- United States

- /

- Personal Products

- /

- NasdaqCM:UPXI

Upexi, Inc.'s (NASDAQ:UPXI) 54% Cheaper Price Remains In Tune With Revenues

Upexi, Inc. (NASDAQ:UPXI) shareholders that were waiting for something to happen have been dealt a blow with a 54% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

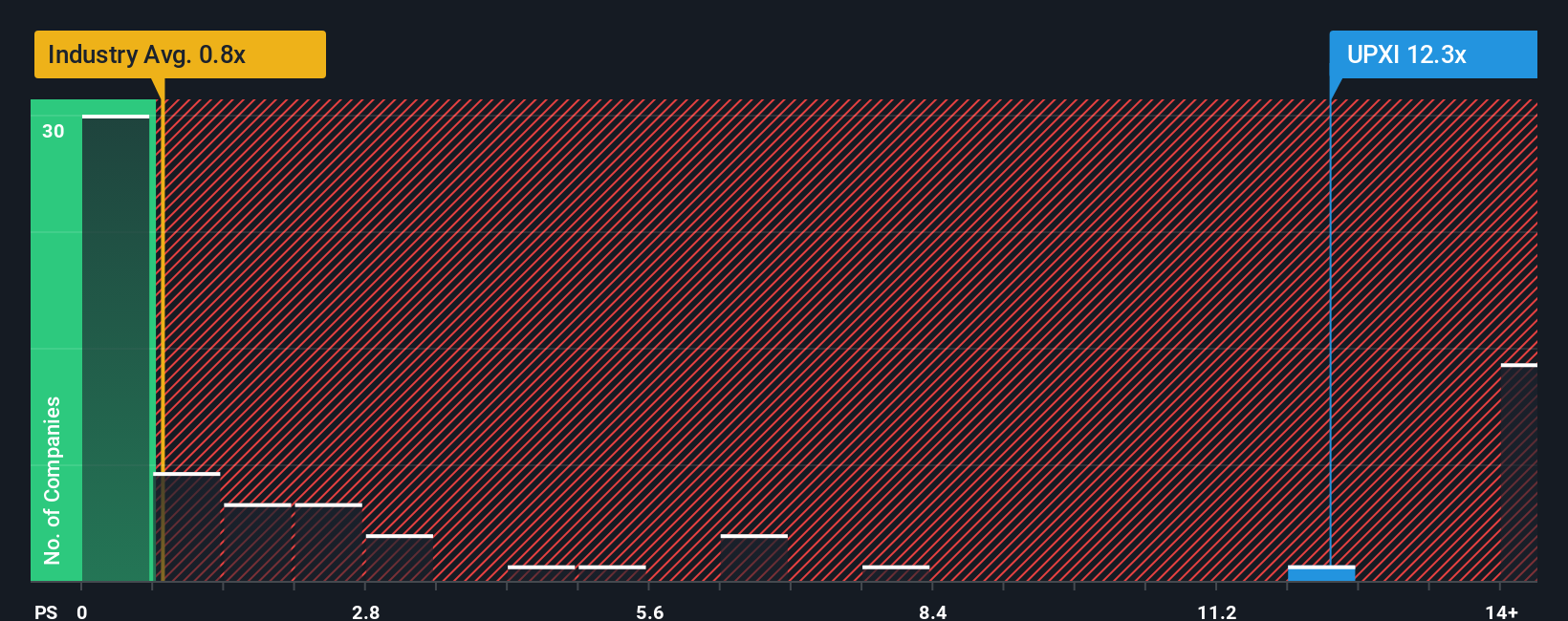

In spite of the heavy fall in price, when almost half of the companies in the United States' Personal Products industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Upexi as a stock not worth researching with its 12.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Upexi

What Does Upexi's Recent Performance Look Like?

Upexi has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Upexi.How Is Upexi's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Upexi's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. As a result, revenue from three years ago have also fallen 31% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 99% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.1%, which is noticeably less attractive.

In light of this, it's understandable that Upexi's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Upexi's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Upexi shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with Upexi.

If these risks are making you reconsider your opinion on Upexi, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UPXI

Upexi

Engages in the development, manufacture, and distribution of consumer products.

Excellent balance sheet with low risk.

Market Insights

Community Narratives