- United States

- /

- Healthcare Services

- /

- NYSE:MCK

A Fresh Look at McKesson’s (MCK) Valuation Following Strong Quarterly Earnings Growth

Reviewed by Simply Wall St

McKesson (MCK) just shared its quarterly results, showing a clear jump in both sales and net income compared to the same period last year. Investors are focused on these numbers as a signal of ongoing performance.

See our latest analysis for McKesson.

Momentum around McKesson has clearly been building, with the stock notching a 7.1% share price return over the past month and an impressive 25.5% in the last quarter. Year-to-date, shares have climbed nearly 49%, reflecting increasing confidence following strong earnings and continued buybacks. Over the longer term, shareholders have also seen total returns of 39.5% in the past year and over 400% in five years. This underscores the company’s ability to deliver both immediate growth and sustained value.

If McKesson’s surge caught your attention, the healthcare sector holds plenty more to discover. See the full list of standout companies with our curated screener: See the full list for free.

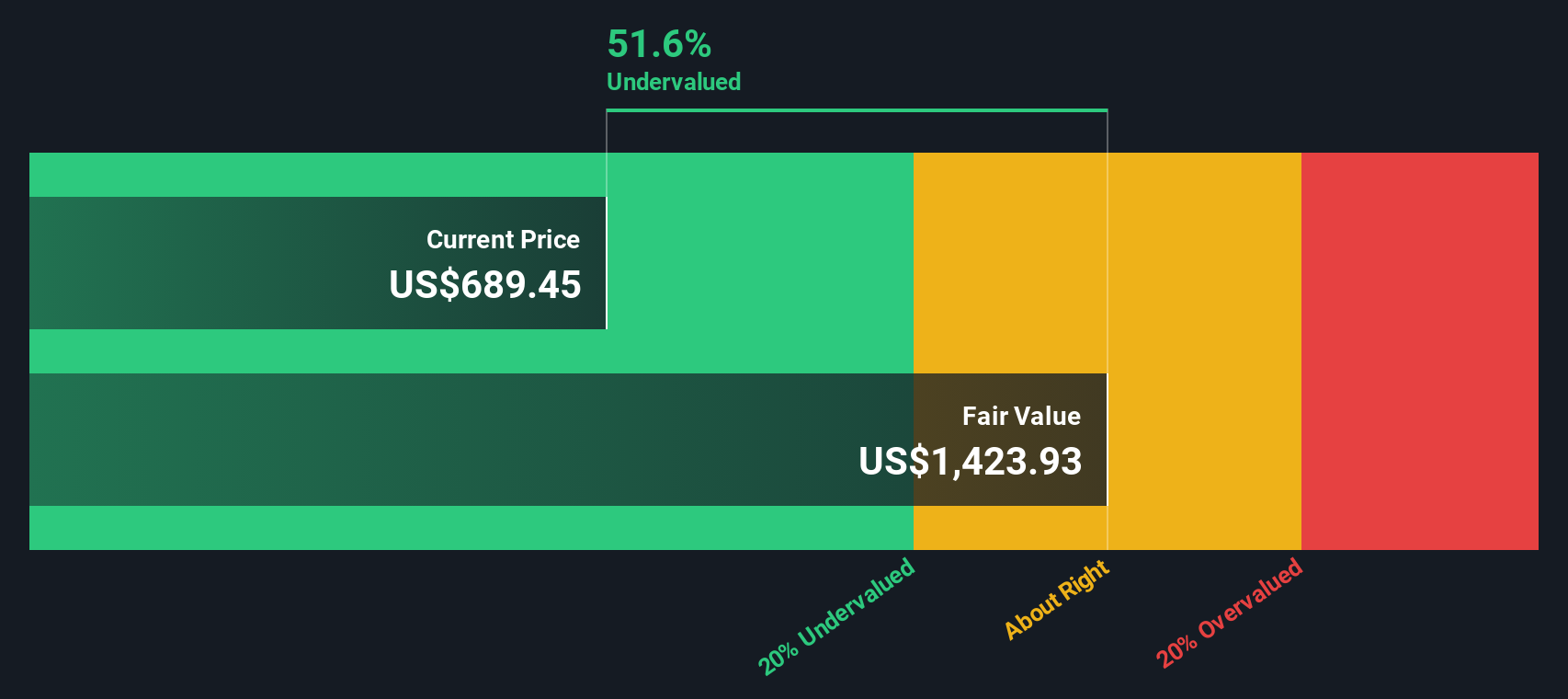

With such rapid gains and strong fundamentals on display, the key question remains: Is McKesson still undervalued at current levels, or is the market already factoring in all its future growth potential?

Most Popular Narrative: 30% Undervalued

Based on the most widely followed narrative, McKesson’s closing price of $842.09 still sits well below the estimated fair value of $1,198. This price gap has caught the industry’s attention, particularly as the company continues its run of strong results and upbeat forecasts.

“Growing demand for pharmaceuticals and medical supplies, fueled by an aging population and higher chronic disease rates, underpins accelerating prescription volume growth. This supports sustained top-line revenue expansion for McKesson. Increasing adoption of specialty and oncology pharmaceuticals, alongside recent acquisitions (Core Ventures and PRISM Vision) that expand the provider network and service portfolio, are improving revenue mix quality and positioning the company for higher operating margins and earnings growth.”

Want to know what’s fuelling this aggressive upside? There’s a core set of quantitative drivers you haven’t seen yet. Fresh growth forecasts, margin shifts, and a future profit multiple that sparks debate. Find out how these financial levers combine to power this bullish outlook.

Result: Fair Value of $1,198 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny or a rapid shift toward lower-margin generics could present challenges for McKesson’s growth story and weigh on future profitability.

Find out about the key risks to this McKesson narrative.

Another View: Discounted Cash Flow Analysis

While the market’s focus has been on McKesson’s price-to-earnings comparison, our DCF model offers a very different outlook. This method estimates the stock’s intrinsic value at $1,398.80, which is nearly 40% above where shares currently trade. Could this signal a much deeper undervaluation hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own McKesson Narrative

If you want to dig deeper or think your own outlook tells a different story, you can quickly build a personal narrative from the data in just a few minutes using Do it your way.

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio by checking out fresh opportunities beyond McKesson. The market moves fast, so give yourself the edge by acting on today’s cutting-edge themes and hidden value plays.

- Tap into the future by tracking innovative companies driving AI breakthroughs with these 25 AI penny stocks for potential market leaders.

- Lock in steady income and peace of mind by finding resilient businesses offering high yields through these 16 dividend stocks with yields > 3%.

- Get ahead of the crowd and spot undervalued gems before they become headlines by using these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives