- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Does ResMed's (RMD) Strong Q1 and Steady Dividend Reveal a Durable Growth-Margin Balance?

Reviewed by Sasha Jovanovic

- ResMed Inc. recently reported first quarter 2026 earnings, posting sales of US$1.34 billion and net income of US$348.54 million, both higher than the same period last year, and reaffirmed a quarterly dividend of US$0.60 per share for shareholders of record on November 13, 2025, with payment due December 18, 2025.

- The announcement highlights ResMed’s continued sales growth alongside its consistent dividend policy, underscoring management’s focus on balancing business expansion and shareholder returns.

- We'll explore how ResMed's solid revenue and income gains this quarter influence its investment outlook and margin growth narrative.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ResMed Investment Narrative Recap

For those considering ResMed, the core belief centers on the long-term expansion of sleep and respiratory health markets, supported by the company’s strong infrastructure in digital health and recurring revenue streams. The recent Q1 2026 earnings report confirms ongoing growth in sales and profits, but does not materially alter the short-term focus on margin expansion or the ongoing risk from competitive and regulatory pressures in the US reimbursement environment.

Among recent company updates, the reaffirmed quarterly dividend of US$0.60 per share, announced alongside earnings, reinforces ResMed’s consistency in shareholder returns. This ongoing dividend policy stands out, especially as operational performance and profitability continue to be the main market catalysts for ResMed.

However, investors should also keep in mind the potential impact of changing US healthcare reimbursement policies, particularly if CMS initiates further competitive bidding programs that could...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion in revenue and $1.9 billion in earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from the current $1.4 billion.

Uncover how ResMed's forecasts yield a $295.13 fair value, a 17% upside to its current price.

Exploring Other Perspectives

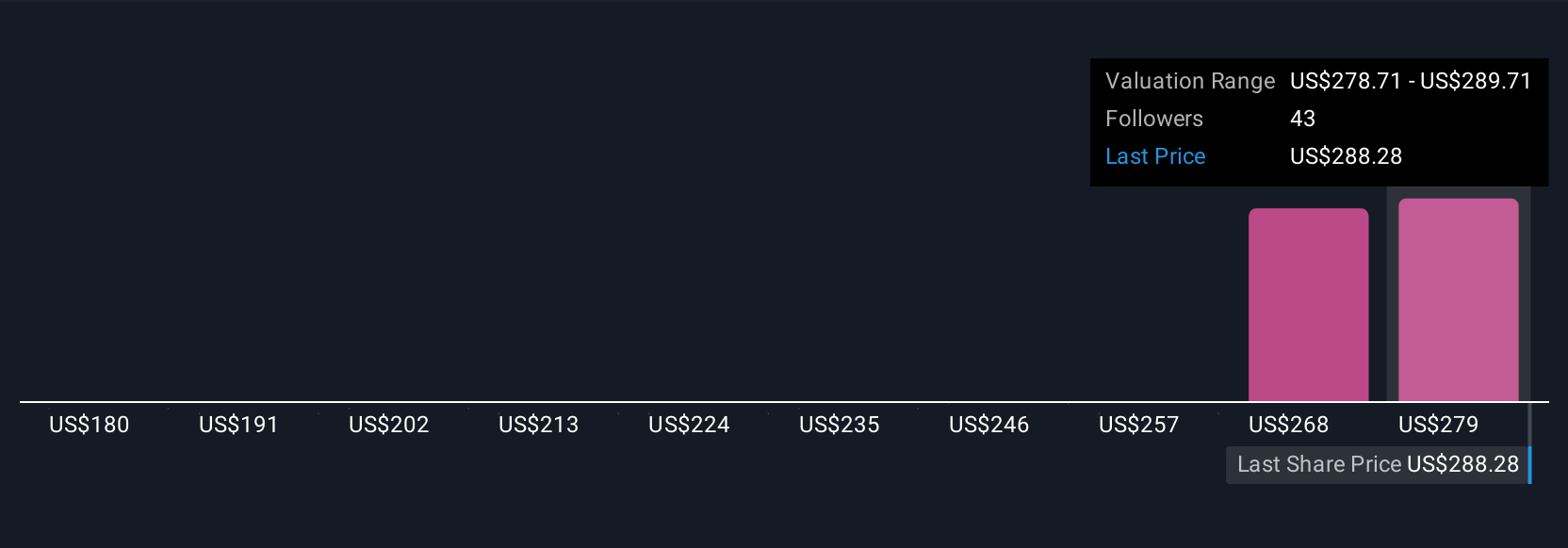

Seven members of the Simply Wall St Community have posted fair value estimates for ResMed, ranging from US$179.72 to US$295.13 per share. While opinions differ widely, ongoing competition and the possibility of stricter healthcare cost controls could significantly influence performance and drive shifts in valuation outlooks.

Explore 7 other fair value estimates on ResMed - why the stock might be worth as much as 17% more than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives