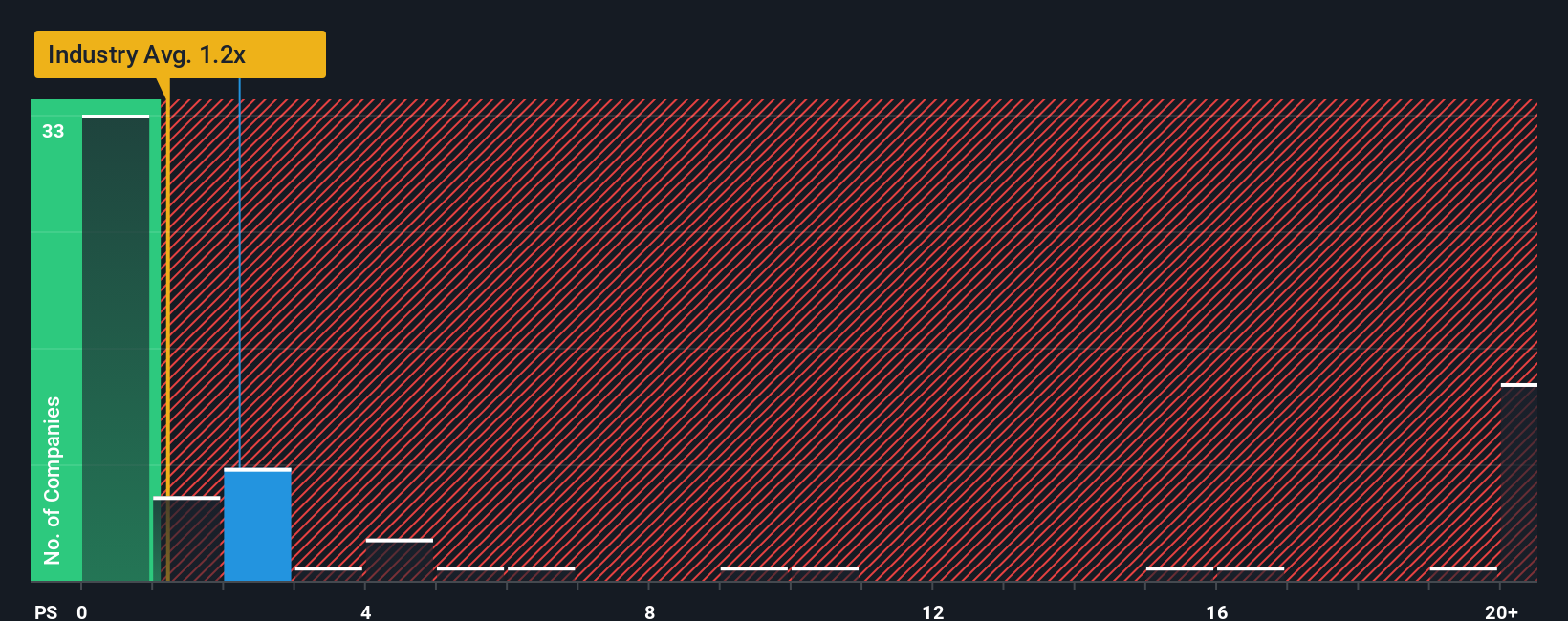

Looking at Estée Lauder through the lens of its price-to-sales ratio presents a less optimistic picture. At 2.2x, the company trades more expensively than the US Personal Products industry average of 1.1x, although it appears cheaper than direct peers at 3.3x. The market's current pricing leaves little margin for error if future revenue growth falls short. Could this premium signal confidence, or does it heighten the risk of a pullback if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Estée Lauder Companies Narrative

If you want a different perspective or prefer to dive into the numbers on your own, building a custom narrative is quick and easy. You can get started in under three minutes. Do it your way

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound beyond Estée Lauder. Get ahead of the curve and take your investing further with these tailored ideas that could help you spot the next big winner for your portfolio.

- Fuel your returns by checking out these 19 dividend stocks with yields > 3% that provide attractive yields above 3%, ideal for steady income seekers.

- Tap into the AI transformation and see which companies are set to benefit with these 24 AI penny stocks making headlines in automation and machine learning.

- Ride the wave of innovation and growth by exploring these 885 undervalued stocks based on cash flows ready for a potential rerate based on their strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives