- United States

- /

- Healthtech

- /

- NYSE:CTEV

Little Excitement Around MultiPlan Corporation's (NYSE:MPLN) Revenues As Shares Take 46% Pounding

Unfortunately for some shareholders, the MultiPlan Corporation (NYSE:MPLN) share price has dived 46% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 87% share price decline.

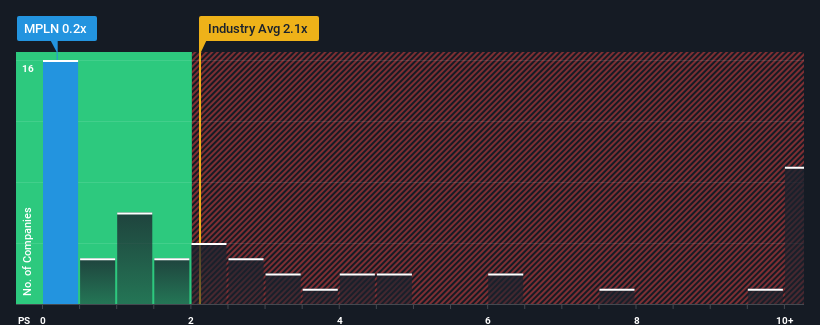

After such a large drop in price, MultiPlan may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.1x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for MultiPlan

How MultiPlan Has Been Performing

While the industry has experienced revenue growth lately, MultiPlan's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think MultiPlan's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, MultiPlan would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 6.8% over the next year. With the industry predicted to deliver 9.4% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why MultiPlan's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does MultiPlan's P/S Mean For Investors?

MultiPlan's recently weak share price has pulled its P/S back below other Healthcare Services companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MultiPlan's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MultiPlan (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on MultiPlan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives