- United States

- /

- Healthcare Services

- /

- NYSE:USPH

How Investors May Respond To U.S. Physical Therapy (USPH) Earnings Preview and Medicare Policy Hopes

Reviewed by Sasha Jovanovic

- U.S. Physical Therapy recently announced it is preparing to release its third-quarter 2025 earnings report, following a year highlighted by key acquisitions and the industrial injury prevention segment surpassing US$100 million in annual revenue.

- An interesting development is the potential for Medicare payment rate increases next year, which could present new opportunities for revenue growth.

- We'll explore how anticipation of the upcoming earnings report and recent acquisitions may influence U.S. Physical Therapy's investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

U.S. Physical Therapy Investment Narrative Recap

To be a shareholder in U.S. Physical Therapy, you need confidence in its ability to grow both through steady demand for physical therapy services and successful clinic acquisitions. The most significant short-term catalyst remains the upcoming earnings report and the potential Medicare payment rate increases, which could relieve longstanding reimbursement pressures. For now, these factors may help offset the biggest risk: persistent uncertainty over future healthcare reimbursement rates. One announcement that stands out is the company's acquisition-driven expansion in outpatient clinics, which has added to its revenue base and supports its record-setting milestones in the industrial injury prevention segment. These moves are directly relevant to near-term growth expectations as investors weigh the company's ability to diversify and scale revenue streams ahead of the earnings release. But investors should also be aware that, despite positive news about potential Medicare increases, ongoing reimbursement volatility still represents a key risk...

Read the full narrative on U.S. Physical Therapy (it's free!)

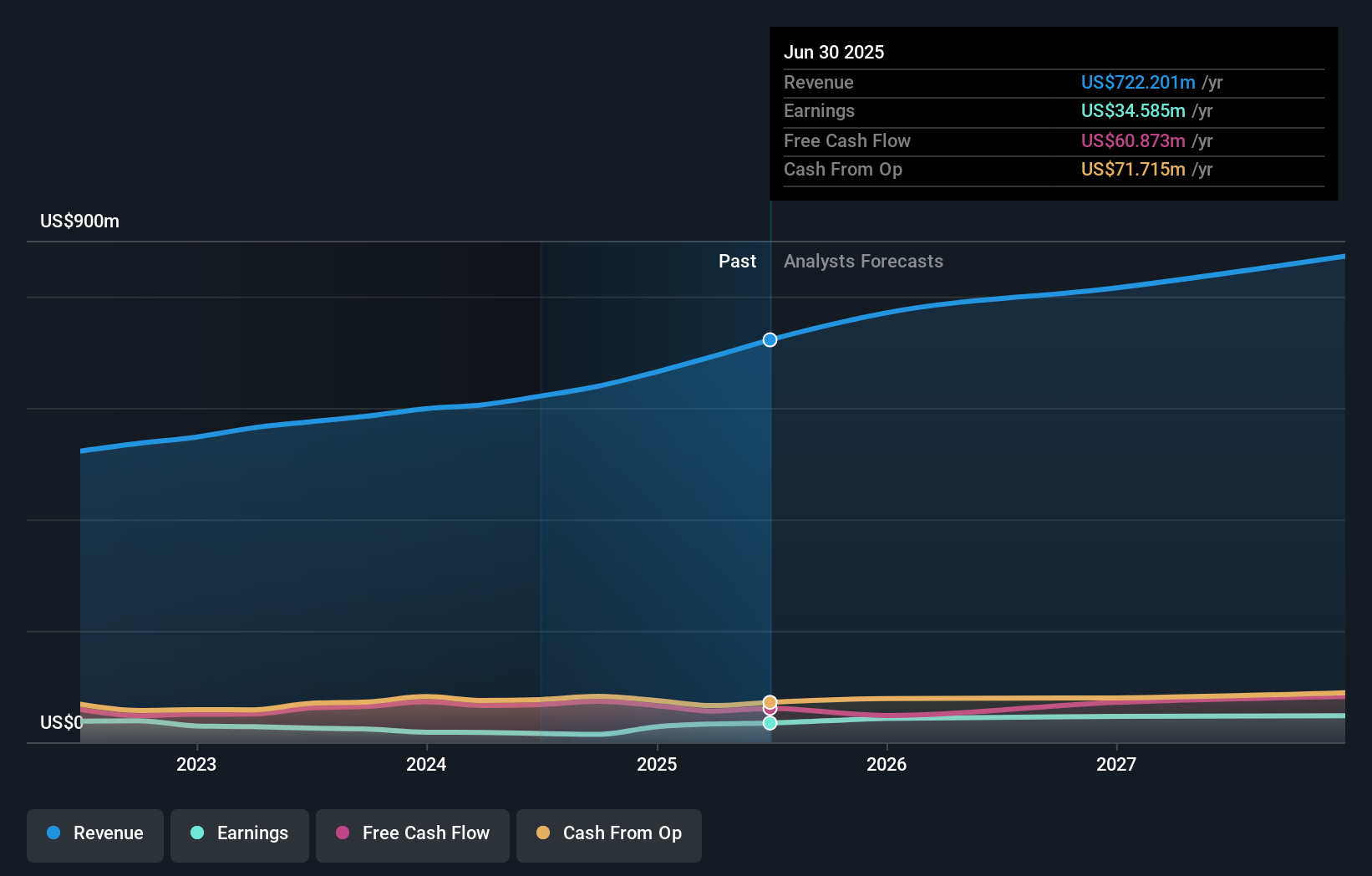

U.S. Physical Therapy's narrative projects $918.4 million revenue and $52.5 million earnings by 2028. This requires 8.3% yearly revenue growth and a $17.9 million earnings increase from $34.6 million today.

Uncover how U.S. Physical Therapy's forecasts yield a $106.83 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community valued U.S. Physical Therapy at US$106.83, so investor viewpoints are limited. While enthusiasm around reimbursement rate changes could lift sentiment, persistent uncertainty on this front means opinions are likely to shift as new information emerges.

Explore another fair value estimate on U.S. Physical Therapy - why the stock might be worth just $106.83!

Build Your Own U.S. Physical Therapy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free U.S. Physical Therapy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Physical Therapy's overall financial health at a glance.

No Opportunity In U.S. Physical Therapy?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USPH

U.S. Physical Therapy

Operates and manages outpatient physical therapy clinics.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives