- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Should Inspire Medical Systems' (INSP) Guidance Cut and Legal Challenges Change Investors' View on Execution Risks?

Reviewed by Sasha Jovanovic

- Inspire Medical Systems recently faced multiple proposed class-action lawsuits alleging it misled investors about the commercial readiness and demand for its Inspire V sleep apnea device, after disclosing significant operational failures with the product’s launch, including incomplete staff training and billing challenges.

- An important development is that the company’s sharp reduction to its 2025 earnings guidance, tied to weak Inspire V demand, has sparked legal action and raised questions around near-term execution risk.

- We’ll examine how the significant earnings guidance cut and operational rollout setbacks could reshape Inspire’s investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Inspire Medical Systems Investment Narrative Recap

To be a shareholder in Inspire Medical Systems, you need to believe in the company’s ability to reaccelerate growth by resolving challenges with the Inspire V device rollout and restoring market trust. The sharp reduction in 2025 earnings guidance, tied directly to poor Inspire V demand and operational issues, has immediately impacted the company’s top short-term catalyst, adoption of Inspire V, while raising the execution risk as the most significant near-term threat to the business.

Given these events, the company’s updated 2025 earnings outlook and the associated class-action lawsuits stand out as the most relevant developments. Both highlight how much Inspire’s future depends on successful Inspire V commercialization and whether management can overcome current training, billing, and reimbursement obstacles in a timely manner.

Yet, with these legal and operational challenges now in sharper focus, investors should be aware that…

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems' narrative projects $1.3 billion in revenue and $103.6 million in earnings by 2028. This requires 14.5% yearly revenue growth and a $50.5 million earnings increase from the current $53.1 million.

Uncover how Inspire Medical Systems' forecasts yield a $106.79 fair value, a 19% upside to its current price.

Exploring Other Perspectives

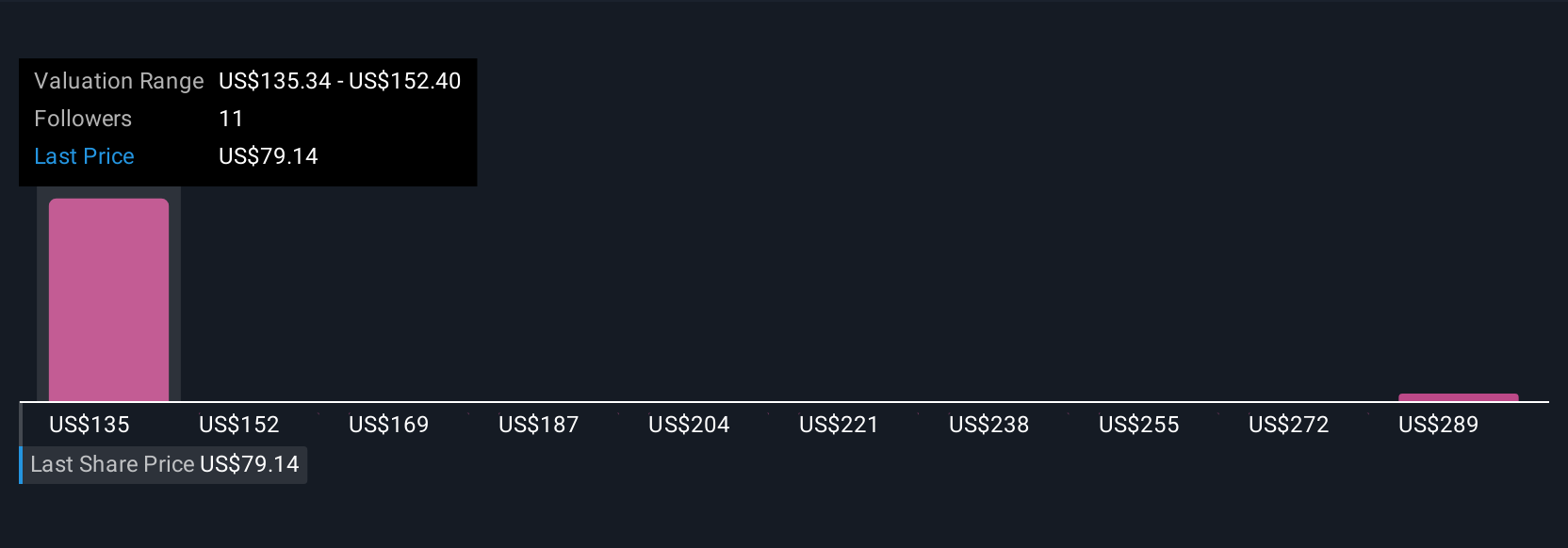

Nine fair value estimates from the Simply Wall St Community span from US$93.33 to US$270.86 per share. While some expect execution setbacks to weigh on performance, others are optimistic recovery is possible once operational hurdles clear, showing just how differently investor expectations can play out.

Explore 9 other fair value estimates on Inspire Medical Systems - why the stock might be worth just $93.33!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives