- United States

- /

- Medical Equipment

- /

- NYSE:PEN

Strong STORM-PE Trial Results for CAVT Could Be a Game Changer for Penumbra (PEN)

Reviewed by Sasha Jovanovic

- Penumbra, Inc. recently announced additional results from the groundbreaking STORM-PE randomized controlled trial, presented at international conferences and published in Circulation, showing their CAVT technology combined with anticoagulation led to notably better clinical outcomes, including greater thrombus reduction and improved functional status, in patients with acute intermediate-high risk pulmonary embolism compared to anticoagulation alone.

- An intriguing insight from the trial is that patients receiving CAVT achieved almost normal walking ability by 90 days, reflecting a substantial recovery advantage without additional safety risk over standard therapy.

- We'll examine how the strong STORM-PE trial outcomes could affect Penumbra's progress in expanding guideline acceptance and market adoption.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Penumbra Investment Narrative Recap

Penumbra's investment case centers on their ability to translate compelling clinical trial data into broader guideline adoption and increased market share, especially for innovative technologies like CAVT in vascular interventions. The latest positive results from the STORM-PE trial address a key short-term catalyst, clinical evidence needed for adoption, yet product concentration remains a significant risk if competitors close the innovation gap or adverse trial outcomes emerge. While this news solidifies Penumbra’s data-driven growth narrative, it does not eliminate competitive or product concentration pressures.

Among recent highlights, the June 2025 FDA clearance and launch of the Ruby XL System stands out as particularly relevant, showcasing Penumbra’s ongoing pipeline progress and expanding its portfolio beyond thrombectomy to large vessel embolization. This supports the narrative that new products and clinical evidence can drive both higher-margin opportunities and protect against reliance on a single franchise or segment.

In contrast, investors should remain mindful of how intensified competition in thrombectomy devices could still limit Penumbra’s pricing power, especially if commoditization accelerates in...

Read the full narrative on Penumbra (it's free!)

Penumbra's narrative projects $1.9 billion in revenue and $274.7 million in earnings by 2028. This requires 13.6% yearly revenue growth and a $127 million earnings increase from $147.7 million today.

Uncover how Penumbra's forecasts yield a $303.33 fair value, a 29% upside to its current price.

Exploring Other Perspectives

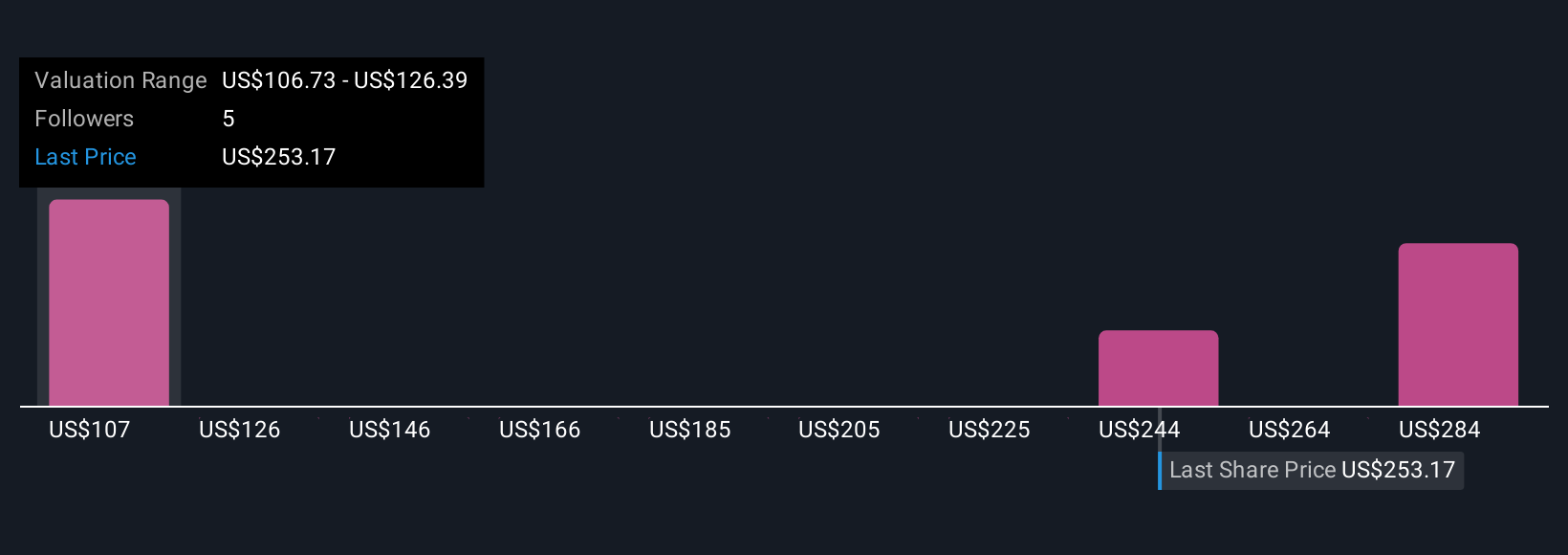

Four different fair value estimates from the Simply Wall St Community range from US$103 to US$303, reflecting both optimism and skepticism about Penumbra’s long-term growth. Clinical trial catalysts like STORM-PE could shift perceptions, but the wide spread reminds you to explore these diverse viewpoints and consider the multiple scenarios for future performance.

Explore 4 other fair value estimates on Penumbra - why the stock might be worth as much as 29% more than the current price!

Build Your Own Penumbra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penumbra research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Penumbra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penumbra's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives