- United States

- /

- Healthcare Services

- /

- NYSE:THC

Tenet Healthcare (THC): Evaluating Valuation After Major Debt Refinancing and Balance Sheet Moves

Reviewed by Simply Wall St

Tenet Healthcare (THC) is taking major steps to strengthen its balance sheet, wrapping up new debt offerings and securing a multi-year revolving credit facility. These latest moves reshape the company’s financing landscape and extend its debt maturities.

See our latest analysis for Tenet Healthcare.

The buzz around Tenet Healthcare’s new financing moves has added to the stock’s momentum this year, with a share price now at $192.91 after a strong year-to-date gain of 54.1%. While shares recently cooled off, posting a 1-week return of -6% and a 30-day return of -3.2%, investor sentiment remains upbeat as the company shores up its balance sheet. Over the long run, Tenet’s 1-year total shareholder return of 24.2% adds to an impressive 3-year run of 328% and a five-year total return topping 510%. This highlights why many see momentum continuing to build.

If you’re intrigued by Tenet’s proactive financial strategy, it’s a good time to see how other healthcare leaders are positioning themselves. See the full list for free.

With Tenet’s refinancing actions strengthening its financial position, the central question for investors is whether the recent run-up leaves more room for upside or if the stock already reflects the company’s future growth prospects.

Price-to-Earnings of 12.5x: Is it justified?

Tenet Healthcare’s current price-to-earnings (PE) ratio sits at 12.5x, a level that suggests the stock is priced attractively relative to its recent profitability and market peers.

The PE ratio compares a company’s share price to its earnings per share. It is a common way to gauge how the market values its future earnings potential. For a healthcare provider like Tenet, it can reveal whether investors are paying a premium or discount for the company’s established earnings base and expected steady growth.

Tenet’s 12.5x PE is not only below the US Healthcare industry average (22x) and its peer group (19.9x), but it is also well beneath the estimated fair PE of 23.4x. This sizable gap indicates that investors may be underpricing Tenet’s future earnings potential and signals substantial room for market repricing if its growth trajectory holds up.

Explore the SWS fair ratio for Tenet Healthcare

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, slower than expected revenue growth or unexpected industry challenges could dampen investor enthusiasm and limit further upside potential for Tenet Healthcare shares.

Find out about the key risks to this Tenet Healthcare narrative.

Another View: What Does Our DCF Model Say?

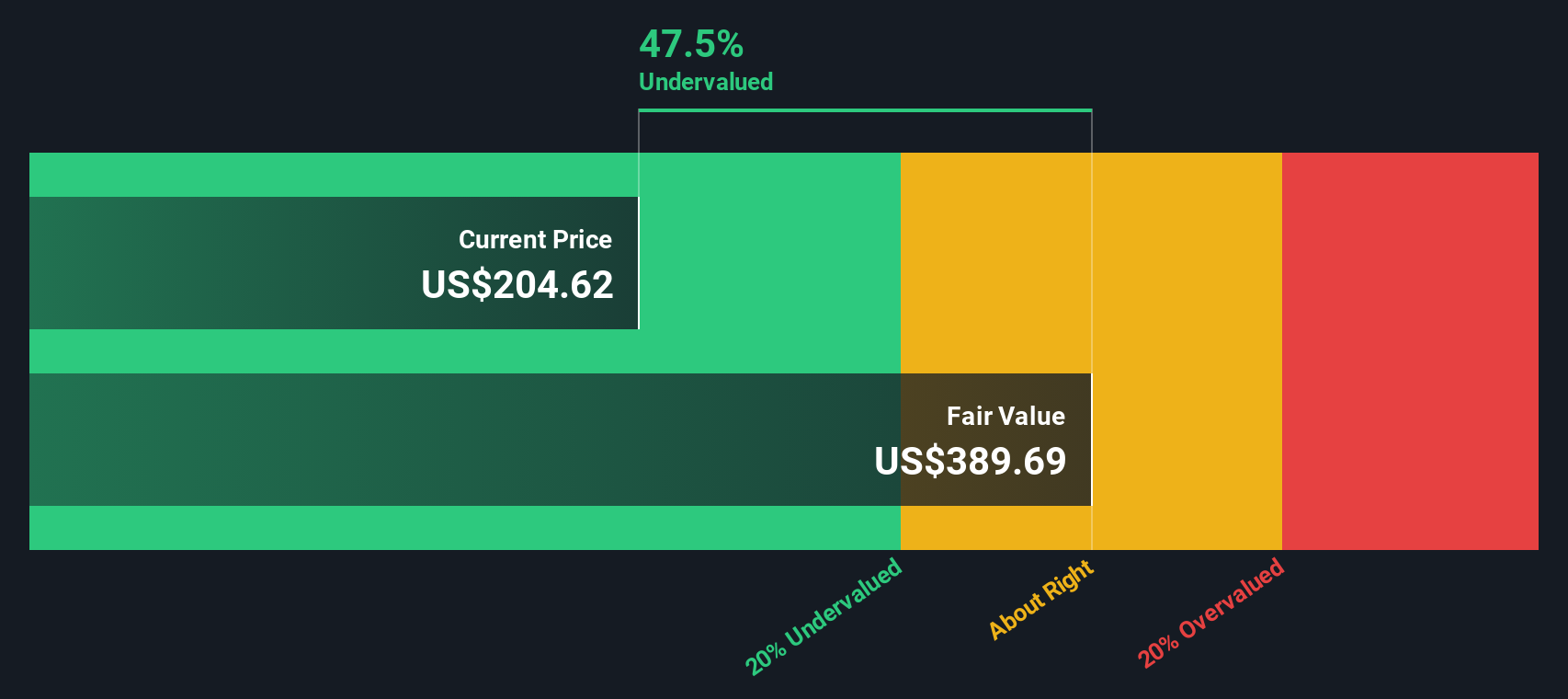

While the price-to-earnings comparison suggests Tenet Healthcare looks inexpensive, our DCF model presents an even more striking picture. According to this approach, Tenet’s shares are trading at a steep 49.5% discount to their estimated fair value. This raises the possibility that the market is significantly underestimating the company’s worth. Can this gap really persist?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tenet Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tenet Healthcare Narrative

If you see the story unfolding differently, or would rather dig into the details yourself, you can build your own perspective in just a few minutes with Do it your way.

A great starting point for your Tenet Healthcare research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizon and make each move count. Don’t miss your opportunity to find stocks with serious upside potential seen by savvy investors.

- Capture growth potential in the most promising AI-driven companies with these 25 AI penny stocks, setting new standards in innovation and automation.

- Collect reliable income by targeting these 16 dividend stocks with yields > 3% for portfolios seeking high yields and sustainable performance in volatile markets.

- Ride the momentum with these 878 undervalued stocks based on cash flows that the market may be overlooking and uncover your next winning position before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives