- United States

- /

- Healthcare Services

- /

- NYSE:MCK

A Closer Look at McKesson’s (MCK) Valuation After Steady Share Price Gains

Reviewed by Simply Wall St

McKesson (MCK) is drawing attention after posting strong gains over the past month, up 5%. The company’s year-to-date return sits at an impressive 42%, which reflects sustained investor interest throughout 2024.

See our latest analysis for McKesson.

This latest move builds on what has been a strong run for McKesson, with momentum clearly favoring the bulls. The share price return over the past year has been stellar, and momentum remains strong with a 5.4% gain in the last month. Looking at both short- and long-term numbers, McKesson has combined steady share price appreciation with a standout one-year total shareholder return of nearly 59%, making it a top performer in its sector.

If you’re interested in spotting more potential winners in healthcare, take a look at the opportunities showcased in our See the full list for free.

But with shares soaring and McKesson trading near analysts’ targets, the central question is whether the company is still undervalued or if the market is already pricing in all of its expected future growth.

Most Popular Narrative: 4.2% Undervalued

McKesson’s widely tracked narrative sets its fair value at $836.71, slightly above the $801.67 last close. This suggests the market may be underestimating recent earnings strength and long-term growth catalysts powering the fair value calculation.

Investments in digitization, automation, and advanced analytics across distribution centers and logistics (such as automated picking systems, AI, and robotics) are enhancing operational efficiency, driving measurable reductions in operating expenses, and supporting long-term net margin improvement.

Want to know what’s fueling this bullish outlook? There is a notably optimistic growth path behind the headline number, built on ambitious forecasts for profit margins and top-line expansion. Wondering which financial levers could truly transform McKesson? See the narrative’s full details and decide if these projections are justified.

Result: Fair Value of $836.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and the possibility of reduced healthcare access could quickly challenge McKesson’s bullish outlook if industry conditions shift.

Find out about the key risks to this McKesson narrative.

Another View: The Multiples Story

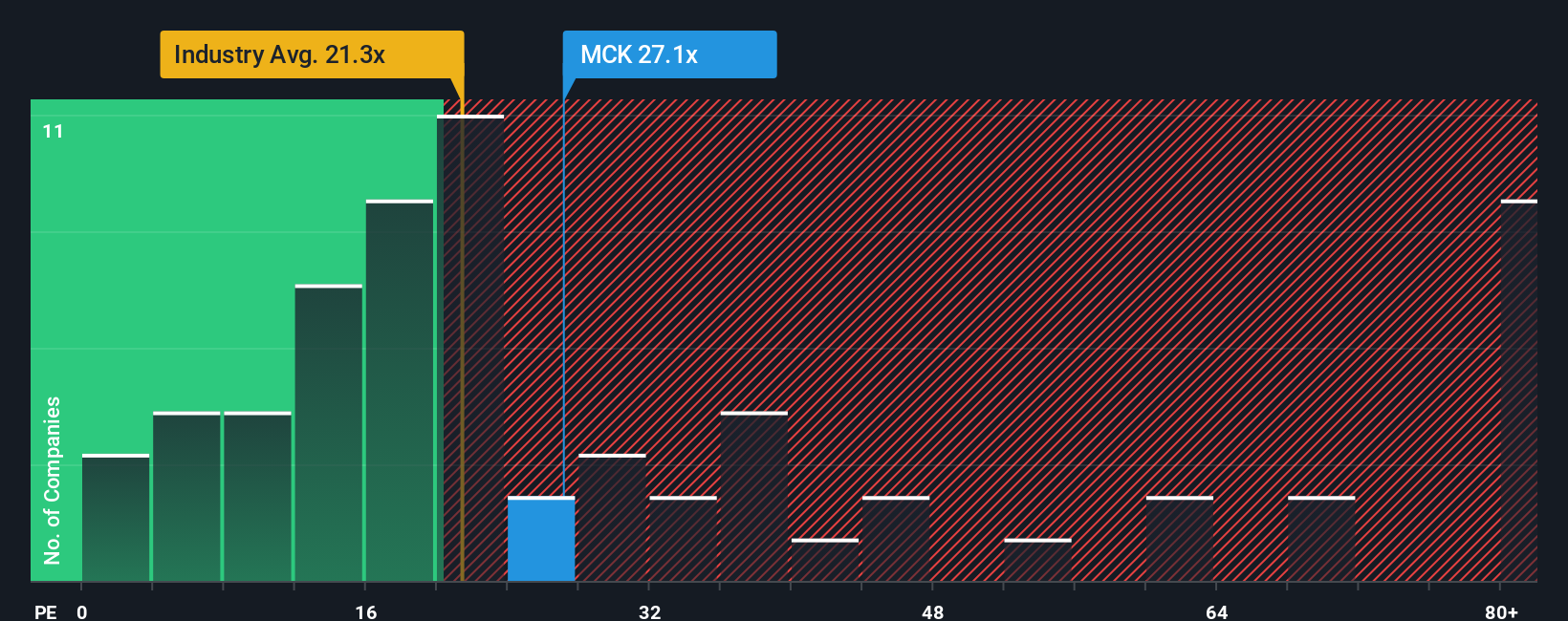

While recent analysis points to McKesson being undervalued, a closer look at its price-to-earnings ratio tells a very different story. Trading at 31.5 times earnings, it sits well above both peers (24x) and the healthcare industry norm (21.7x), as well as its fair ratio of 31.3x. This premium suggests investors are pricing in a lot of optimism; however, does the strong momentum justify such a stretch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you want a fresh perspective or wish to analyze the numbers yourself, you can craft your own narrative in just a couple of minutes: Do it your way

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock more opportunities by harnessing powerful screeners that point you toward tomorrow’s winners. Don’t let a great investment slip past when the tools are right at your fingertips.

- Tap into superior yield potential by zeroing in on these 17 dividend stocks with yields > 3% with consistently strong payouts and the fundamentals to keep delivering reliable returns.

- Accelerate your growth strategy by leveraging these 27 AI penny stocks that are at the forefront of artificial intelligence innovation and transforming industries worldwide.

- Supercharge your portfolio with value by targeting these 880 undervalued stocks based on cash flows trading below their true worth, ready to close the gap as market recognition builds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives