- United States

- /

- Healthcare Services

- /

- NYSE:SEM

Does Upgraded 2025 Outlook and Expansion Signal a Stronger Growth Story for Select Medical (SEM)?

Reviewed by Sasha Jovanovic

- In the past week, Select Medical Holdings reported third-quarter 2025 results with sales of US$1,363.45 million, up from US$1,271.58 million a year prior, alongside an acquisition of a 30-bed critical illness recovery hospital and continued expansion of its outpatient network.

- A significant insight is the company’s raised earnings guidance for the full year 2025, reflecting increased confidence due to favorable regulatory updates and ongoing investments in new facilities.

- We’ll examine how the upward revision of earnings guidance following a Medicare rule delay impacts Select Medical Holdings’ investment outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Select Medical Holdings Investment Narrative Recap

Shareholders in Select Medical Holdings generally need to believe in expanding demand for facility-based rehabilitation and critical illness recovery, underpinned by demographic trends and operational scaling. The latest news, a revenue beat and a Medicare rule delay, directly bolsters the most important short-term catalyst: boosted earnings from favorable reimbursement timing, while the biggest immediate risk, ongoing reimbursement pressure, remains but is less acute for now.

One relevant update is the company's raised 2025 earnings guidance, supported by recent regulatory relief and investment in new facilities. Management's confidence in reaffirming guidance, despite segment-specific challenges, underscores that current catalysts are being supported by external and internal factors. But on the other hand, investors should be aware of continued risks surrounding reimbursement pressures and...

Read the full narrative on Select Medical Holdings (it's free!)

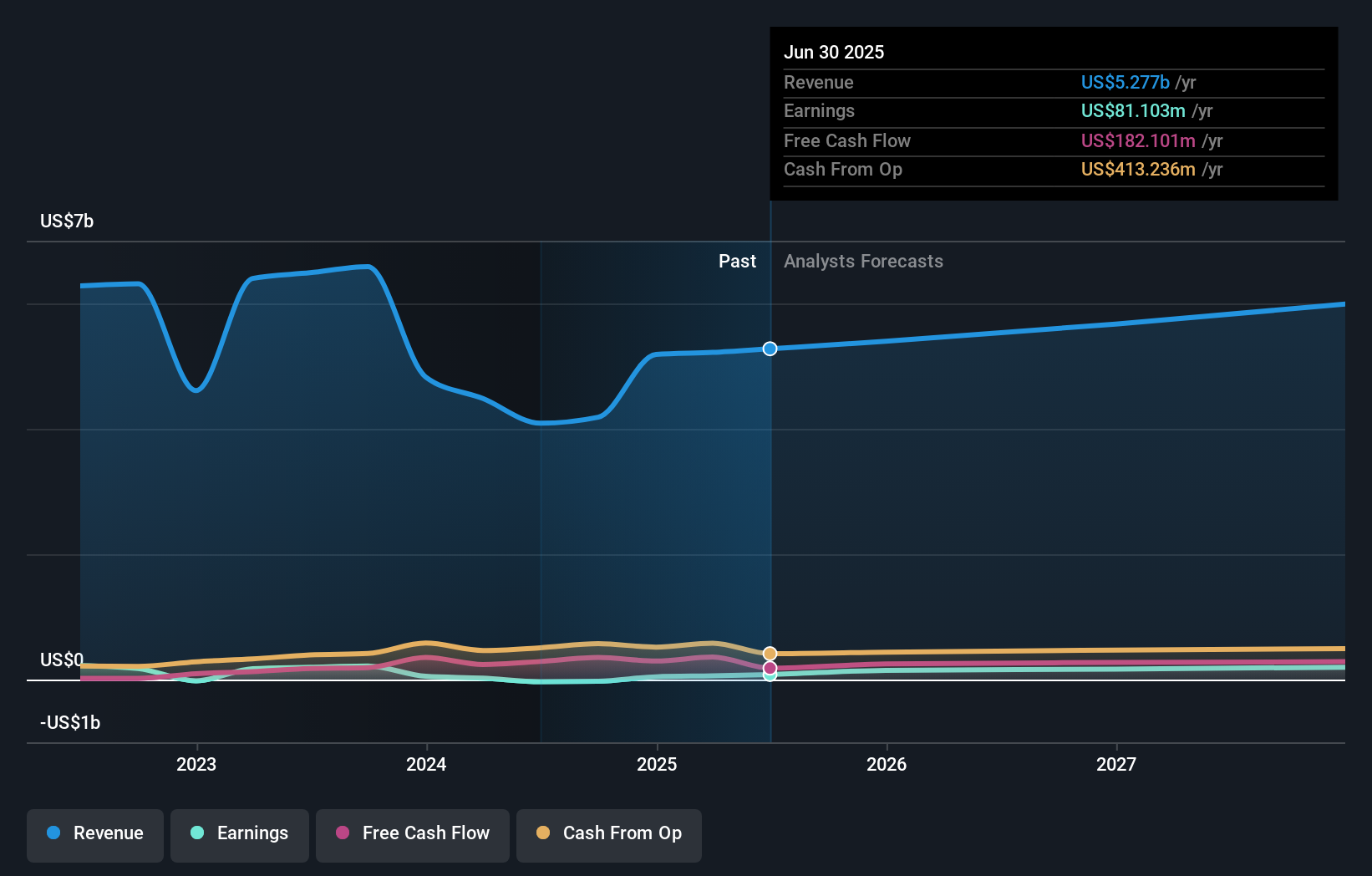

Select Medical Holdings' narrative projects $6.1 billion in revenue and $233.8 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $152.7 million earnings increase from $81.1 million currently.

Uncover how Select Medical Holdings' forecasts yield a $17.83 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community place Select Medical’s fair value between US$4.54 and US$17.83, drawing on two independent forecasts. Amid recent regulatory tailwinds, you can see how perspectives differ widely on the company’s earnings upside and margin stability.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth as much as 34% more than the current price!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEM

Select Medical Holdings

Through its subsidiaries, operates critical illness recovery hospitals, rehabilitation hospitals, and outpatient rehabilitation clinics in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives