- United States

- /

- Medical Equipment

- /

- NYSE:STE

Assessing STERIS Shares After Double Digit Gains and Recent Valuation Debate in 2025

Reviewed by Simply Wall St

If you have STERIS stock in your portfolio, or you are considering adding it, it is hard not to notice how its performance stands out lately. The company’s shares closed recently at $249.23, and while the past week brought a modest 0.5% gain, the last month was a bit softer, down just 1.0%. Zoom out, and things look much more impressive: STERIS is up 23.1% so far this year, and over the past three years, the stock has soared 59.7%. Even its five-year return sits at an impressive 51.0%, more than holding its own in a market where not every healthcare name is keeping pace.

Some of this momentum might be fueled by broader market interest in companies providing reliable, defensive growth. In a climate where investors seem eager to balance risk and stability, STERIS’s business model has clearly attracted attention. Still, with the company being undervalued in only 1 out of 6 valuation checks (giving it a valuation score of 1), the real puzzle is whether there is untapped potential or if the current price already reflects STERIS’s strengths.

Let’s dig into the different ways analysts are measuring STERIS’s value, and see whether traditional metrics are telling the whole story, or if there is a deeper signal you might not want to miss at the end.

STERIS scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: STERIS Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future free cash flows and discounting them back to their value today. This approach provides a theoretical estimate of what the stock should be worth, based on the company's ability to generate cash in the years ahead.

For STERIS, the latest reported Free Cash Flow stands at $876.5 million. Analysts forecast modest growth over the next several years, with free cash flow expected to rise to $923.1 million by 2027. Beyond the next five years, Simply Wall St extrapolates continued growth and projects free cash flow reaching around $1.39 billion by 2035. All projections are denominated in US dollars.

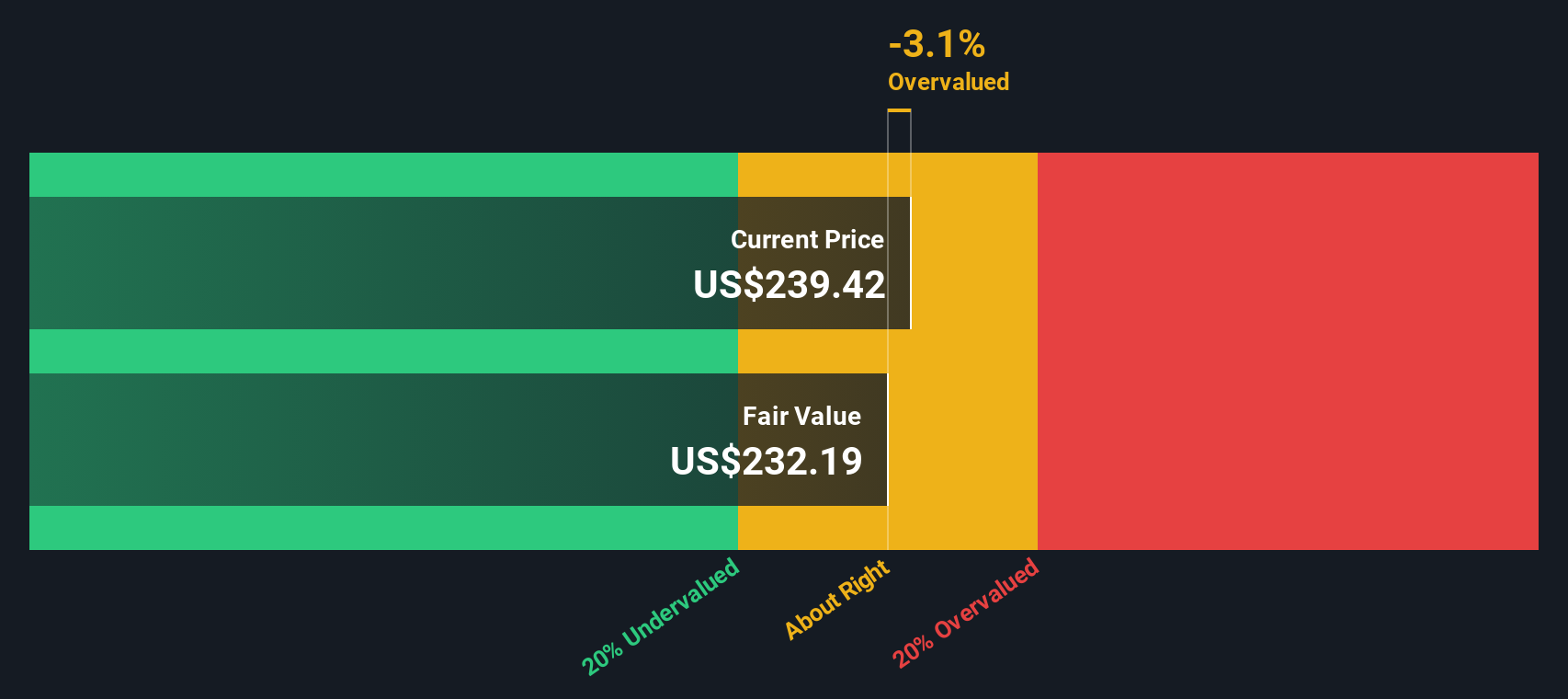

Based on these projected figures and using a 2 Stage Free Cash Flow to Equity method, the model calculates a fair value of $232.19 per share. Given that the current market price is $249.23, STERIS stock is about 7.3% above its DCF-derived intrinsic value. In practical terms, this suggests the shares are trading very close to fair value, with only a slight lean toward overvaluation.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for STERIS.

Approach 2: STERIS Price vs Earnings

The Price-to-Earnings (PE) ratio is a primary valuation tool for profitable companies like STERIS, as it directly connects a company's share price to its actual earnings performance. This makes it especially useful for investors seeking to understand how much they are paying for each dollar of STERIS’s earnings, a core consideration in stock analysis.

What qualifies as a "normal" or "fair" PE ratio depends on factors like the company's expected earnings growth and its perceived risk. Higher growth prospects can often justify higher PE ratios, as investors are willing to pay more for future earnings. In contrast, increased risks or lower growth trends can pull ratios lower in comparison to the overall market or industry.

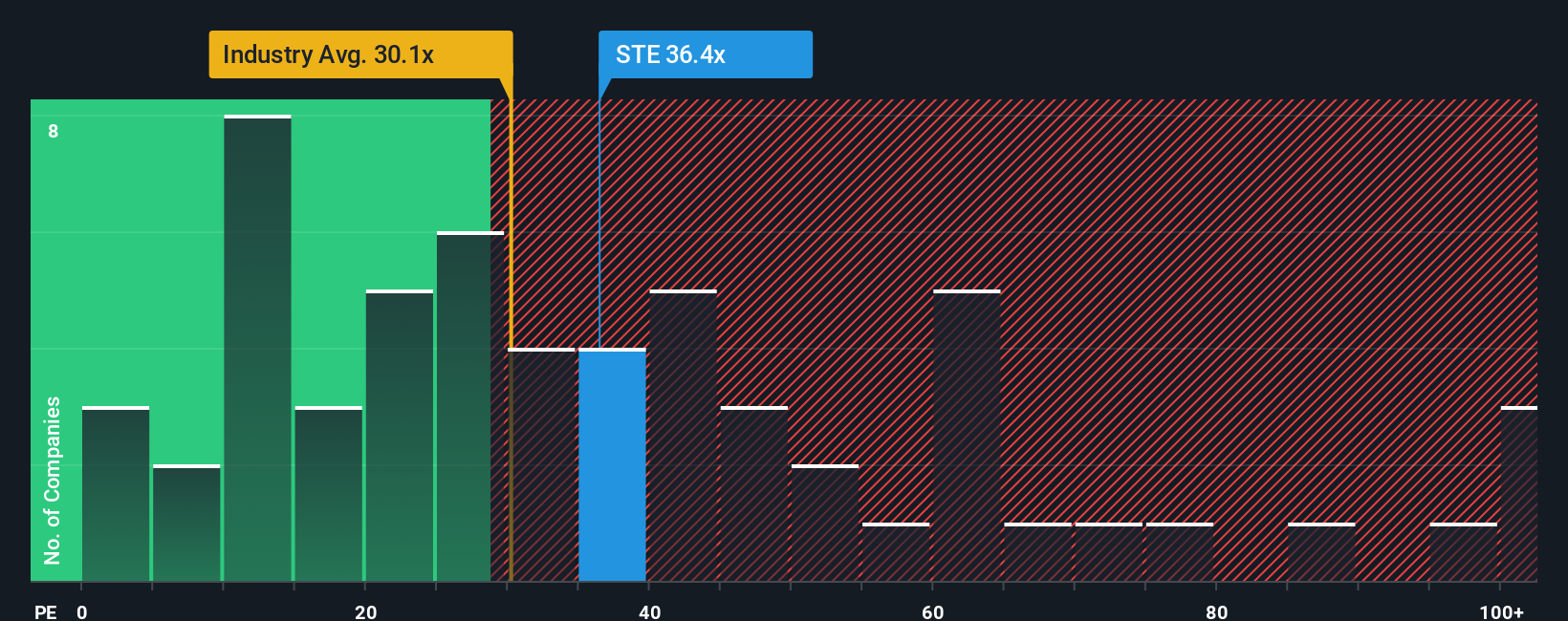

Currently, STERIS trades at a PE ratio of 37.9x. When compared to the Medical Equipment industry average of 28.4x and an average of 46.0x among its direct peers, STERIS sits noticeably above the sector but well below many competing companies. However, rather than relying solely on these broad benchmarks, Simply Wall St’s proprietary “Fair Ratio” offers a more tailored gauge. Calculated by weighing unique factors like STERIS’s earnings growth, profit margins, industry dynamics, market cap, and specific risks, the Fair Ratio for STERIS is set at 23.6x. This nuanced approach is designed to yield a benchmark that is more relevant to the company’s true value profile compared to the typical industry average or the scatter of peer multiples.

With STERIS’s PE ratio of 37.9x sitting noticeably above its Fair Ratio of 23.6x, the stock appears somewhat expensive through this lens.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your STERIS Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an innovative, more dynamic approach to investing. A Narrative allows you to capture your own story about a company like STERIS, going beyond traditional metrics by linking your expectations for its future revenue, earnings, and margins directly to an estimated fair value. In practice, a Narrative turns your perspective into a framework for smarter decision-making. This lets you see at a glance whether your outlook supports buying, holding, or selling based on how your Fair Value compares to the current price.

Simply Wall St makes Narratives accessible to every investor on its Community page, where millions share and update their views. Unlike static forecasts, these Narratives automatically adjust when new information emerges, from quarterly earnings to headline news, keeping your decisions relevant in real time. For example, using STERIS, some investors believe that steady recurring revenue from healthcare demand and margin expansion will push its fair value as high as $295.0 per share. Others worry about rising regulatory costs and market risks, pegging fair value much lower at $231.0. With Narratives, you are empowered to define your own view, stay updated with evolving data, and invest more intelligently.

Do you think there's more to the story for STERIS? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STE

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives