- United States

- /

- Healthtech

- /

- NYSE:PHR

Does Growing Analyst Optimism Reinforce Phreesia’s (PHR) Edge in Healthcare Technology?

Reviewed by Sasha Jovanovic

- Earlier this week, BMO Capital initiated coverage on Phreesia with an ‘Outperform’ rating, joining a number of other brokerages that have recently expressed a positive outlook for the company.

- This collective show of analyst confidence highlights Phreesia’s perceived advantage in the increasingly digitized healthcare technology landscape.

- To explore what this reinforced analyst optimism could mean for Phreesia’s future, we’ll consider its implications for the company’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Phreesia Investment Narrative Recap

At its core, Phreesia’s investment case is grounded in the digital transformation of healthcare, with the company aiming to expand its footprint in patient intake, payments, and engagement solutions. While fresh coverage and an ‘Outperform’ consensus from BMO Capital and other analysts reinforces market confidence, it does not fundamentally alter the short-term focus: the adoption and performance of new product modules remain the most important catalyst, whereas risks tied to stronger competition and uncertain macroeconomic conditions continue to weigh on revenue growth visibility.

The recent launch of Phreesia VoiceAI, an AI-powered phone solution, is particularly relevant, as it aligns with analysts’ view that innovation and product adoption are essential to driving higher recurring revenue per client. As healthcare organizations look for ways to handle administrative burdens more efficiently, successful implementation of VoiceAI could play a key role in supporting Phreesia’s growth ambitions, especially if it achieves meaningful traction within its target market.

However, in contrast to this product momentum, investors should be aware of the potential for increased competitive intensity in healthcare IT...

Read the full narrative on Phreesia (it's free!)

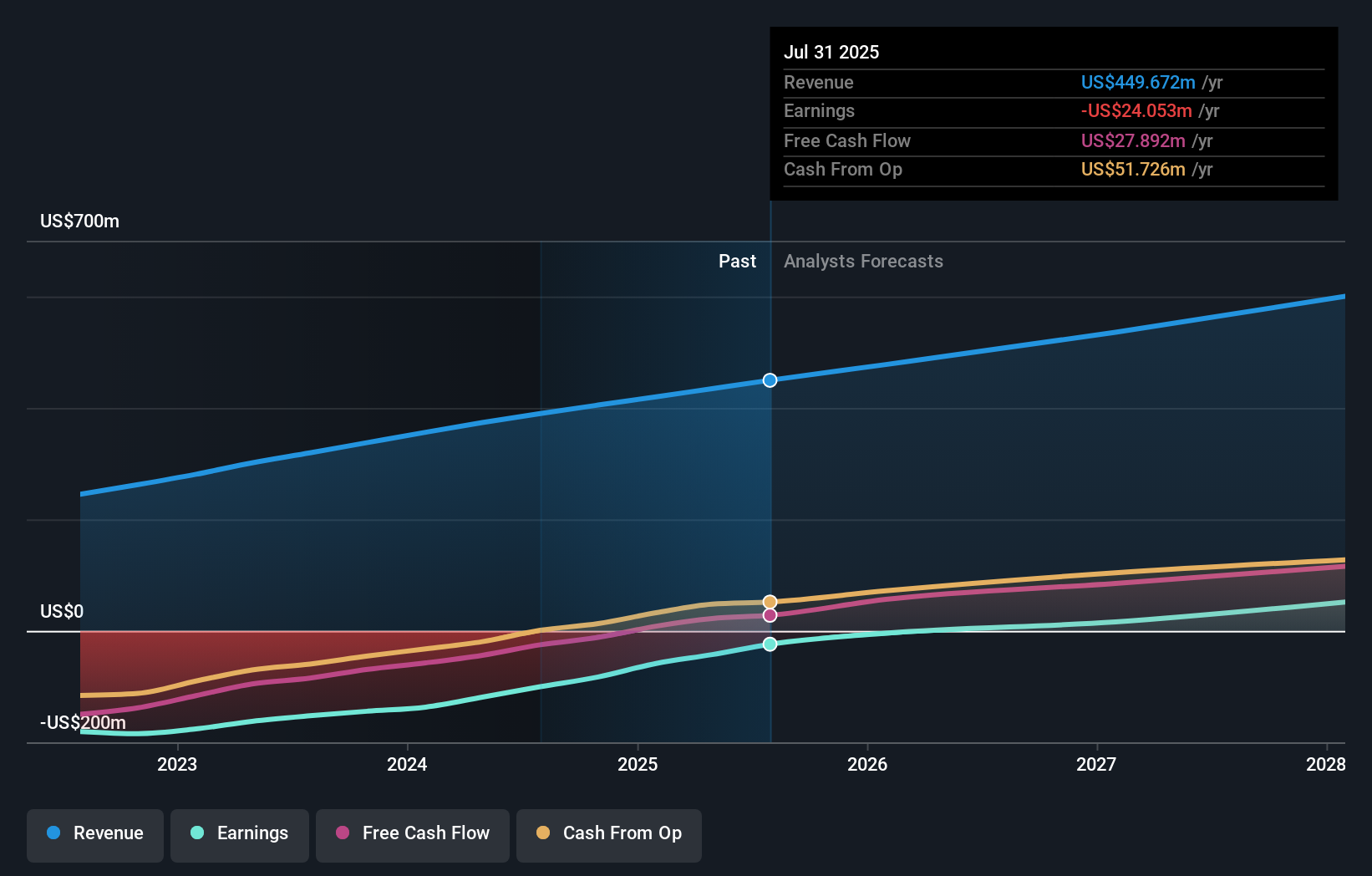

Phreesia's outlook anticipates $611.2 million in revenue and $52.6 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 12.0% and a $95.3 million increase in earnings from the current level of -$42.7 million.

Uncover how Phreesia's forecasts yield a $33.73 fair value, a 55% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided one retail fair value estimate for Phreesia, landing at US$33.73 per share. While opinions vary, many focus on Phreesia’s push for AI-driven efficiencies and ongoing competitive pressures as key variables influencing the outlook.

Explore another fair value estimate on Phreesia - why the stock might be worth just $33.73!

Build Your Own Phreesia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Phreesia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phreesia's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives