- United States

- /

- Healthcare Services

- /

- NYSE:UNH

How Investors Are Reacting To UnitedHealth Group (UNH) Board Changes and Governance Moves Amid Regulatory Pressures

Reviewed by Sasha Jovanovic

- In November 2025, UnitedHealth Group appointed Dr. Scott Gottlieb, former FDA commissioner and current board member at multiple major healthcare firms, as an independent director, and made amendments to its bylaws administrative details, while also filing a US$222.29 million shelf registration for ESOP-related common stock offerings.

- These moves come amid heightened scrutiny over a recent US$6.5 billion cost miscalculation and a Department of Justice probe, prompting intensified focus on risk management, operational adjustments, and governance strength within the company.

- We'll now examine how Dr. Gottlieb's addition to the board could impact UnitedHealth Group's ongoing response to regulatory challenges and operational shifts.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

UnitedHealth Group Investment Narrative Recap

To be a UnitedHealth Group shareholder, you need to believe in the company’s ability to adapt to regulatory pressures and evolving Medicare dynamics while maintaining operational resilience. The appointment of Dr. Scott Gottlieb adds governance credentials, but doesn’t materially affect the key short-term catalyst: UnitedHealth’s success in realigning Medicare risk management and cost controls, nor does it change the heightened risk stemming from recent regulatory investigations and the $6.5 billion cost overrun.

The recent shelf registration filing for US$222.29 million in ESOP-related common stock offerings stands out as an announcement closely tied to ongoing organizational adjustments. While this action is administrative in nature, it may signal continued focus on balancing shareholder interests during a period when operational and legal outcomes are shaping the company’s near-term performance.

By contrast, investors should be especially aware of the potential financial implications of further changes in Medicare funding and reimbursement levels, as ...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group's narrative projects $501.1 billion in revenue and $20.0 billion in earnings by 2028. This requires 5.8% yearly revenue growth and a $1.3 billion decrease in earnings from current earnings of $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $386.72 fair value, a 21% upside to its current price.

Exploring Other Perspectives

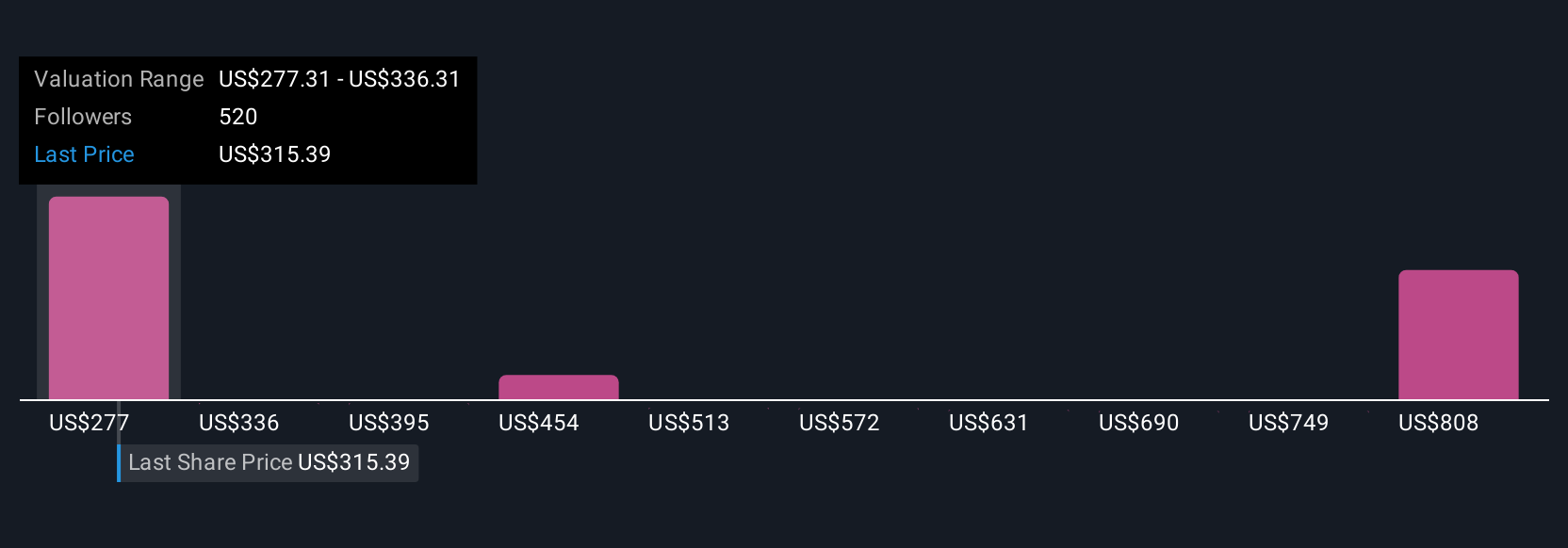

Across 84 Simply Wall St Community estimates, fair values for UnitedHealth range from US$290 to US$847, reflecting broad individual expectations. Amid this range, the company’s execution in adapting to new CMS risk rules holds real weight for future performance, consider how these diverse views mirror underlying uncertainties.

Explore 84 other fair value estimates on UnitedHealth Group - why the stock might be worth over 2x more than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives