- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Humana (HUM): Earnings Growth Outlook Reverses Margin Decline Narrative

Reviewed by Simply Wall St

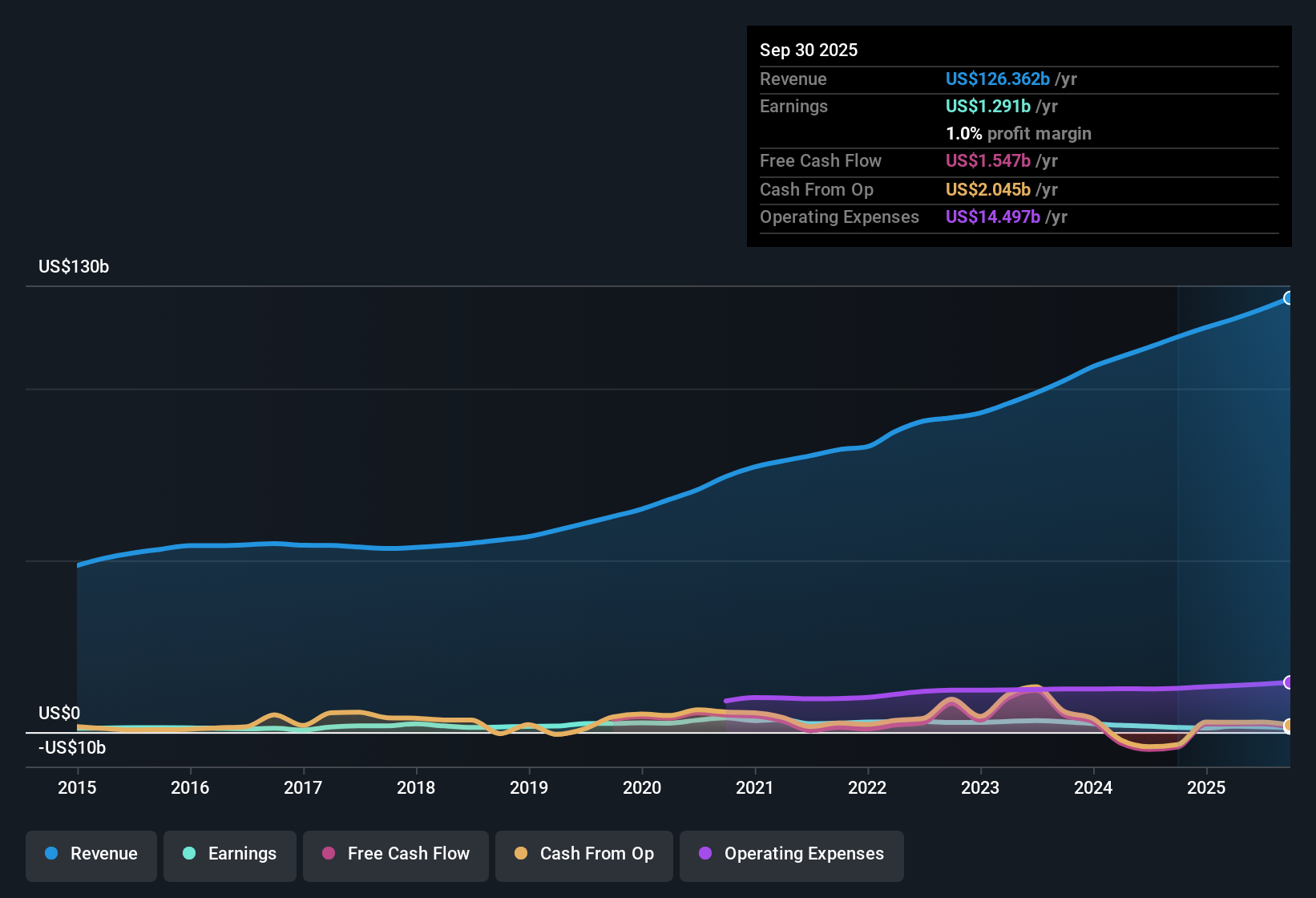

Humana (HUM) posted a softer set of headline numbers this cycle, with revenue projected to advance 7.1% per year, lagging the broader US market’s anticipated 10.4%. EPS has taken a hit, declining by 17.2% per year over the past five years, and net profit margins dipped from 1.5% to 1.3%. Yet, the outlook has flipped: forward estimates call for annual earnings growth of 26.9%, which is well ahead of the US market average of 15.8%. Meanwhile, the shares are trading below estimated fair value and the company’s valuation multiples remain attractive. With no flagged risks in the latest disclosures, the stage appears set for investors to focus on the improving earnings picture above all else.

See our full analysis for Humana.Next, we’ll see how these fresh results measure up to expectations and the prevailing narratives in the market. Some perspectives might be reinforced, while others could get a reality check.

See what the community is saying about Humana

Margins Targeted for a Comeback

- Net profit margins are projected to rise from 1.3% today to 2.2% in three years, with analysts expecting earnings to nearly double from $1.6 billion to $3.3 billion by September 2028.

- According to the analysts' consensus view, multiple initiatives, including investments in clinical excellence, new AI capabilities in contact centers, and strategic capital allocation for acquiring 30 new centers, are aimed at driving higher margins and sustainable profit growth.

- Consensus narrative notes these efforts are expected to enhance medical margins and operational efficiency, reinforcing the positive profit outlook implied by the upward margin forecast.

- However, achieving the projected margins could depend on successfully closing gaps in care and integrating Medicaid and CenterWell segments as planned, underscoring some execution risk even in the optimistic scenario.

- For more on how analysts balance these margin ambitions with operational realities, dive into the full consensus narrative. 📊 Read the full Humana Consensus Narrative.

Valuation Leans in Investors’ Favor

- Humana’s Price-To-Earnings ratio is 20.2x, lower than the peer average of 23.5x and the industry’s 21.5x, while current share price of $264.94 trades at a deep discount to its DCF fair value of $667.31.

- The consensus narrative highlights that, at this level, shares are viewed as attractively valued by most analysts because the price-to-earnings gap versus sector peers adds downside protection, and future profit forecasts imply additional upside if the growth targets are met.

- Consensus narrative points out that to justify the analyst price target of $294.96, investors need to believe in a pathway to $3.3 billion earnings and a lower multiple (13.2x PE) by 2028, which is a meaningful reset compared to today’s higher multiple.

- With the current share price at $264.94 already under this price target, the modest 8.7% upside reflects market belief that Humana is fairly valued on average, though bullish analysts see potential for more if profit growth materializes as projected.

Growth Relies on Medical Model Expansion

- The push to expand value-based models, including growth in CenterWell and Medicaid services, is driving robust year-over-year patient and membership increases that underpin the forecast of 7.0% annualized revenue growth for the next three years.

- Analysts' consensus view emphasizes that the sustainability of this growth depends on effectively integrating new care centers and delivering high Stars ratings, while successfully adapting to regulatory changes such as Medicare’s MA Stars program and MACRA’s V28 coding adjustments.

- Meeting these challenges could ensure revenue and margin expansion, supporting overall earnings growth, but any operational missteps or regulatory headwinds may quickly pressure the current optimistic outlook.

- Consensus highlights that ongoing strategic investments distinguish Humana’s approach, yet also leave execution as a key risk, with the need to align business strategy and regulatory response closely.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Humana on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers others might have missed? Share your take and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Humana.

See What Else Is Out There

While Humana’s earnings growth outlook is strong, the company still faces execution risks related to sustaining higher margins and effectively integrating new operations.

If you want steadier performance through market ups and downs, check out stable growth stocks screener (2072 results) to find companies known for consistent revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives