- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

Solventum (SOLV) Is Up 5.8% After Raising Earnings Outlook on Strong Q3 Results

Reviewed by Sasha Jovanovic

- Solventum Corporation recently reported its third quarter 2025 results, with revenue of US$2.10 billion and net income jumping to a very large increase from a year ago, as well as raising full-year earnings guidance to the high end of its previously indicated range.

- Management emphasized that accelerated volume improvements across segments and faster-than-expected benefits from commercial and product innovation initiatives played a key role in these results.

- We’ll assess how the company's higher earnings outlook and operational execution are reshaping Solventum’s investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Solventum Investment Narrative Recap

To be a shareholder in Solventum, you need to believe the company can successfully leverage its commercial transformation and product innovation to drive lasting earnings growth even as it navigates separation from 3M and a multi-year ERP rollout. The recent sharp jump in net income and the raised guidance represent a positive signal for the short-term earnings catalyst, but do not materially reduce the largest execution risk: possible disruption from ongoing systems and organizational changes.

The most relevant recent announcement is Solventum's updated 2025 earnings guidance, now at the high end of its previous range. This reflects management's confidence that accelerated volume growth and operational improvements are gaining traction, supporting the company’s current narrative of strengthened operational execution as a near-term catalyst for the stock.

However, investors should also be aware that this improved outlook contrasts sharply with the ongoing execution risks tied to Solventum’s multi-year ERP and separation processes, which could still...

Read the full narrative on Solventum (it's free!)

Solventum's narrative projects $8.2 billion revenue and $981.9 million earnings by 2028. This requires a 0.7% annual revenue decline and a $601.9 million earnings increase from $380.0 million today.

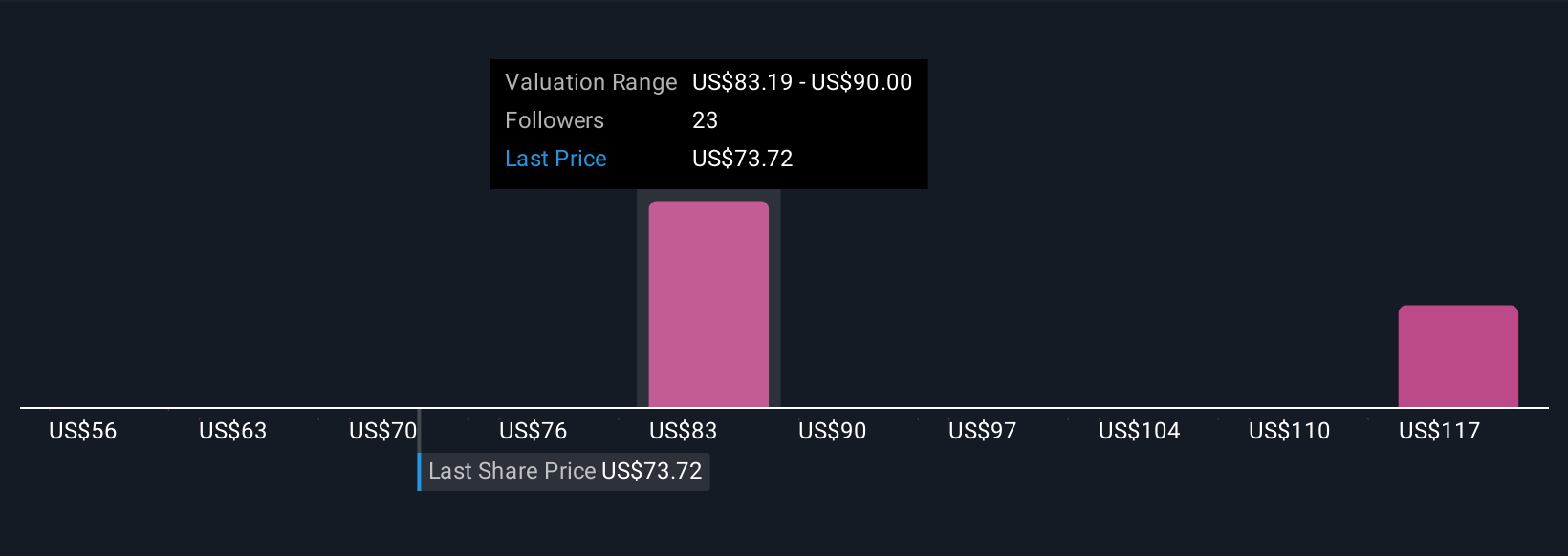

Uncover how Solventum's forecasts yield a $84.11 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Solventum's fair value between US$55.96 and US$130.94. While some focus on recent operational improvements as a key driver, others caution that ongoing transformation risks could shift expectations further, making it essential to consider multiple viewpoints when assessing Solventum's outlook.

Explore 3 other fair value estimates on Solventum - why the stock might be worth 26% less than the current price!

Build Your Own Solventum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solventum research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Solventum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solventum's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives