- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

Integer Holdings (ITGR) Is Down 11.4% After CEO Transition and Reduced 2025 Outlook - What's Changed

Reviewed by Sasha Jovanovic

- Integer Holdings recently appointed Payman Khales as President, CEO, and Board member, following the retirement of Joseph Dziedzic, alongside an update to its full-year outlook due to lower-than-expected new product adoption and revised customer forecasts.

- This leadership transition arrives as the company experiences reduced guidance for 2025, reflecting demand headwinds in key product lines and customer-driven changes.

- We'll examine how lower customer forecasts and revised guidance may reshape Integer Holdings' investment outlook in light of this leadership change.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Integer Holdings Investment Narrative Recap

To be a shareholder in Integer Holdings today, you need conviction that the company’s long-term growth in critical medical device markets can endure through short-term volatility from shifting customer demand. The recent leadership transition, combined with lowered guidance tied to weaker-than-expected adoption of new products, puts immediate focus on management’s ability to adapt and stabilize revenue, a key near-term catalyst. The most significant risk remains Integer’s limited forward visibility and concentrated customer base, now magnified by this period of operational change.

Among Integer’s recent announcements, the updated 2025 earnings guidance is most pertinent to current events. The company has reduced its sales and profit expectations following customers’ revised forecasts, reinforcing how even minor changes in buying patterns can materially affect reported results and sentiment around growth. For investors tracking near-term movement, the persistence of these headwinds and management’s response may prove critical for restoring confidence.

In contrast to ongoing optimism, it is important for investors to be aware that Integer’s reliance on a handful of large OEM contracts means that even one major customer adjusting its...

Read the full narrative on Integer Holdings (it's free!)

Integer Holdings' projections indicate $2.2 billion in revenue and $306.5 million in earnings by 2028. This outlook assumes 7.0% annual revenue growth and a $222.7 million increase in earnings from the current $83.8 million.

Uncover how Integer Holdings' forecasts yield a $137.38 fair value, a 113% upside to its current price.

Exploring Other Perspectives

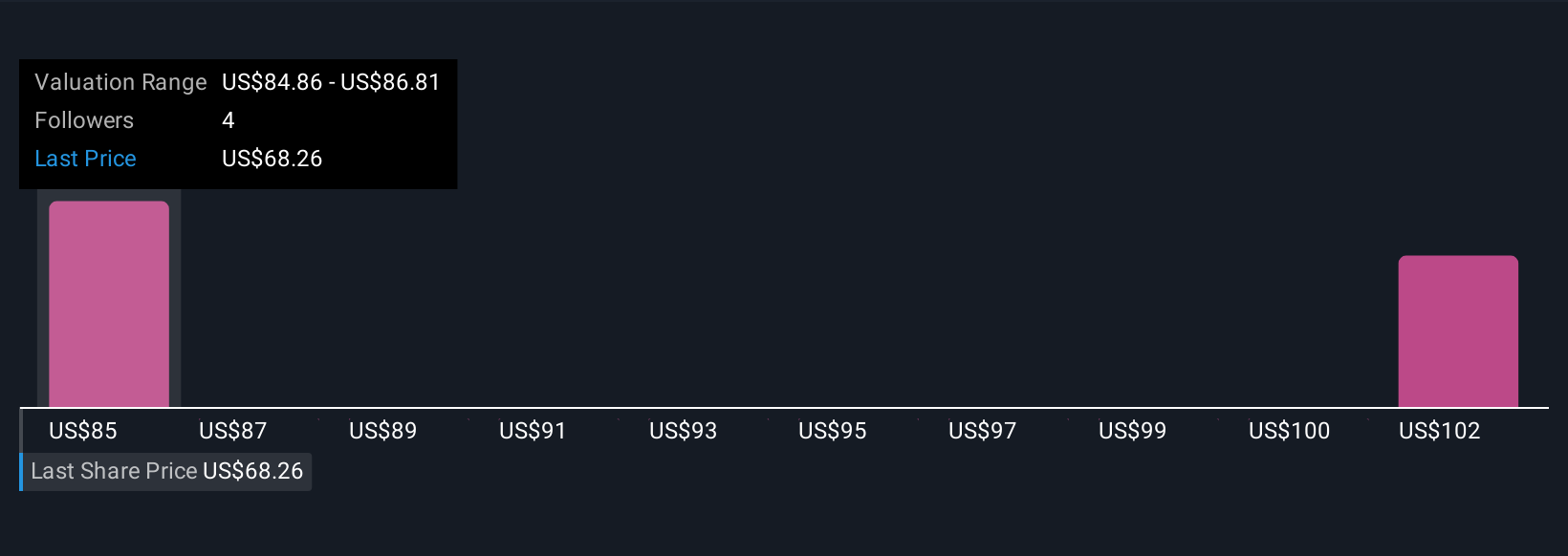

Simply Wall St Community members estimate fair value for Integer Holdings between US$104.95 and US$137.38, across two independent forecasts. With recent guidance cuts highlighting demand risks, consider how sharply opinions can differ when assessing Integer’s future.

Explore 2 other fair value estimates on Integer Holdings - why the stock might be worth just $104.95!

Build Your Own Integer Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integer Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Integer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integer Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives