- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Should Investors Rethink Kimberly-Clark After a 20% Drop in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Kimberly-Clark is attractively priced right now, you are in the right place for a deep dive into what the numbers really mean for investors like you.

- Despite a long-term decline, the stock is showing small signs of life with a 0.2% uptick over the past week. However, it is still down 13.3% over the last month and 20.4% year-to-date.

- Investor sentiment has shifted recently in light of broader consumer staples sector volatility and headlines about input cost challenges. Both of these factors have added fresh uncertainty and fueled short-term price swings for Kimberly-Clark.

- On our valuation checks, Kimberly-Clark notches a top score of 6 out of 6, suggesting it may be overlooked by the market. Let’s explore what that actually means using a few classic valuation frameworks. Stick around because we will also share a smarter approach to uncovering its real value by the end of this article.

Find out why Kimberly-Clark's -19.5% return over the last year is lagging behind its peers.

Approach 1: Kimberly-Clark Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and discounting them back to their present value. This approach helps investors understand what the business is fundamentally worth, regardless of daily market swings.

For Kimberly-Clark, the DCF model uses a two-stage Free Cash Flow to Equity setup. The company’s most recent free cash flow stands at $1.79 billion, and analysts forecast this will rise each year, reaching an estimate of $3.21 billion by 2035. Cash flow growth in years beyond 2027 is projected by trend, supplementing the limited analyst estimates for the early years.

Based on these projections, the DCF model calculates an intrinsic fair value of $194.34 per share. With the stock currently trading at a substantial 46.5% discount to this value, the model indicates Kimberly-Clark is significantly undervalued compared to its underlying cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kimberly-Clark is undervalued by 46.5%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Kimberly-Clark Price vs Earnings

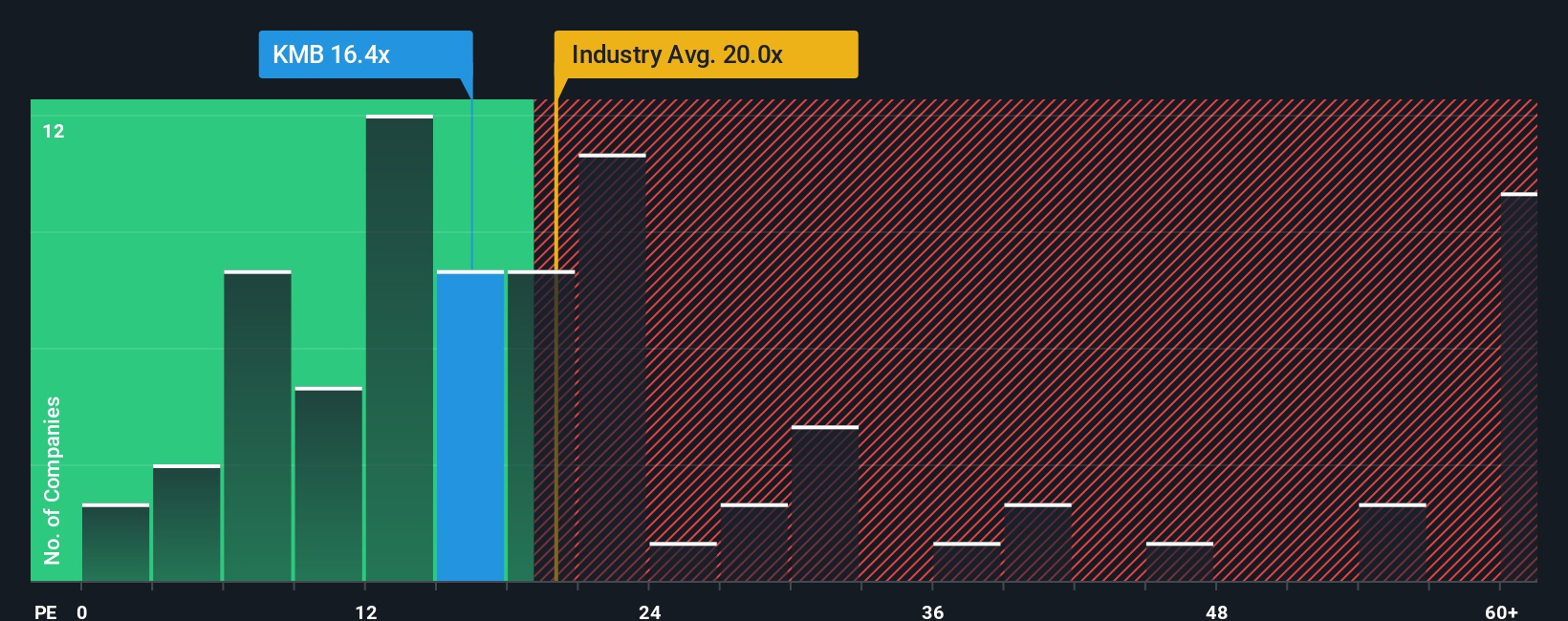

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Kimberly-Clark because it directly reflects how much investors are willing to pay for each dollar of earnings. Investors often favor the PE ratio when assessing mature companies in stable industries, as it balances profitability with expectations for future growth.

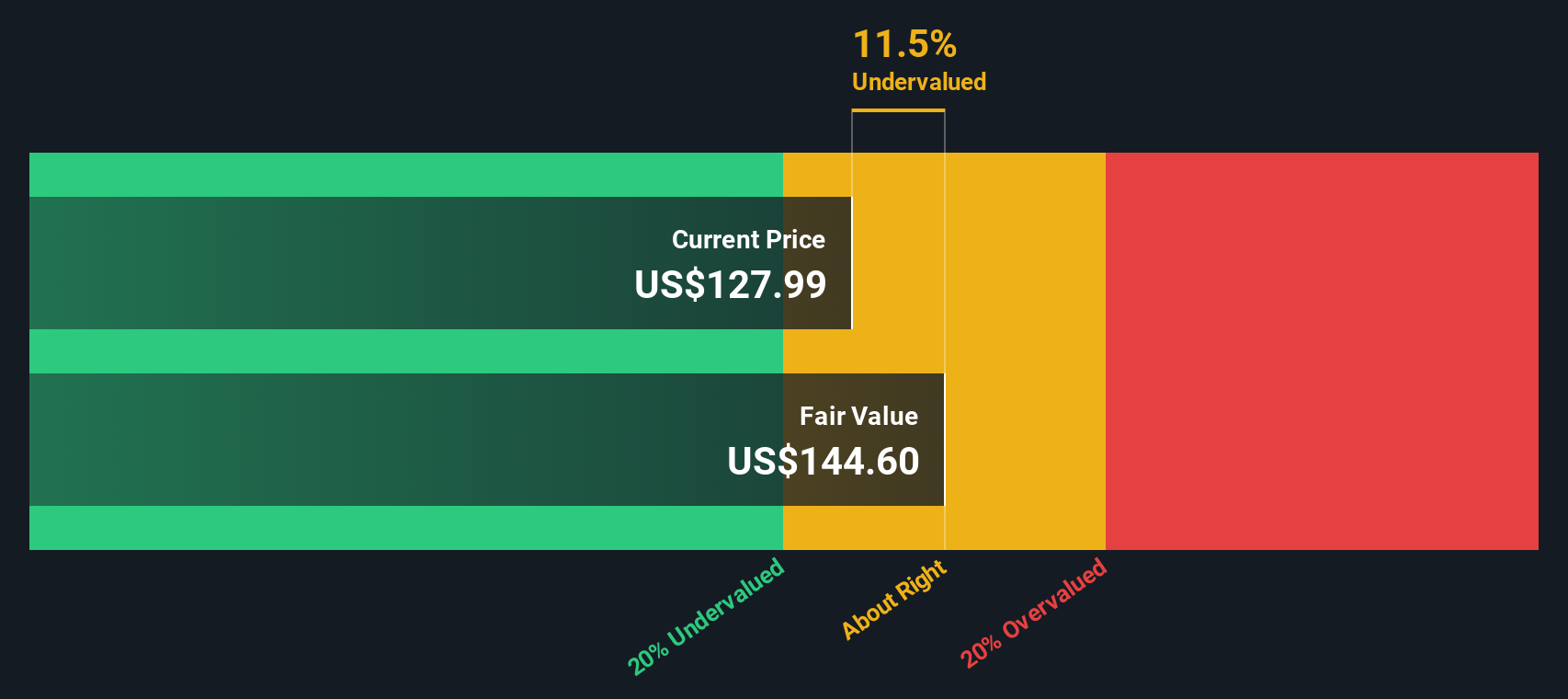

The "normal" or fair PE ratio can vary significantly across sectors, largely influenced by growth prospects and risk. Higher growth potential typically supports a higher PE, while increased risk or limited growth may warrant a lower ratio. When we look at Kimberly-Clark, its current PE ratio stands at 17.5x, which is slightly below the Household Products industry average of 17.7x and notably below the peer group average of 20.0x. This suggests the stock might be priced more conservatively than its peers.

However, benchmarks only tell part of the story. Simply Wall St's proprietary "Fair Ratio" incorporates multiple factors specific to Kimberly-Clark, including its expected earnings growth, risk profile, profit margins, industry context, and market capitalization. By going beyond a simple comparison with industry or peer averages, the Fair Ratio, which is 22.3x in this case, offers a tailored view of what investors should be willing to pay for Kimberly-Clark’s earnings given all relevant factors.

Comparing the Fair Ratio of 22.3x with the company’s actual PE of 17.5x reveals that Kimberly-Clark appears undervalued on this metric and may offer attractive upside if it delivers on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kimberly-Clark Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company and what you believe about its future, tying together what you expect for revenue, earnings, margins, and ultimately, a fair value that reflects your unique perspective.

Narratives make investing more human by connecting the numbers with your investment thesis. You outline where you think the business is headed, decide what that means financially, and get a fair value that adapts as the real world changes. You do not need to be an expert, and there is no code or complex formula. Just answer a few easy prompts and see your story play out using the same tool millions of investors already use on the Simply Wall St Community page.

Best of all, Narratives are kept up-to-date automatically as news or earnings are released, so you always see how shifts in the business could affect valuation and your decision about whether to buy or sell. For example, regarding Kimberly-Clark, some investors see lasting brand resilience and innovation driving growth and set fair value as high as $162 per share, while others highlight intense competition and slowing demand, valuing shares closer to $118. Your Narrative lets you decide which view or combination makes the most sense for you.

Do you think there's more to the story for Kimberly-Clark? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives