- United States

- /

- Household Products

- /

- NasdaqGS:REYN

Reynolds Consumer Products (REYN): Assessing Valuation as Growth Trends Brighten Investor Interest

Reviewed by Simply Wall St

Reynolds Consumer Products (REYN) stock is attracting renewed attention as recent performance numbers reveal an interesting mix of steady revenue growth and improving net income. Investors are naturally weighing how these trends could influence shares in the months ahead.

See our latest analysis for Reynolds Consumer Products.

After a choppy start to the year, Reynolds Consumer Products has seen its share price find firmer footing, climbing nearly 9% across the last 90 days as fundamentals have brightened. However, the longer-term total shareholder returns still reflect some lingering caution, with a modest 5-year dip.

If you’re keeping an eye out for other companies gaining momentum, now is a great time to widen your perspective and discover fast growing stocks with high insider ownership

With shares still trading at a double-digit discount to analyst targets, but growth already picking up, investors are left to wonder if there is real value left on the table or if the market is already betting on continued gains.

Most Popular Narrative: 9.9% Undervalued

The most-followed narrative sets Reynolds Consumer Products’ fair value at $27.63, just above the last close of $24.88, highlighting a perceived discount by market watchers and focusing attention on the company's future growth path.

Operational efficiencies, enhanced retail strategies, and proprietary technology position the company for higher margins and long-term earnings growth amid rising sustainability trends.

Curious how much future revenue growth and expanding profit margins can move the needle for Reynolds? The biggest drivers, along with the bold assumptions analysts are making, fuel this compelling valuation story. Don’t miss out on the deeper narrative everyone is talking about.

Result: Fair Value of $27.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent input cost volatility and fierce competition from private labels could quickly undermine Reynolds’ steady margin and growth assumptions.

Find out about the key risks to this Reynolds Consumer Products narrative.

Another View: SWS DCF Model Points to Deeper Value

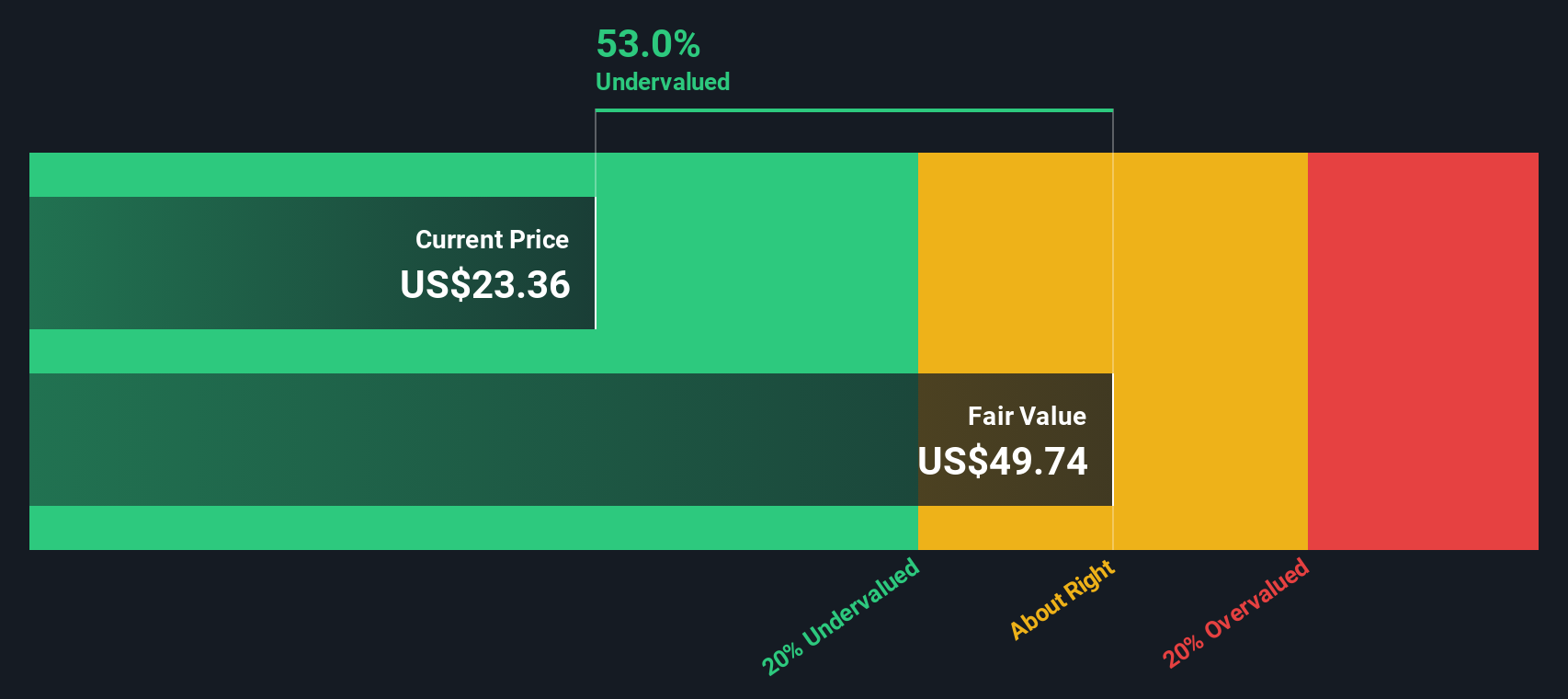

While traditional price multiples tell one story, the SWS DCF model paints an even bolder picture. It suggests Reynolds Consumer Products is trading at a steep 51% discount to its estimated fair value of $51.15. Are the market’s doubts overblown, or does the DCF overlook key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Reynolds Consumer Products Narrative

If you want to dig deeper, challenge the current outlook, or follow your own analysis, you can put together your own perspective in just a few minutes. Do it your way

A great starting point for your Reynolds Consumer Products research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd by finding new opportunities built around trends you care about. Smart investors seize the edge with tomorrow’s potential winners, not yesterday’s headlines.

- Capture long-term value with companies chosen for their strong cash flow and attractive prices by tapping into these 870 undervalued stocks based on cash flows.

- Uncover growth stories at the intersection of healthcare and innovation when you check out these 32 healthcare AI stocks, making advancements in patient outcomes and medical technology.

- Power up your portfolio with innovative digital assets and future-ready business models by exploring these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REYN

Reynolds Consumer Products

Produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives