- United States

- /

- Healthcare Services

- /

- NYSE:MOH

How Might Molina Healthcare's (MOH) Latest Debt Move Shape Its Risk Profile Amid Litigation?

Reviewed by Sasha Jovanovic

- In November 2025, Molina Healthcare announced the completion of its US$850 million private offering of 6.500% senior notes due 2031, with net proceeds of approximately US$838 million intended for corporate purposes and repayment of existing loans.

- The event follows multiple legal announcements from law firms coordinating class action lawsuits alleging that Molina Healthcare failed to adequately disclose adverse developments in its medical cost trends and reduced financial guidance for 2025.

- We will assess how this combination of significant debt issuance and ongoing litigation may affect Molina’s broader investment narrative and risk profile.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Molina Healthcare Investment Narrative Recap

To be a shareholder in Molina Healthcare today, you need to believe in the company's ability to grow through new Medicaid contracts and manage medical cost trends, despite legal and financial headwinds. The recent US$850 million debt issuance does not immediately alter the key short-term catalyst, the execution and retention of large state Medicaid contracts, nor does it materially change the main risk, which remains the outcome of ongoing lawsuits challenging Molina's financial disclosures and cost management.

One of the most interesting announcements alongside these developments is Molina’s recent contract win in Florida, where it will serve about 120,000 Medicaid enrollees with expected 2025 premiums near US$5 billion. This new business ties directly to the company’s core catalyst of expanding its Medicaid footprint to bolster revenue and help offset headwinds from margin pressures and litigation uncertainties.

Conversely, investors should be aware of the unresolved litigation that could influence financial flexibility and reputational risk if...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's narrative projects $50.7 billion in revenue and $1.3 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a $0.2 billion increase in earnings from $1.1 billion today.

Uncover how Molina Healthcare's forecasts yield a $172.53 fair value, a 16% upside to its current price.

Exploring Other Perspectives

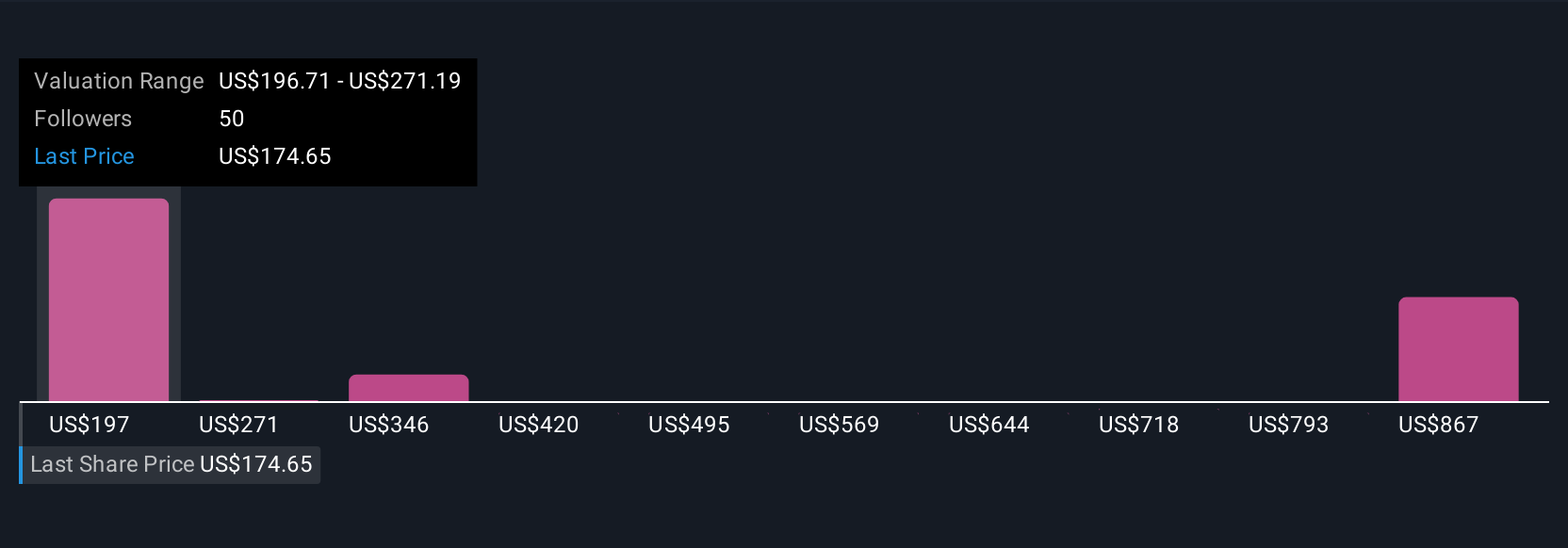

Nine fair value estimates from the Simply Wall St Community range from US$172.53 to US$649.18 per share, reflecting wide disagreement on Molina’s outlook. With execution on major Medicaid contracts taking center stage, you can see why opinions differ and why it’s worth exploring the full spectrum of views.

Explore 9 other fair value estimates on Molina Healthcare - why the stock might be worth just $172.53!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success