- United States

- /

- Healthtech

- /

- NYSE:CTEV

MultiPlan Corporation (NYSE:MPLN) Not Doing Enough For Some Investors As Its Shares Slump 40%

To the annoyance of some shareholders, MultiPlan Corporation (NYSE:MPLN) shares are down a considerable 40% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

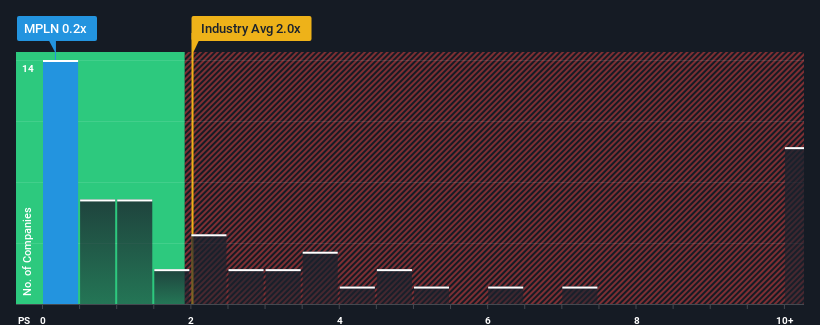

Since its price has dipped substantially, MultiPlan's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Healthcare Services industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for MultiPlan

What Does MultiPlan's Recent Performance Look Like?

MultiPlan could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on MultiPlan will help you uncover what's on the horizon.How Is MultiPlan's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like MultiPlan's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.5% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.5% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 9.4%, which paints a poor picture.

With this in consideration, we find it intriguing that MultiPlan's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

MultiPlan's recently weak share price has pulled its P/S back below other Healthcare Services companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MultiPlan's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, MultiPlan's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for MultiPlan (of which 1 can't be ignored!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives