- United States

- /

- Medical Equipment

- /

- NYSE:OWLT

Further Upside For Owlet, Inc. (NYSE:OWLT) Shares Could Introduce Price Risks After 31% Bounce

Owlet, Inc. (NYSE:OWLT) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

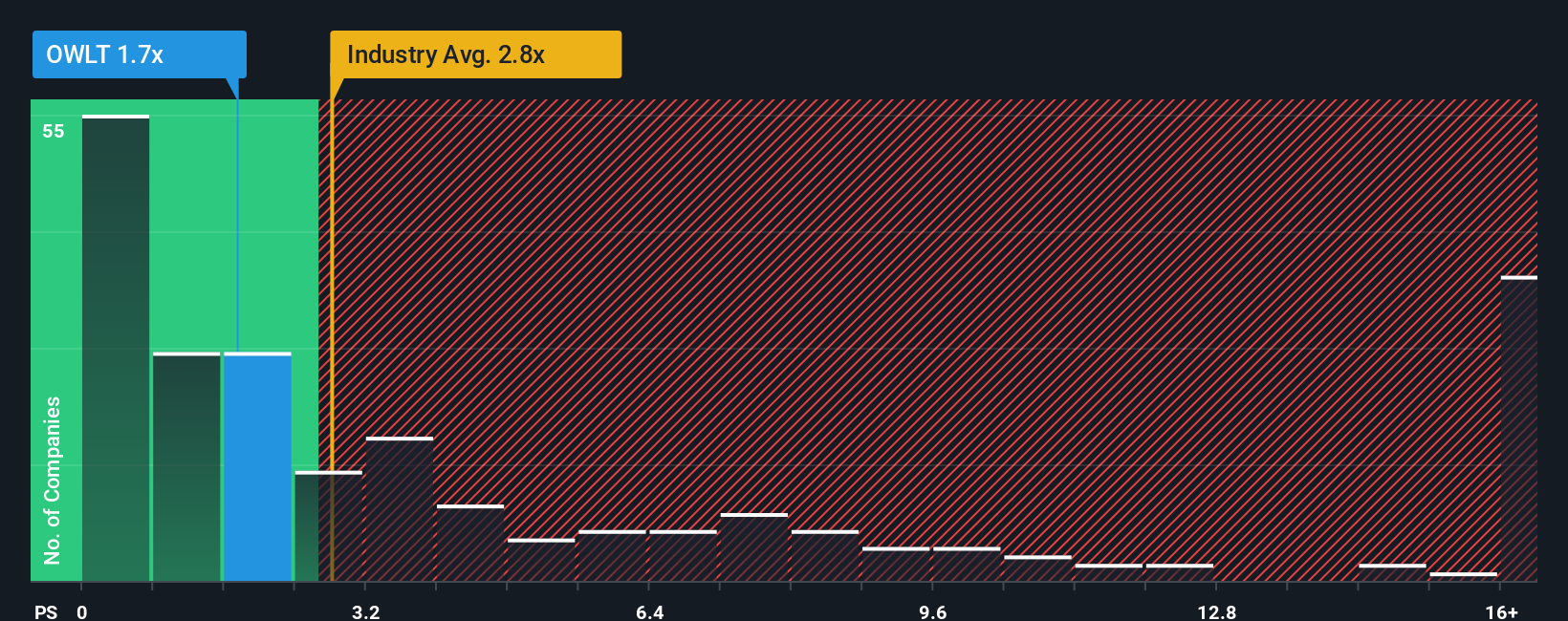

Although its price has surged higher, Owlet may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Owlet

How Owlet Has Been Performing

Recent times have been advantageous for Owlet as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Owlet.Do Revenue Forecasts Match The Low P/S Ratio?

Owlet's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 23% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.2% per year, which is noticeably less attractive.

In light of this, it's peculiar that Owlet's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite Owlet's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Owlet currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 3 warning signs for Owlet you should be aware of, and 2 of them are potentially serious.

If you're unsure about the strength of Owlet's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OWLT

Owlet

Provides digital parenting solutions in the United States, the United Kingdom, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives