- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Even though Inspire Medical Systems (NYSE:INSP) has lost US$271m market cap in last 7 days, shareholders are still up 172% over 5 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Inspire Medical Systems, Inc. (NYSE:INSP) share price has soared 172% in the last half decade. Most would be very happy with that. Also pleasing for shareholders was the 21% gain in the last three months.

Since the long term performance has been good but there's been a recent pullback of 4.8%, let's check if the fundamentals match the share price.

Check out our latest analysis for Inspire Medical Systems

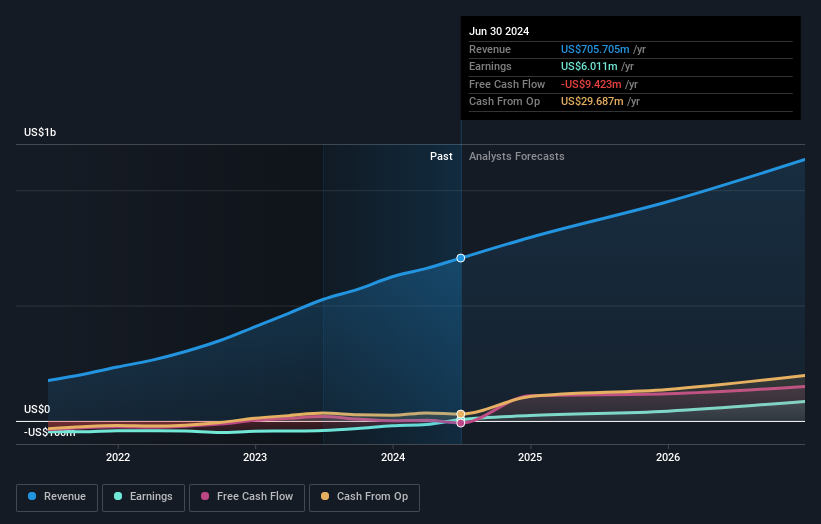

While Inspire Medical Systems made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Inspire Medical Systems can boast revenue growth at a rate of 46% per year. Even measured against other revenue-focussed companies, that's a good result. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 22% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Inspire Medical Systems seems like a high growth stock - so growth investors might want to add it to their watchlist.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Inspire Medical Systems is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 25% in the last year, Inspire Medical Systems shareholders lost 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 22% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Inspire Medical Systems better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Inspire Medical Systems , and understanding them should be part of your investment process.

We will like Inspire Medical Systems better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet and undervalued.