- United States

- /

- Household Products

- /

- NYSE:CHD

A Look at Church & Dwight (CHD) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Church & Dwight.

This year’s steady slide in Church & Dwight’s share price has caught attention, especially after a tough 30-day stretch that extends a broader year-long trend. While the company remains a mainstay in consumer staples, the recent decline of 24.8% in total shareholder return over the past twelve months suggests momentum is fading, as investors weigh growth prospects against shifting market sentiment.

If you’re curious to see what else stands out in the current market, now’s the time to explore fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst targets despite steady revenue growth and solid profits, the key question is whether the recent dip signals an undervalued opportunity or if the market has already accounted for future growth prospects.

Most Popular Narrative: 14% Undervalued

With the fair value set at $96.95 and shares closing at $83.34, the narrative views Church & Dwight as offering notable upside. This sets up a debate around future revenue momentum and profit margins underlying the current valuation.

Innovation and new product launches remain a major internal catalyst. Roughly half of recent organic growth is attributed to innovations (e.g., BATISTE Light, HERO Mighty Patch Body, Touchland new fragrances), which tend to command higher prices and increase household penetration. These factors provide momentum for above-peer revenue growth and margin improvement.

Want to know why innovation is the heartbeat of this valuation? The narrative leans heavily on expectations of surging profits and bold margin expansion. Get the inside story on what big assumptions are fueling this price target.

Result: Fair Value of $96.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost inflation and weakness in key vitamin brands could challenge margin recovery and place pressure on the current optimism about valuation.

Find out about the key risks to this Church & Dwight narrative.

Another View: Valuation Through Multiples

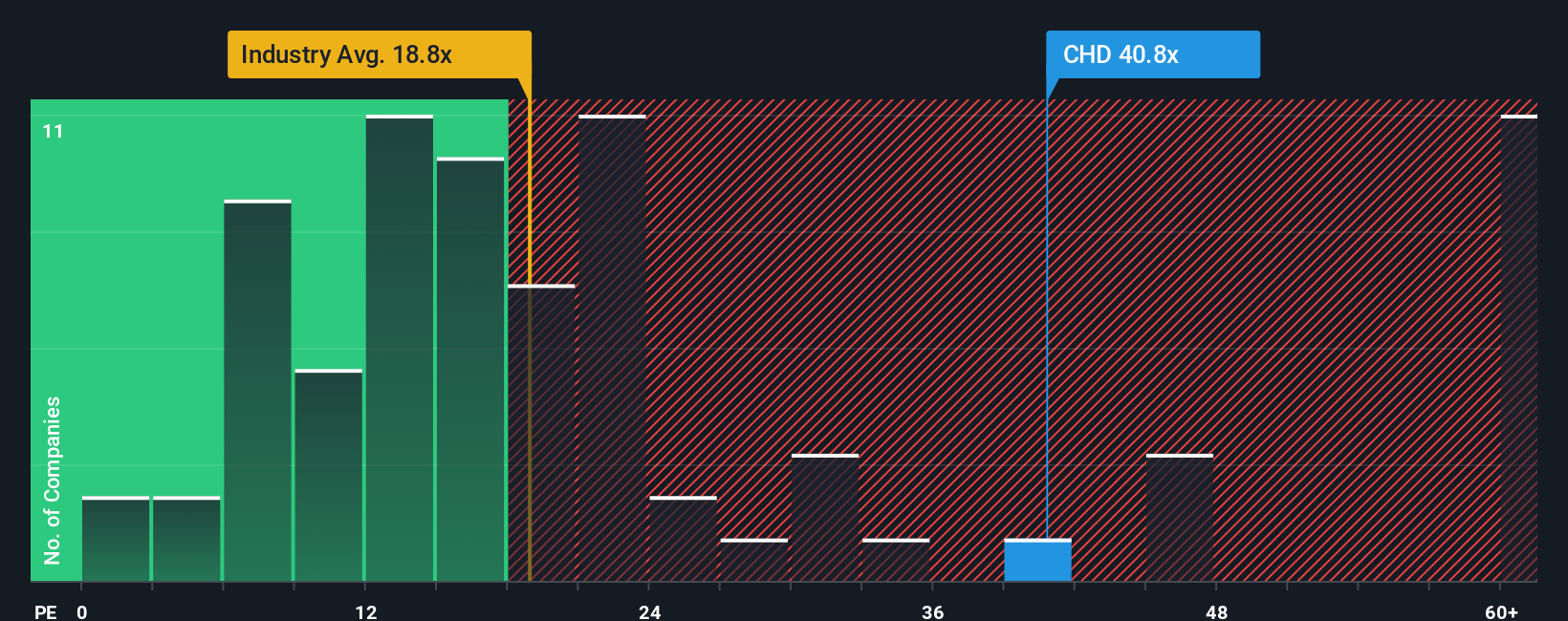

Looking from a different angle, Church & Dwight trades at a price-to-earnings ratio of 25.6x, which stands significantly above both the peer average of 17.8x and the industry average of 17.5x. Notably, this is also higher than the fair ratio of 20.4x, hinting that the market could move closer to that level over time. This premium raises questions about whether it signals investor confidence in future growth, or a valuation risk if results disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Church & Dwight Narrative

If you want to take a hands-on approach and craft your own perspective from the numbers, you can do so quickly in just a few minutes. Do it your way

A great starting point for your Church & Dwight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your opportunities by taking action now and see what's hot beyond Church & Dwight. Don’t watch others get ahead while you wait.

- Tap into massive income potential with these 16 dividend stocks with yields > 3% offering yields above 3% to help strengthen your portfolio’s cash flow.

- Explore the next tech breakthrough by checking out these 25 AI penny stocks which are poised to benefit from advancements in artificial intelligence.

- Secure your edge with these 923 undervalued stocks based on cash flows before the crowd catches on to overlooked bargains based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives