- United States

- /

- Healthtech

- /

- NYSE:CTEV

MultiPlan Corporation (NYSE:MPLN) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Those holding MultiPlan Corporation (NYSE:MPLN) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 90% share price decline over the last year.

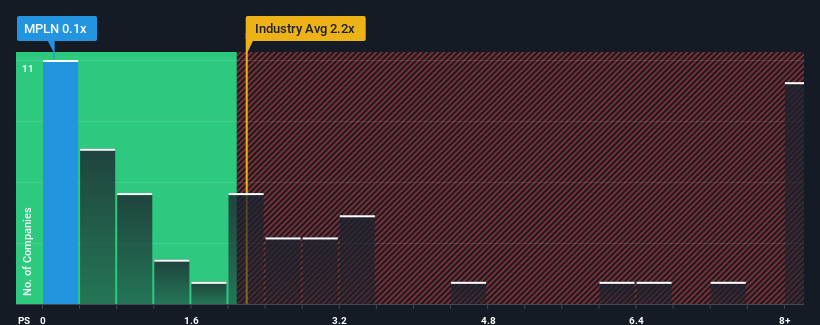

Although its price has surged higher, MultiPlan may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.2x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for MultiPlan

How Has MultiPlan Performed Recently?

MultiPlan could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MultiPlan.How Is MultiPlan's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as MultiPlan's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 0.2% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to expand by 9.2%, which paints a poor picture.

In light of this, it's understandable that MultiPlan's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On MultiPlan's P/S

Shares in MultiPlan have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of MultiPlan's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MultiPlan (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives