- United States

- /

- Household Products

- /

- NYSE:CHD

Church & Dwight (CHD) Margin Drops to 8.7%, Challenging Bullish Profit Recovery Narratives

Reviewed by Simply Wall St

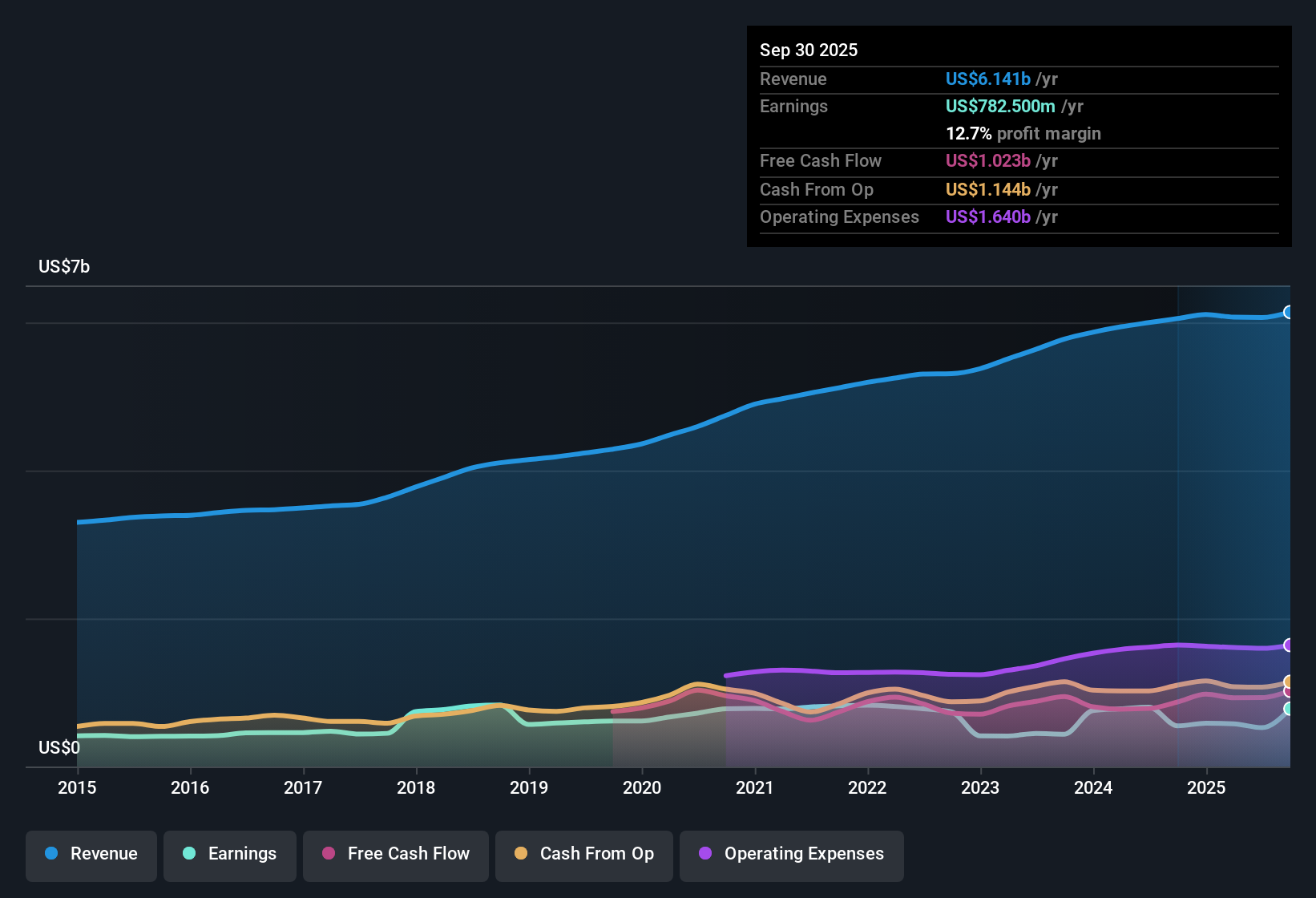

Church & Dwight (CHD) reported net profit margins of 8.7%, down from last year’s 13.4%, and earnings have averaged an 8.1% yearly decline over the past five years. The recent period was marked by a one-off loss totaling $408.1 million. While earnings are forecast to rise 6.7% per year, this growth is notably slower than US market averages. Shares are trading at a price-to-earnings ratio of 40.7, which is well above both industry and peer averages. The premium now hinges on the company’s ability to restore margin strength and deliver steady profit growth.

See our full analysis for Church & Dwight.The next section sets these results up against the market’s current narratives and dives into how the numbers stack up to widely held expectations.

See what the community is saying about Church & Dwight

Margin Outlook Hinges on Expected Rebound

- Analysts predict that profit margins will grow from the current 8.7% to 14.7% over the next three years, a sizable recovery that would put Church & Dwight’s profitability near historical highs despite recent setbacks.

- Analysts' consensus view suggests this margin turnaround is anchored in ongoing e-commerce gains and product innovation, but there is a tension:

- Consensus believes the online channel, now making up 23% of global sales, paves the way for higher margins with direct-to-consumer efficiencies and sustained category growth.

- However, critics highlight that elevated input costs and underperformance in key segments like vitamins are still weighing on the bottom line, so fully restoring margins is not guaranteed just yet.

- With these shifts in mind, see how both risks and opportunities around margins color the complete narrative for Church & Dwight. 📊 Read the full Church & Dwight Consensus Narrative.

Acquisitions and Innovation Fuel Top-Line Ambitions

- Roughly 50% of recent organic growth is attributed to new products and strategic acquisitions like HERO and Touchland, which are credited with expanding international reach and boosting volume in premium categories.

- Consensus narrative points out that this pace of innovation supports analysts’ forecasts for 3.7% annual revenue growth:

- Analysts call out robust share gains in health, hygiene, and wellness brands (for example, HERO’s international expansion to 50 countries within a year) as drivers of future revenue streams.

- Still, some caution that slower growth in legacy brands and category headwinds, such as the 25% year-over-year consumption drop in vitamins, could continue to drag on reported results.

Premium Valuation Depends on Delivery

- Church & Dwight’s price-to-earnings ratio is 40.7, far above the industry (18.7) and peer group (18.9), even as analysts target a future PE of 29.0. Today’s share price of $87.69 only makes sense if future profit and revenue goals are met.

- According to analysts’ consensus view, the current share price is just 9.3% below their price target of $96.74, so the stock is seen as “fairly priced” but with little margin for error if growth or margin expansion falls short:

- Expectations are high that $1.0 billion in annual earnings and $6.8 billion in revenue are achievable by 2028, or else valuation could quickly come under pressure.

- Consensus cautions that a premium this steep relies heavily on a swift return to margin strength, with overreliance on star brands and input cost inflation representing real risks if momentum wobbles.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Church & Dwight on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Take a moment to craft your own narrative and share your perspective in just a few minutes. Do it your way

A great starting point for your Church & Dwight research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Church & Dwight’s high valuation and dependence on margin rebound means that any slip in earnings or profit growth could leave investors exposed.

If you want more predictable performance and less uncertainty around results, check out stable growth stocks screener (2101 results) to discover companies consistently delivering steady earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives