- United States

- /

- Medical Equipment

- /

- NYSE:RMD

ResMed (RMD) Margin Beat Reinforces Quality Earnings Narrative

Reviewed by Simply Wall St

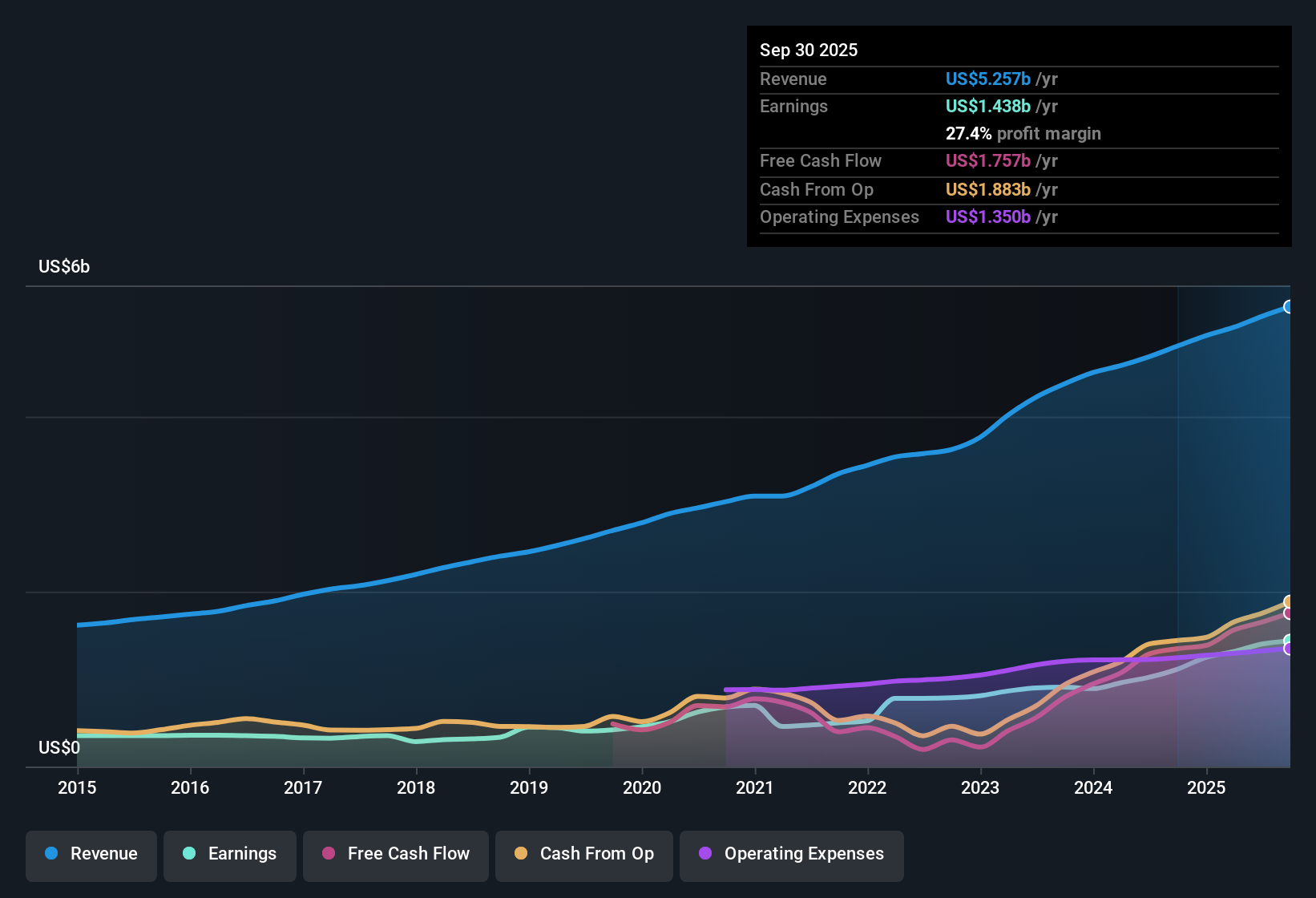

ResMed (RMD) posted impressive numbers with net profit margins climbing to 27.4% from 23.1% a year ago, and EPS advancing 29.2% year-over-year. Over the last five years, earnings have grown at a robust 19.8% annually, though forecasts call for a slower pace with 8.8% earnings and 7.1% revenue growth per year, both trailing US market averages. Despite moderation in projected growth, the latest results highlight ResMed’s consistent profit expansion, high-quality earnings, and valuation multiples that compare favorably with industry peers.

See our full analysis for ResMed.The next section dives into how these headline results stack up against the most widely held market narratives. This analysis will shed light on where consensus gets support and where it might be surprised.

See what the community is saying about ResMed

Margin Gains Outpace Peers

- Net profit margins rose to 27.4%, exceeding last year’s 23.1%, and remain stronger than the medical equipment industry. This supports ResMed’s long-term pricing power even as US market averages move higher.

- According to the analysts' consensus view, operational improvements and new digital health platforms have strengthened competitive advantages, fueling resilient margin growth and earnings durability.

- Analysts highlight that procurement, manufacturing, and logistics optimization are structurally improving gross margins and driving overall profit expansion.

- Further adoption of home-based, cloud-connected solutions is expected to enhance high-margin, recurring revenues and increase both profit margins and retention over time.

Consensus analysts believe the latest margin trends reinforce the view that ResMed’s business model is gaining structural efficiency and resilience. 📊 Read the full ResMed Consensus Narrative.

Forecast Growth Moderates Versus Market

- Earnings are projected to grow by 8.8% and revenue by 7.1% per year, both trailing the broader US market’s 15.9% and 10.4% averages. This may temper expectations among those looking for outperformance.

- Consensus narrative flags that while strategic investments and increased global awareness should sustain steady top-line growth, the slower pace compared to the US market average could limit valuation expansion.

- ResMed’s focus on innovation, acquisitions, and expanding the sleep health market supports recurring revenue, but analysts warn that market and regulatory headwinds may hinder upside momentum.

- The gap in forecast growth rates suggests that, while high-quality earnings continue, ResMed may face hurdles in matching or beating competitors’ sector-wide acceleration.

Valuation Remains Attractive Despite Soft Guidance

- With a price-to-earnings ratio of 25.1x, which is below both the industry average (27.7x) and peers (35.6x), and a current share price ($246.88) still under the DCF fair value ($268.71), ResMed shows relative value in a sector often priced for growth.

- Consensus narrative notes that analyst price targets hover near $293.80, just 19% above the current share price. This signals that most see ResMed as fairly valued and not a deep-value play, but with downside well-cushioned by its strong fundamentals.

- Ongoing improvements in operational efficiency, along with a disciplined approach to capital allocation, provide some margin of safety even as future growth estimates ease.

- Analysts diverge widely in their targets, reflecting debate over whether ResMed’s current multiples offer enough upside given its more modest growth expectations ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ResMed on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a unique angle? Share your viewpoint and shape your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ResMed.

See What Else Is Out There

ResMed’s slower forecasted earnings and revenue growth could limit investor upside compared to faster-growing peers in the sector.

If you’re searching for established names expected to outpace this trend, check out high growth potential stocks screener (60 results) to discover companies with much more robust growth on the horizon.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives