- United States

- /

- Healthcare Services

- /

- NYSE:THC

A Look at Tenet Healthcare’s (THC) Valuation After Surprising Earnings Beat and Raised Guidance

Reviewed by Simply Wall St

Tenet Healthcare posted third-quarter results that came in ahead of expectations, with both revenue and earnings beating forecasts. The company also nudged its full-year guidance higher, reinforcing optimism for the rest of 2025.

See our latest analysis for Tenet Healthcare.

Tenet Healthcare’s upbeat results and raised outlook appear to have fueled strong momentum in the shares, with a 2.75% gain on results day and a 7% share price return in just the past month. Looking at a broader timeframe, momentum has been building for most of the year, as the shares have surged 73% year-to-date and delivered an impressive 55% total shareholder return over the past twelve months. This highlights both recent optimism and robust long-term execution.

If Tenet’s strong performance has you considering what opportunities may lie ahead in the sector, take a look at other leading names on our Healthcare Growth Screener: See the full list for free.

With shares trading near all-time highs and management lifting guidance again, investors are now left asking if Tenet is still undervalued given its growth outlook, or if the market is already factoring in future gains.

Most Popular Narrative: 2.3% Overvalued

With Tenet Healthcare shares recently closing at $216.17, the most widely followed narrative suggests the company’s fair value is slightly lower. That puts current pricing just above where analysts see justified value, offering little margin for error and raising the stakes on future performance.

Ongoing expansion of Tenet's ambulatory surgical center (USPI) footprint and consistent M&A activity in high-margin, high-acuity outpatient procedures (e.g., total joint replacements, spine surgery) are capitalizing on the industry shift towards outpatient care. This supports both revenue growth and future net margin expansion due to favorable case mix and operational scale.

Want to know what’s fueling this nearly break-even fair value estimate? There’s a bold projection for future margins and aggressive assumptions on outpatient shift. Which single catalyst could tip the scales for Tenet’s narrative value? Think it’s just steady growth? Click to see the numbers analysts are banking on.

Result: Fair Value of $211.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures or changes to Medicaid supplemental payments could quickly alter Tenet’s margin outlook and challenge this prevailing narrative.

Find out about the key risks to this Tenet Healthcare narrative.

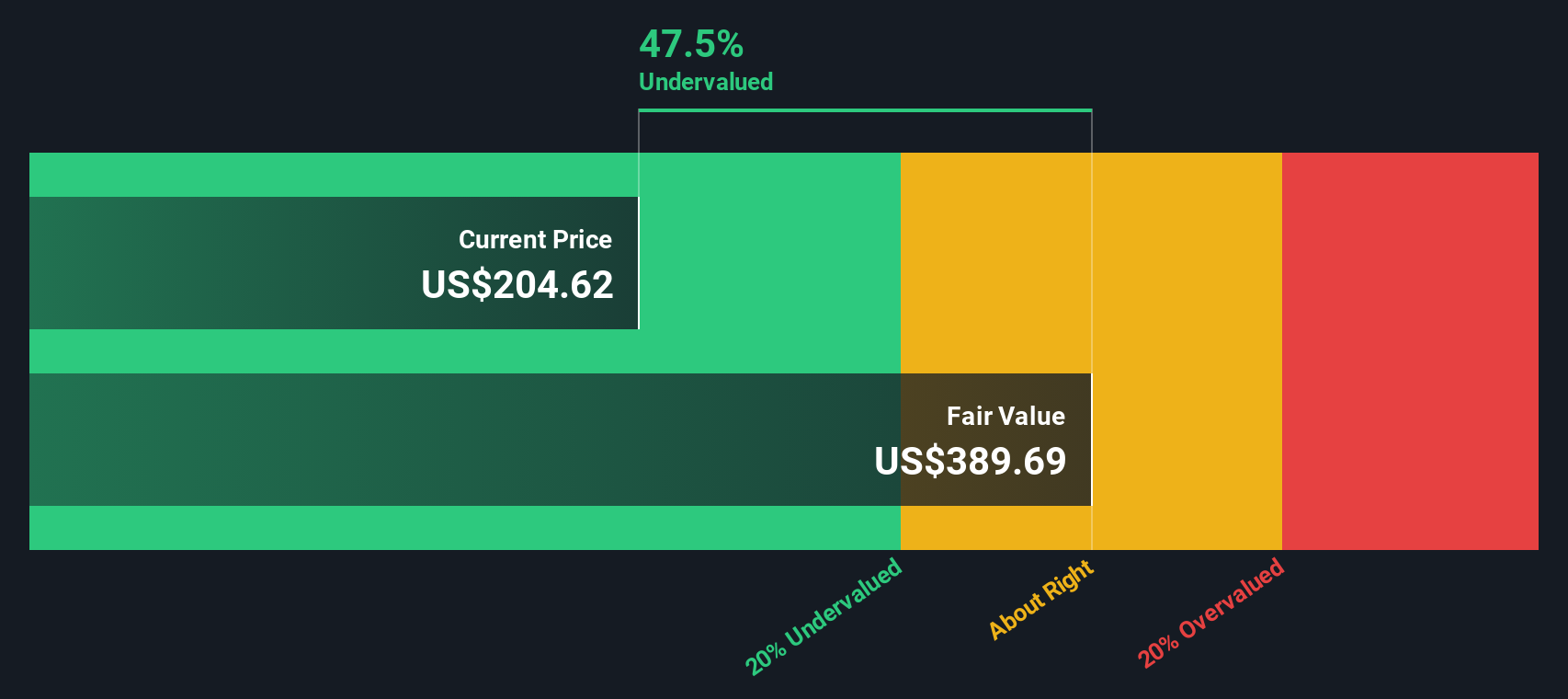

Another View: Our DCF Model Points to Undervaluation

Taking a different approach, the SWS DCF model suggests Tenet Healthcare is significantly undervalued. While multiples-based valuations put the share price above fair value, the DCF model estimates fair value at $393.19, which is far above the current $216.17. Could the market be underappreciating long-term prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tenet Healthcare Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your personal view in just a few minutes. Do it your way

A great starting point for your Tenet Healthcare research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart opportunities go fast. Stay ahead by targeting investment angles you might have missed and power up your portfolio with ideas tailored to future trends.

- Boost your passive income by checking out these 19 dividend stocks with yields > 3%, which offers attractive yields above 3% for solid, steady cash flow.

- Ride the next wave of technology gains with these 27 AI penny stocks that are pushing boundaries in artificial intelligence and automation.

- Secure financial fundamentals with these 870 undervalued stocks based on cash flows to find shares priced below their intrinsic value, setting you up for potential long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives