- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Kimberly-Clark (KMB): Assessing Valuation as Shares Rebound from Recent Weakness

Reviewed by Simply Wall St

Kimberly-Clark (KMB) shares have moved slightly upward in recent days, catching the attention of investors interested in consumer products. The stock’s behavior prompts a closer look at its recent performance and what is driving sentiment.

See our latest analysis for Kimberly-Clark.

Kimberly-Clark’s share price has recovered some ground after a sharp downturn earlier in the year, reflecting a recent uptick in investor optimism following a prolonged stretch of weakness. With a 1-year total shareholder return of -19.3%, momentum remains muted even as short-term price action suggests a possible shift in sentiment.

If you’re watching for a turnaround, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

Given the recent uptick in share price and a notable discount to both analysts’ targets and intrinsic value, the key question now is whether Kimberly-Clark is trading below its true worth or if the market has already factored in all future growth expectations. Could this be a window for value investors, or has the opportunity already passed?

Most Popular Narrative: 15.8% Undervalued

With the most widely followed narrative setting fair value at $128.63, Kimberly-Clark’s last close of $108.29 suggests the stock may be trading at a steep discount. The current disconnect between price and narrative fair value is fueling debate over what could propel shares higher.

Strategic refocus on higher-growth, higher-margin North America and International Personal Care segments (post-Suzano JV) is expected to accelerate revenue and gross margin growth. This is aligned with long-term demographic shifts such as aging populations requiring more adult care and healthcare-related products.

Is the real growth driver hiding in plain sight? The narrative’s bold price target is built on assumptions about sector shifts, margin improvements, and future segment focus. You will have to dig into the details to uncover the financial forecast moving this valuation.

Result: Fair Value of $128.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges such as intensified competition in key categories and uncertainty in the consumer environment could quickly shift the outlook for Kimberly-Clark’s growth narrative.

Find out about the key risks to this Kimberly-Clark narrative.

Another View: Sizing Up Value Using Market Multiples

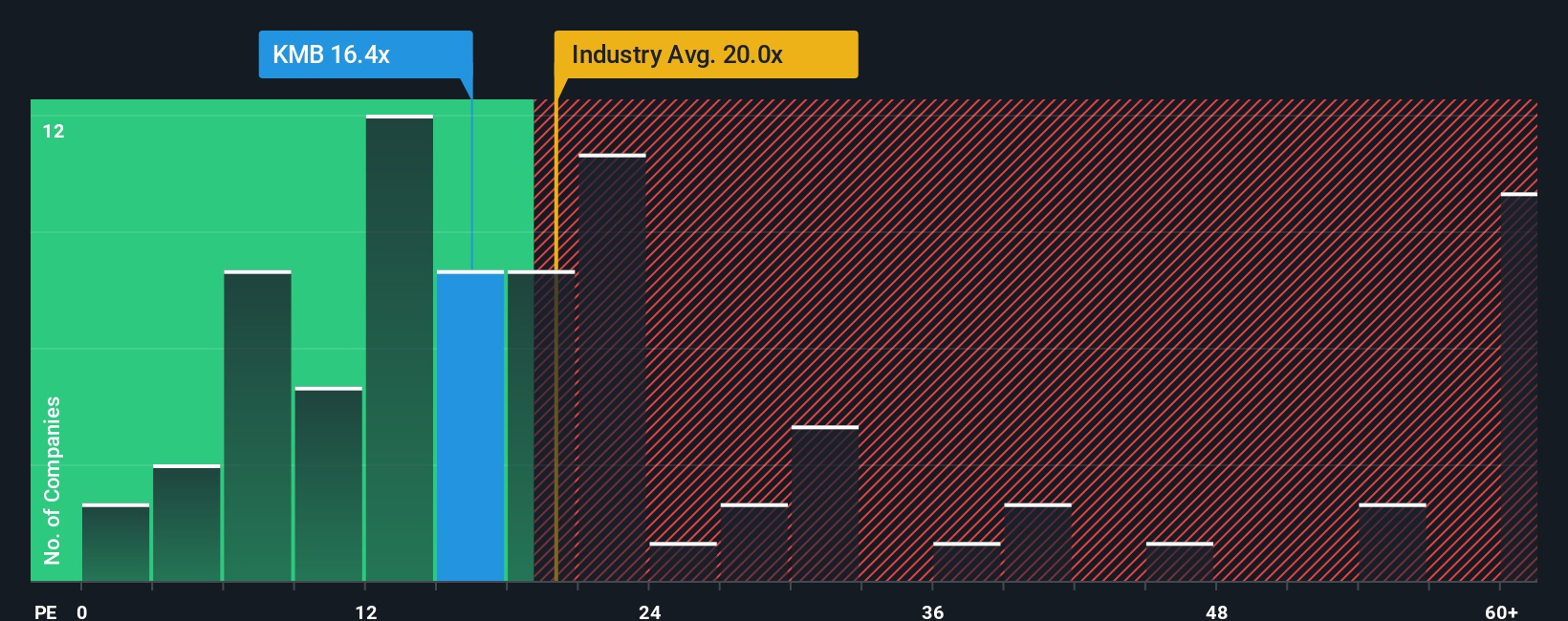

Looking from a different angle, Kimberly-Clark’s price-to-earnings ratio sits at 18.2x. This is a bit steeper than the global household products industry at 17.4x, but cheaper than the peer average of 20.5x. Notably, it is under the “fair ratio” of 22.4x, which is the level markets may one day price in.

Does this mean the stock is still hiding value, or does a higher multiple increase the risk of disappointment if the story shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimberly-Clark Narrative

If you want to take a different approach or put your own spin on the numbers, you can quickly develop your own narrative in just a few minutes. Do it your way.

A great starting point for your Kimberly-Clark research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Great opportunities are waiting beyond Kimberly-Clark. Jump ahead of the pack and give your portfolio new momentum by exploring these targeted stock ideas right now:

- Capitalize on high yields and steady income when you browse these 15 dividend stocks with yields > 3% that consistently deliver more than 3% returns.

- Ride the surge in artificial intelligence by scanning these 25 AI penny stocks that are reshaping industries from the inside out.

- Seize overlooked potential by seeking out these 926 undervalued stocks based on cash flows that may be primed for growth based on strong cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success