- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (NYSE:VEEV) Powers Medtech Trials with Expanded Clinical Platform Adoption

Reviewed by Simply Wall St

Veeva Systems (NYSE:VEEV) recently announced a significant milestone with over 50 medtech companies adopting its Clinical Platform applications, a move that aligns with stringent regulatory demands and shifting market dynamics. The company's stock increased by 22% over the last quarter, boosted by solid earnings with a revenue surge to $759 million and strategic guidance for the coming fiscal year. Simultaneously, broader market trends like easing inflation and positive trade talks between the U.S. and China likely provided a supportive backdrop for Veeva's gains, as the S&P 500 and Nasdaq also climbed to new highs during the same period.

Buy, Hold or Sell Veeva Systems? View our complete analysis and fair value estimate and you decide.

Veeva Systems's recent announcement regarding the adoption of its Clinical Platform applications by over 50 medtech companies signals potential benefits for the company's growth trajectory, aligning well with strategic vendor consolidation trends in the pharmaceutical industry. This development could further bolster revenue as Veeva capitalizes on increased interest in its Data Cloud offerings, promising a more robust market presence.

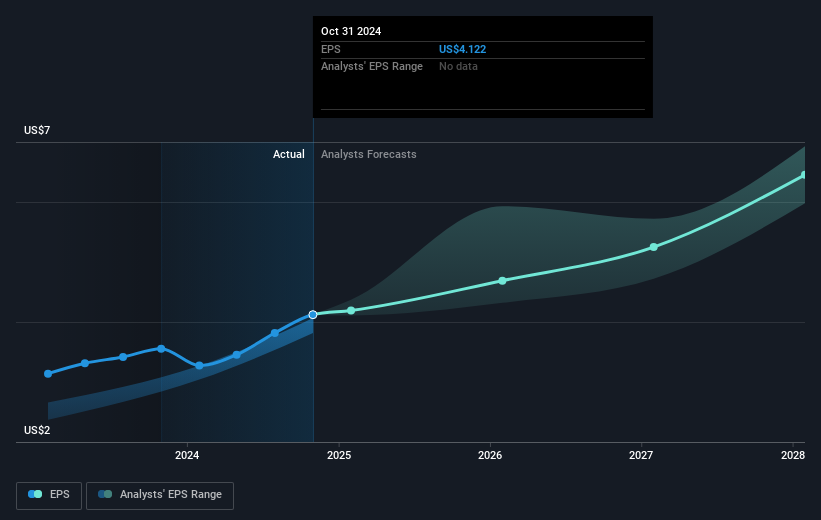

Over the past three years, Veeva Systems achieved a total shareholder return of 58.45%, reflecting solid performance and market confidence. This outpaces the one-year industry return of 32.1%, positioning Veeva favorably in the competitive landscape. As analysts forecast Veeva's revenue to grow by 12% annually over the next three years, the recent news may lend support to these expectations, potentially driving both revenue and earnings higher.

Currently, Veeva's share price sits at US$232.81, which is 11.3% below the consensus price target of US$262.35. This gap indicates room for further appreciation should the company's operational efficiencies and AI-driven innovations materialize as anticipated. The combination of favorable industry trends and Veeva's strategic developments could be decisive in meeting or exceeding the market's earnings forecasts and supporting future stock price movements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives